Market update & Focuslist - 05/29

Evening Market Update & Strategic Insights

Good evening!

Thought of the day

A strong process keeps emotions out of the equation, keeping you grounded in the data.

Cheers, Alex! ✌️

PT Wiki Is Now Live!!

After weeks of building, writing, editing, and organizing... I’ve finally wrapped up the Free PrimeTrading Wiki. This is the central place where I’ve documented my entire swing trading system — the mindset, process, setups, tools, and how I actually execute.

If you’ve ever wanted a full breakdown of how I approach the market day in and day out, this is it.

What’s Inside:

Alex's Swing Trading System – full framework, entries, sizing, market timing

TradersLab Scans – the exact filters I use to build my Focus List

Trading Psychology Reflections – key mindset shifts and lessons

Glossary of Terms – clear definitions so we’re all speaking the same language

Education Articles – deep dives on Risk Management and Market Structure

Education Sessions – recorded walkthroughs: system, TLMM, process building

Tools – my Trading Journal + TradingView scripts (21dma structure, ATR extensions)

The only piece still missing is the Discord Onboarding section — it’ll be added in the next few days. This project is for you — to help you understand the why, not just the what. Let me know what you think.

https://traderslab.gitbook.io/primetrading

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

PRICE

The price didn’t break and remains above the rising 21-day moving average structure.

Futures show a different picture with a failed breakout pre-market, which faded before the open.

My head is at a continuation of that consolidation and potentially a higher low structure being made, or even a shakeout below the 21dma. It would give time for breadth to cool-off and get a proper market setup.

BREADTH

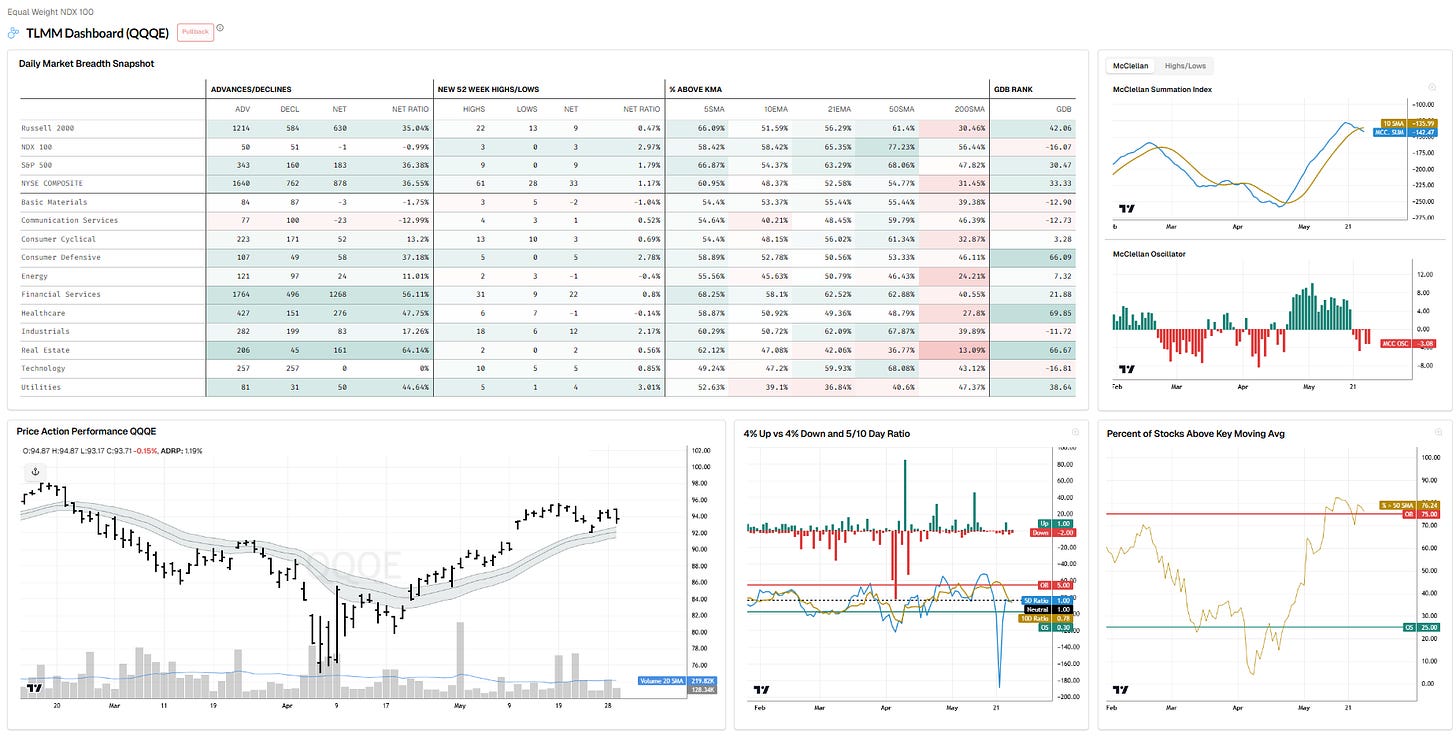

MCSI - Continues to trend below the now rounding 10-day moving average.

MCO - Pretty stable

%50dma - Still overbought and hook-down with a potential lower high beeing made.

That’s not the picture I want to see with MCSI trending down with a mid-term breadth ext. still overbought. That’s part of why I scaled down exposure today.

Breadth contracting.

TLMM DASHBOARD NASDAQ (MODEL: PULLBACK)

MARKET INTERNALS

Downtrend below 21dma structure.

Downtrend below 21dma structure.

10Y Bond Yields (TNX)

Right back into the 21dma-structure… potential breakdown or support?

/BTC (Bitcoin)

Not able to hold the short-term range, and retesting the 21dma. Could use a deeper pullback after the run it had… we’ll see.

Hey, tonight's report is packed!

Sector breakdowns, focus setups with alert levels, fresh scans, my latest portfolio moves, and a look at the week ahead.

Join in to get the full scoop and stay on top!

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.