Good evening folks,

I am very disappointed that the market and leading names were not able to push further on this bear market rally. Tomorrow is a big FED day, so we’ll gain more clarity on where the market is going.

This will be a shorter letter tonight, as you’ll see that things don’t look too good on the market & a lack of quality setups as well.

Let’s go!✌️

MARKET REVIEW

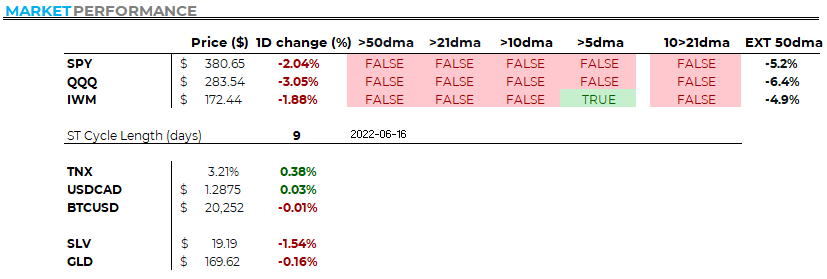

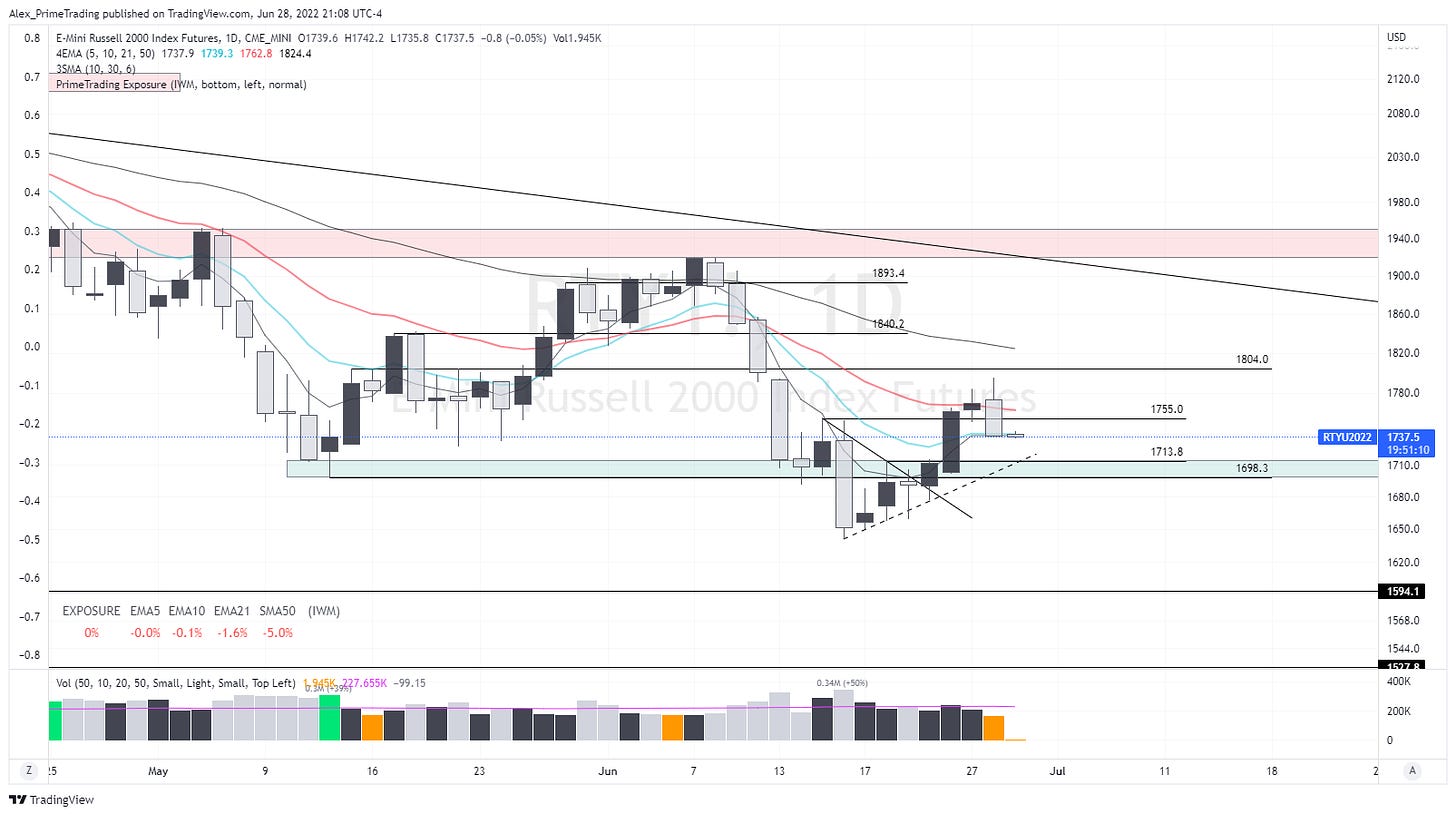

I was well aware that we were playing a bear market rally, but honestly, I was expecting a bit more fuel in the tank. We rolled over at the 21dma and undercut the 1755$ level which triggered my bear scenario once again.

We barely closed at/below (depends on your source) below the 5dma, bringing our exposure model back down to 0% again.

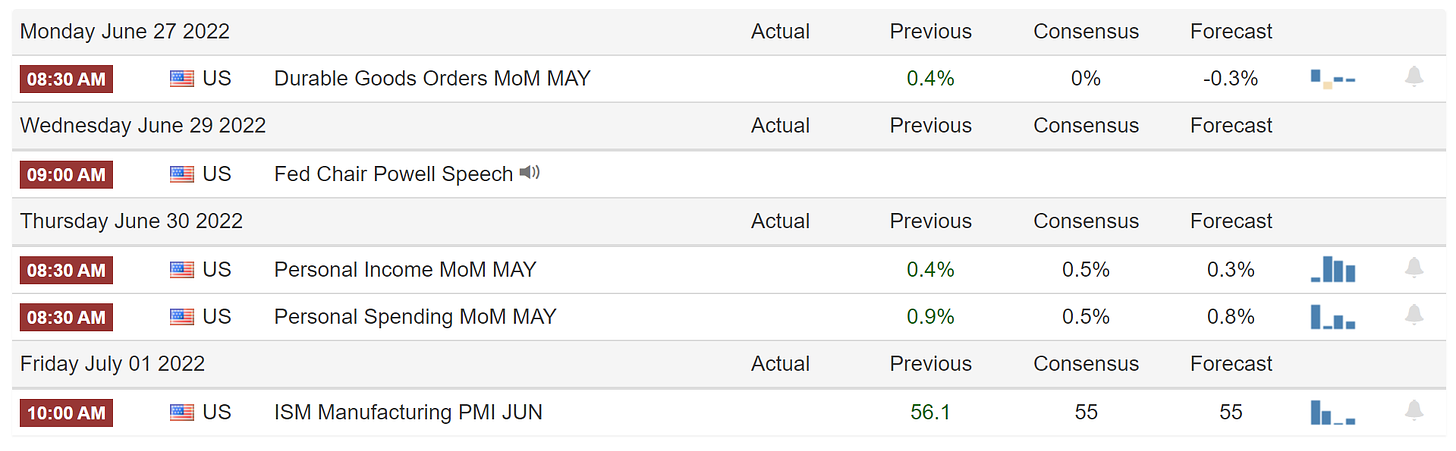

Keep in mind that tomorrow is an important day, as FED chairman Jerome Powell speaks at 9:00. This will move the market for sure, which side, that we can’t be certain.

The next potential area of support is around 1698/1713$ which was the most recent base support area. If we can’t hold this, we are likely to continue with another leg down.

Bullish scenario:

IF:

Reclaim 1755$ on volume following JPoww

THEN:

Cover short TZA position & open TNA

Bearish scenario:

Well, there was nothing orderly in today’s action! :) We undercut right on volume the 1755$ pivot and more importantly, all positions got me out today. This is very telling and we are clearly engaged in this bearish scenario of last night.

IF:

THEN:

MARKET BREADTH

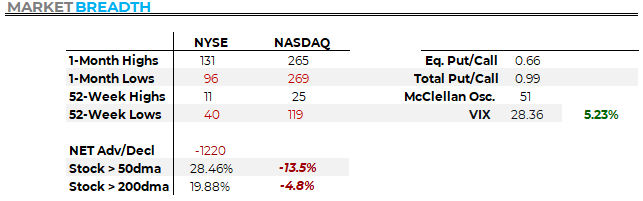

Breadth confirms the move down and we also see the P/C ratio spiking as well. Nothing extreme, but to be noted.

Stocks > 50dma (MMFI) We followed the market down and also undercut the 50dma.

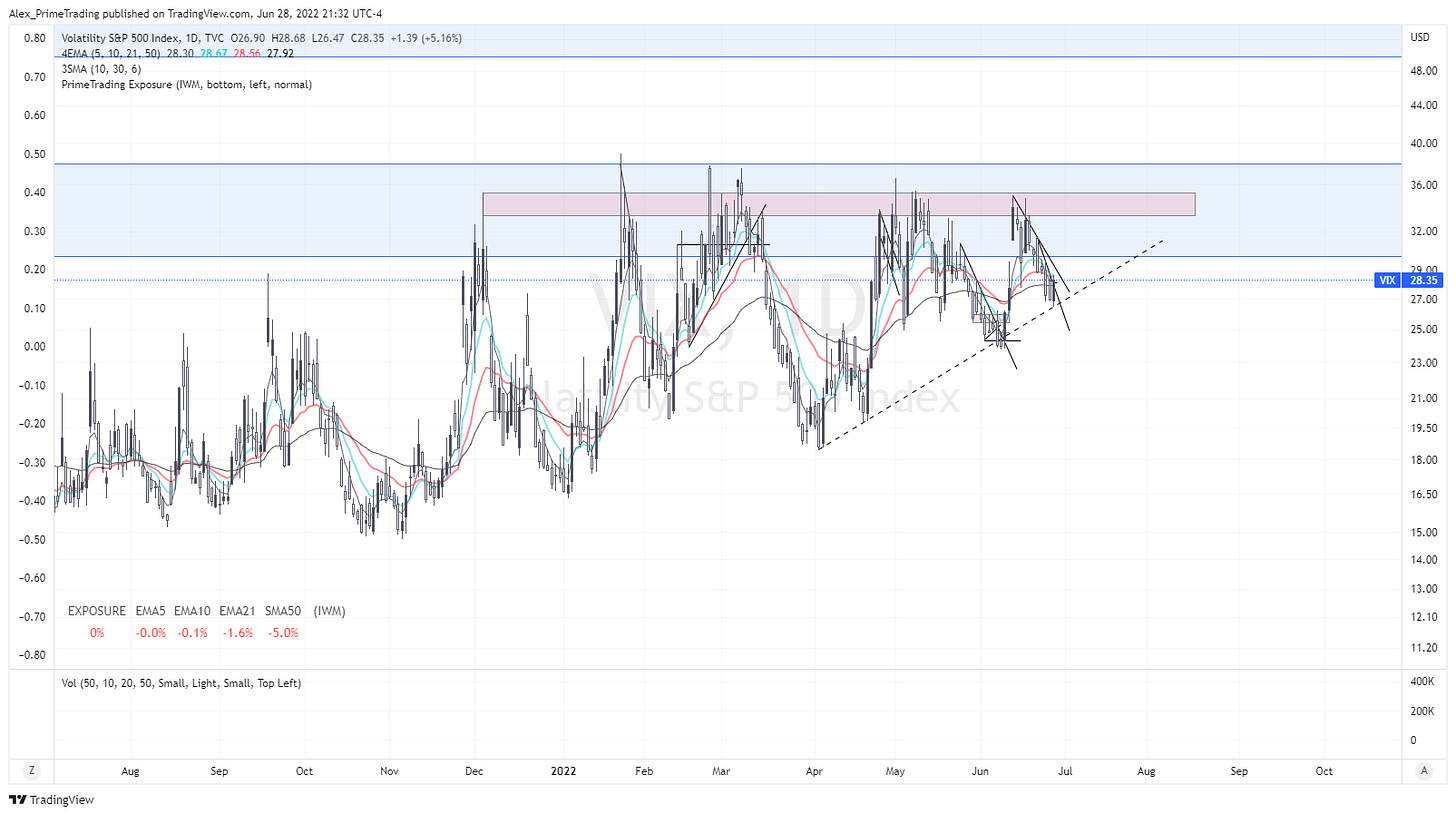

VIX is making higher lows in the last few months. With each market rally having a higher & higher low in that base. We bounced off that UTL today.

I’m realizing that we'll have to break that price structure for a real rally or bottom to take place.

ECONOMIC CALENDAR

!! FED CHAIR POWELL SPEECH BEFORE MARKET OPEN

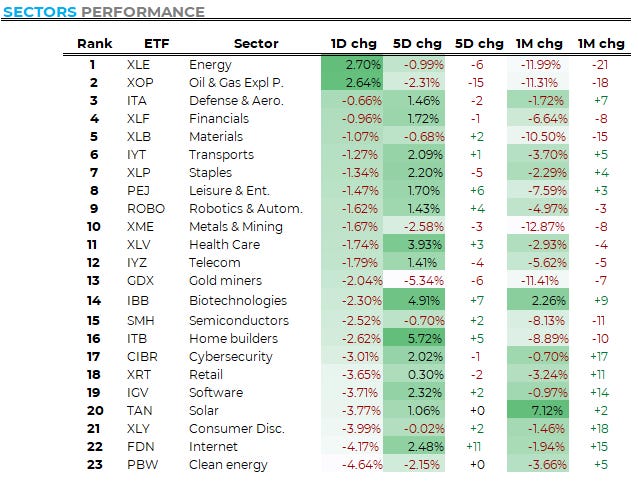

SECTORS PERFORMANCE

Outside of Energy & Oil, pretty much everything has been taken to the shed today. In the next few days/weeks (IF WE CONFIRM THE MOVE DOWN), I’ll start to look at those leading groups we saw in the most recent rally for signs of strength.

PEJ, XLV IBB IGV TAN & FDN

I will want to see which one of those group hold the best, make higher lows while the market makes a lower low, etc. Stay tuned

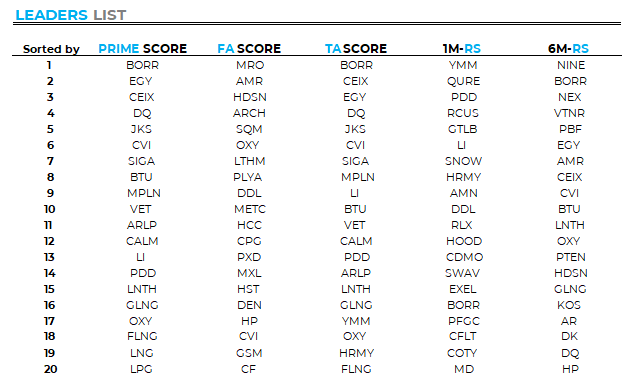

LEADERS LIST

Overall leaders 40/60 (PRIME Score)

BORR,EGY,CEIX,DQ,JKS,CVI,SIGA,BTU,MPLN,VET,ARLP,CALM,LI,PDD,LNTH,GLNG,OXY,FLNG,LNG,LPG,

Fundamental leaders (FA Score)

MRO,AMR,HDSN,ARCH,SQM,OXY,LTHM,PLYA,DDL,METC,HCC,CPG,PXD,MXL,HST,DEN,HP,CVI,GSM,CF,

Technical leaders (TA Score)

BORR,CEIX,EGY,DQ,JKS,CVI,SIGA,MPLN,LI,BTU,VET,CALM,PDD,ARLP,LNTH,GLNG,YMM,OXY,HRMY,FLNG,

Relative Strength 1 Month (1M-RS)

YMM,QURE,PDD,RCUS,GTLB,LI,SNOW,HRMY,AMN,DDL,RLX,HOOD,CDMO,SWAV,EXEL,BORR,PFGC,CFLT,COTY,MD,

Relative Strength 6 Month (6M-RS)

NINE,BORR,NEX,VTNR,PBF,EGY,AMR,CEIX,CVI,BTU,LNTH,OXY,PTEN,HDSN,GLNG,KOS,AR,DK,DQ,HP,

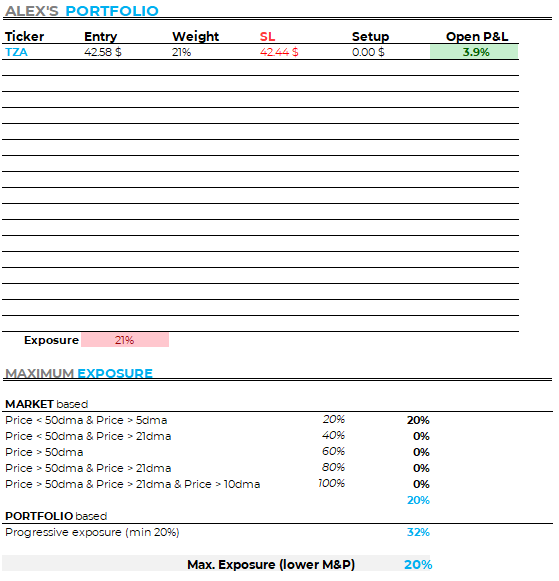

PT PORTFOLIO UPDATE

Well, as explained, I sold every position today while the market confirmed the bearish scenario and my new positions (LNTH, PLAB, VIR) came back to their entry pivot.

I also tried a position in SQM at the open, but market weakness knock me off quickly at a small loss.

New positions:

Trimmed positions:

Closed positions:

LNTH, PLAB, VIR & TNA

Alex’s FOCUSLIST

No quality setups along a potential rollover scenario playing out.

REFERENCES

Articles on my system:

I really hope that you enjoyed. If you did, please share it so that more folks can be reached and this Newsletter can grow. :)

Hi Alex,

I don´t understand why you closed all positions. In the report from the 27th you wrote "21dma rejection & Close below 1713$". Well the 21dma got rejected but IWM didnt close below 1713.

Neither LNTH and VIR got below the SL you had.

Thankful if you can expalin it in more detail to me :)

Cheers