Market update & Focuslist - 06/01

Evening Market Update & Strategic Insights

Good evening!

Thought of the day

Most traders miss the biggest runs because they stay stuck in fear, waiting for the next crisis that never hits the way they expect. If you want to catch real upside, you’ve got to block out the noise, trust what’s in front of you, and stay mentally open to strength.

Alex’s PF performance. - May. 2025 📑🛡️

MTD ( +22.78% )

YTD ( +39.18% )

YTD benchmark QQQ (+1.54%)

Well, one hell of a month, AGAIN!!

Probably the best trading I've put out since 2020. That market was good, but I was definitely in the zone, as proved by MTD stats. I was able to engage at the right time at the start of that rally, just as we reclaimed the 21dma-structure, MCSI curling up, and breadth was coming off oversold....textbook Alex market setup. TradersLab pointed me right into the leaders that were setting up tight in their 21dma-structure area. I got properly exposed in what proved to be the cycle winners. Couldn't have asked for more.

I really appreciated my patience all the way up, and mostly waited for my extensions target before trimming into strength, which proved helpful in keeping my exposure for a larger move than previously. These new rules are working great.

I could have been more patient yesterday, but I'm happy how I protected my EC and was ready to engage back again today. This proved to be the right move.

MTD stats:

Didn't overtrade with 35 trades (same as April)

Good win rate, above avrg at 51% (same as April)

RRR well above 3, and April now in the 8s...so good riding end of April positions.

Could have kept losses smaller in May, but UBER hit me yesterday.

Overall, I couldn't be happer with my trading this month, and let's see where this new trend goes!

Cheers, Alex! ✌️

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

Market remains in pullback, which now looks more & more like time digestion than price correction. And that's fine, that's what we want to see after the recent move off the lows.

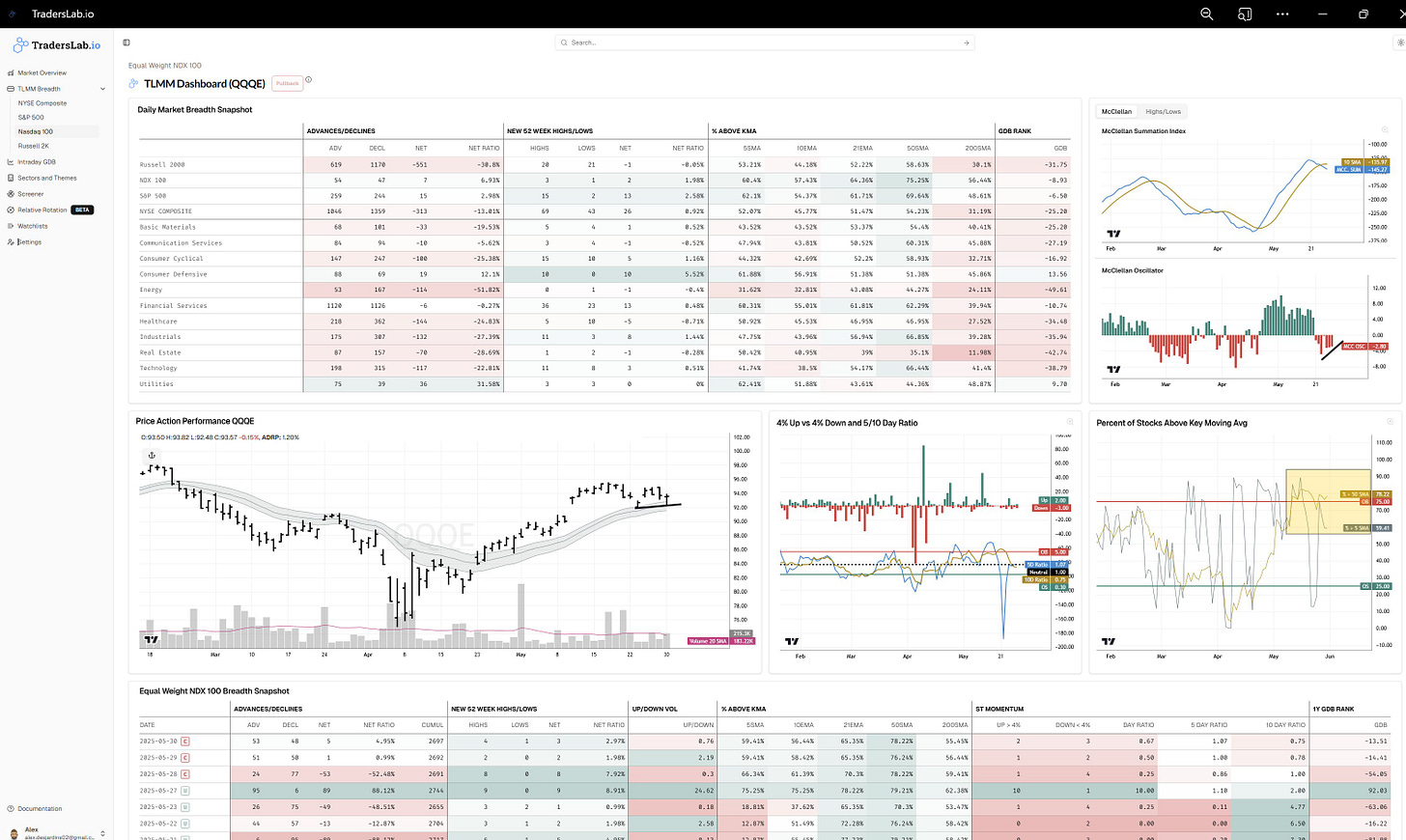

QQQE made a potential higher low off the 21dma-structure on Friday, and MCO is making that positive divergence despite a pretty overbought short-term to mid-term breadth extension.

I think this market looks very strong, with many leaders bouncing hard from their 21dma-structure on Friday as well.

This will be an interesting week for sure!

PRICE

Very good support right in the 21dma-structure on Friday. I like that price look with a potential higher low structure right in support.

BREADTH

MCSI - Continues to trend below the now rounding 10-day moving average.

MCO - Continued improvement over the last 2 days. Potential positive divergence.

%50dma - Keep surfing in OB.

TLMM DASHBOARD NASDAQ (MODEL: PULLBACK)

MARKET INTERNALS

Downtrend below 21dma structure.

Downtrend below 21dma structure.

10Y Bond Yields (TNX)

Right back into the 21dma-structure… potential breakdown or support?

/BTC (Bitcoin)

Daily reversal right off the 21dma-structure. Interesting spot for sure!

Hey, tonight's report is packed!

Sector breakdowns, focus setups with alert levels, fresh scans, my latest portfolio moves, and a look at the week ahead.

Join in to get the full scoop and stay on top!

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.