Alex's daily Market update & Focuslist - 04/12

The market rejected the initial CPI reaction and closed very weak - wait & see

PrimeTrading is an equity swing trading community based on DISCORD to learn & trade alongside experienced traders.

✅ See how I execute intraday while I share my trades live.

✅ Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

✅ Share & Discuss potential trade ideas with a like-minded amazing community

✅ Talk Macro Economy, Cryptocurrencies & much more!

✅ Talk about mental game & psychology to evolve as a trader!

✅ Education & mentoring from Alex & experienced traders.

✅ Q&A zoom meetings

Improve as a trader with a risk management first approach while working directly with me intraday.

Alex 🛡️✌️

GENERAL MARKET ANALYSIS

NASDAQ (NQ_F) Daily

Price Action Analysis:

NQ initially had a good reaction to the CPI report but quickly faded the move. We found some support by the end of the morning, but we reacted badly to the FOMC minutes at 14:00 and close near the lows at the 12949$ base area.

That failed breakout and large tail on above-average volume is not looking good and a warning sign going into tomorrow.

NQ_F is now below the 10dma but still above the base area & 21dma.

On the upside (bullish scenario),

The 13331$ previous swing high pivot will be the level to watch to confirm an upside continuation.

On the downside (bearish scenario),

12949$ level & 21dma has to hold.

S&P500 (ES_F) Daily

RUSSELL 2K (RTY_F) Daily

LIQUID LEADERS (PRICE ACTION ANALYSIS)

The mega-caps are still under pressure today, and some look seriously into troubles going into tomorrow. These will be important to follow. Do we see a rotation out of mega-caps into small/mid-cap, or does the mega-cap’s weakness bring the whole market with them?

MSFT -Daily

One of the few still acting OK at the 10dma. We are still holding well that 283.33$ base level.

AAPL -Daily

We followed through on the 162.14$ base level rejection (sBORS) and broke the UTL. We are still above the 21dma, but if we lose it tomorrow, a 157$ support area is possible.

NVDA - Daily

Bear flag into the 275.89$ level broke on the downside today on increased volume. We are right at the 21dma & 263.99$ level. We have to hold these, or a deeper PB is possible.

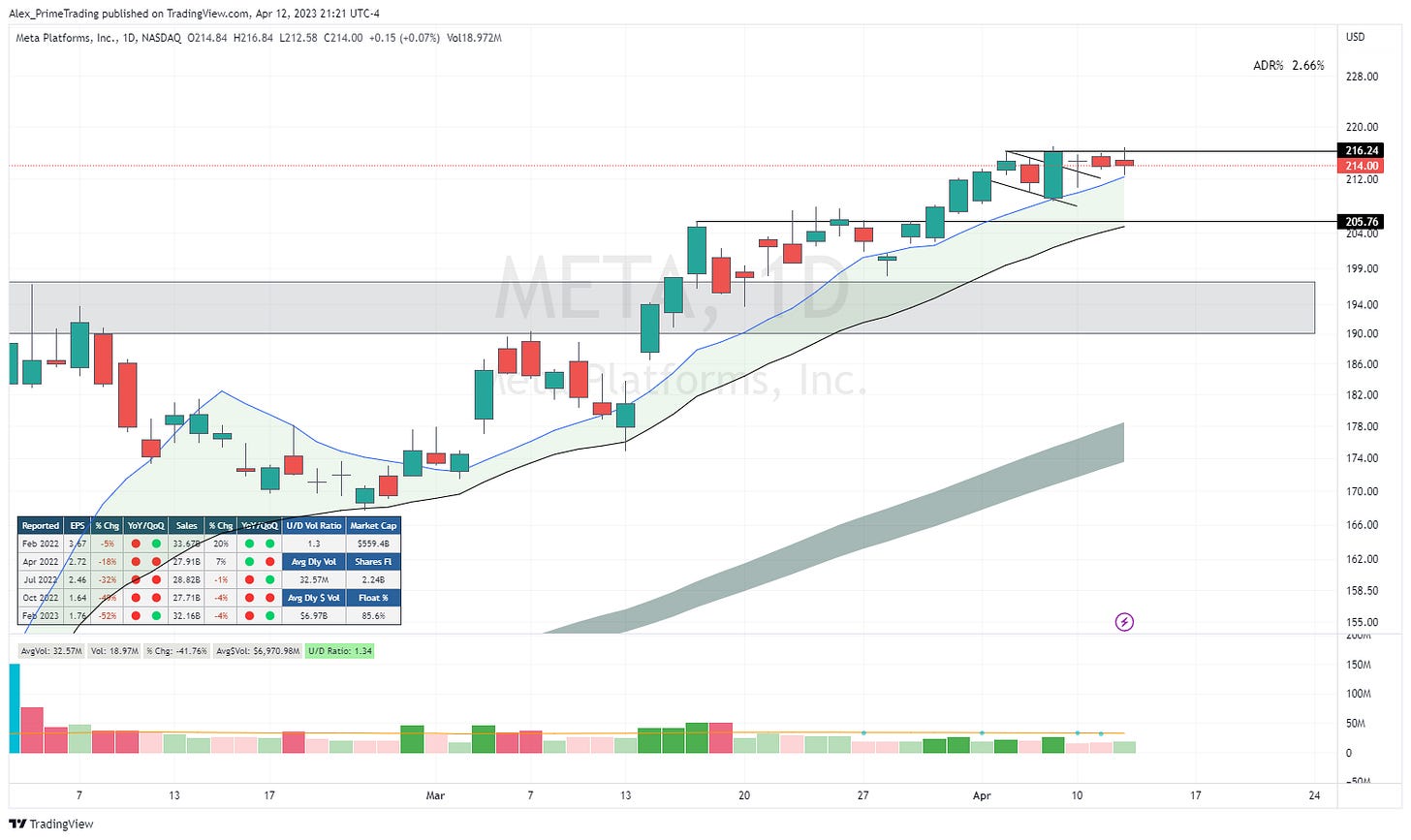

META - Daily

Still acting very strong as we hang above the 10dma. We need a breakout above 216.24$ to get upside continuation.

In the following sections of tonight’s letter, I’ll cover essential parts of my daily routine & preparation for tomorrow’s trading session.

✅ My overall current market Takeaways & GAMEPLAN for tomorrow

✅ My daily Focuslist, including setups, alert levels & explanation (LONG/SHORT)

✅ My Portfolio update

✅ Sectors Review

✅ Market Breadth & Internals

✅ Economic Calendar

✅ Prime Model spreadsheet (PT_database)

✅ Leaders list (technicals, fundamentals & potential TMLs)

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.