Market update & Focuslist - 06/15

Evening Market Update & Strategic Insights

Thought of the day

Small cuts add up. If you enter well, you won’t feel the need to micromanage every tick.

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

That Iran/Israel war is the wild card, and certainly adding a lot of noise right now. I’ll try the most I can to keep that noise out of my process, and focus on price action only.

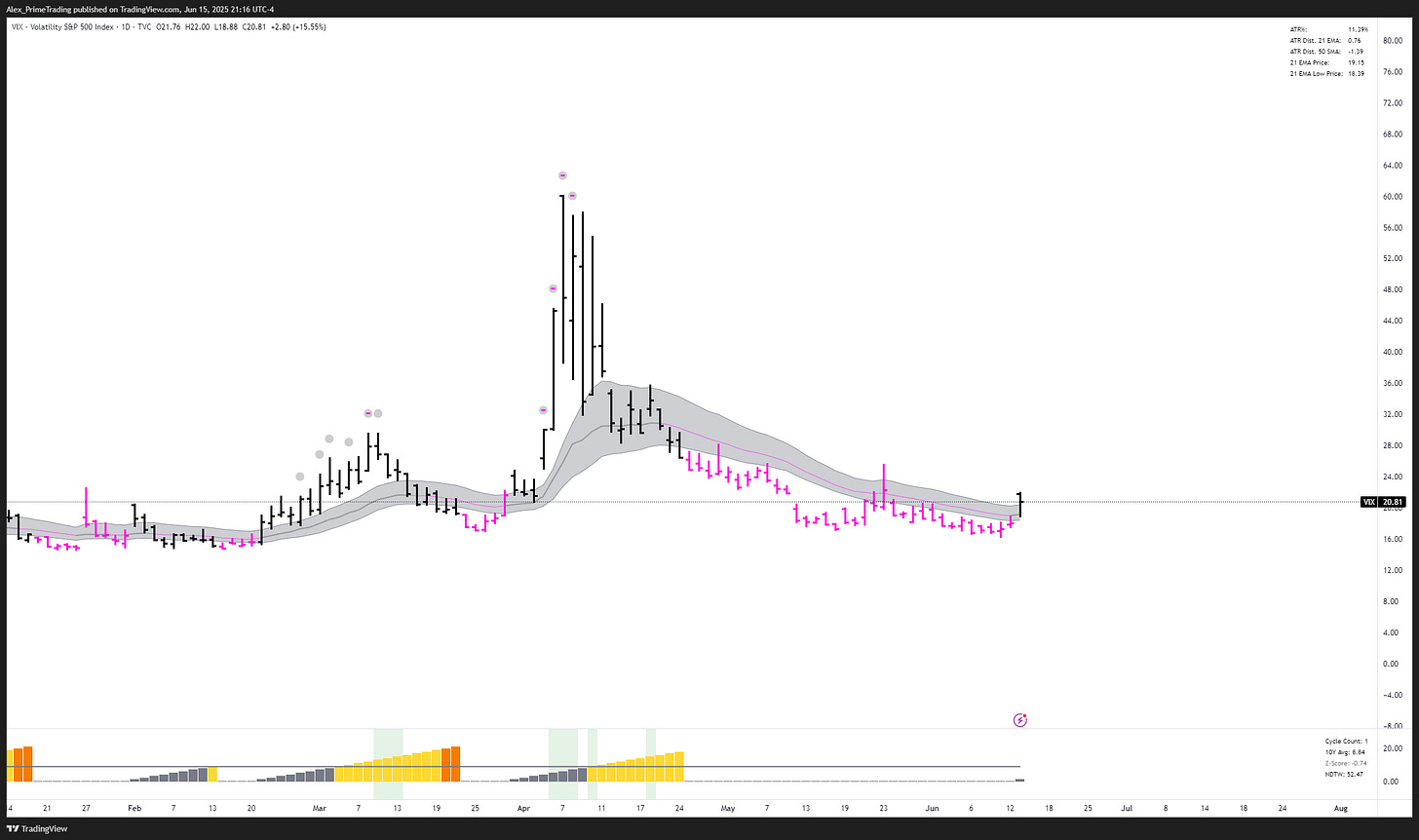

We are currently slightly above the 10Y average, so still early in the larger trend. With the price right in the 21dma-structure, the liquid leaders stocks acting well, and short-term breadth extension getting oversold, I continue to stay engaged and execute at the 21dma-structure in the leading stocks of my universe.

If the QQQs are breaking down below their 21dma-structure, then I’ll look for a longer pullback, but so far we are above a rising structure, so the trend is still in place.

With MCSI back in a downtrend, I will look to be less aggressive until we reconfirm the hook-up.

Market Cycle Statistics (Trend > 21dma-structure)

Cycle Count (days): 36

10Y cycle average (days): 33.32

Z-Score: -+0.09

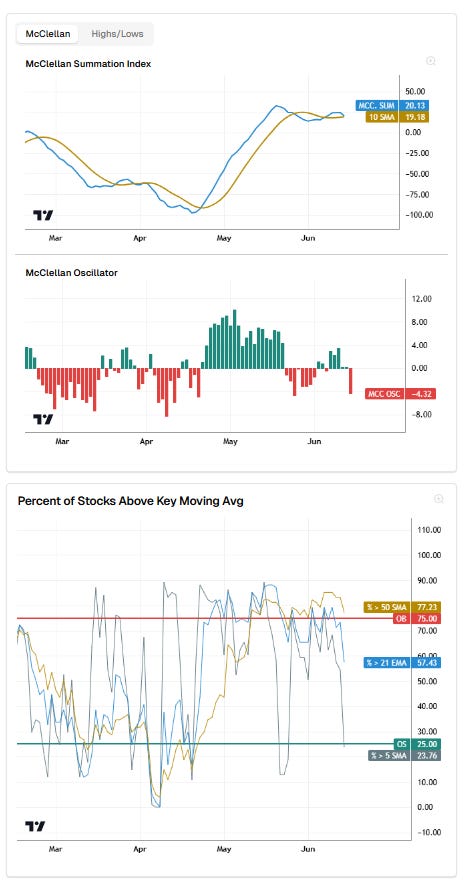

BREADTH

MCSI (McClellan Summation Index) - MCSI hook-down and retesting the 10dma line. Breadth contracting, so might be more choppy or even point to a longer pullback if price confirm the structure breakdown.

short-term breadth extension is getting oversold.

TLMM DASHBOARD NASDAQ (MODEL: PULLBACK)

MARKET INTERNALS

Downtrend below 21dma structure.

Pushing against the 21dma-structure. Key spot to watch.

21dma structure reclaim. On watch if reject or confirm it.

10Y Bond Yields (TNX)

21dma-structure retest.

/BTC (Bitcoin)

Tight at the 21dma-structure. Potential higher low being made.

Hey, tonight's report is packed!

Sector breakdowns, focus setups with alert levels, fresh scans, my latest portfolio moves, and a look at the week ahead.

Join in to get the full scoop and stay on top!

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.