Market update & Focuslist - 06/17

Evening Market Update & Strategic Insights

Thought of the day

It's a classic trap, and honestly, one most of us fall into at some point—myself included.

Traders feel the need to guess the top of a trend because it feels smart. There’s this internal reward mechanism that says, “If I can nail the exact top, I’m ahead of the crowd. I’m the one who saw it before everyone else.” It’s ego mixed with the illusion of control.

But here’s the thing: markets don’t care about your predictions. They care about price. And strong trends usually go way further than what feels reasonable. That’s the uncomfortable truth.

Another reason is fear—fear of giving back profits. You’re up nicely in a trade, and instead of managing it with structure, you start thinking, “What if it pulls back? What if this candle is the top?” That fear pushes you to act early, exit too soon, or even worse—flip short in front of strength.

The real pros? They ride strength and wait for the structure to break, not just the vibe. They trim when stretched, scale out with rules, and let the market prove when it’s time to be done.

Trying to constantly anticipate the end of a trend isn't about being smart—it's about trying to be right. But real performance comes from being in sync with strength, not predicting its death.

Just something to reflect on next time you're itching to call the top.

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

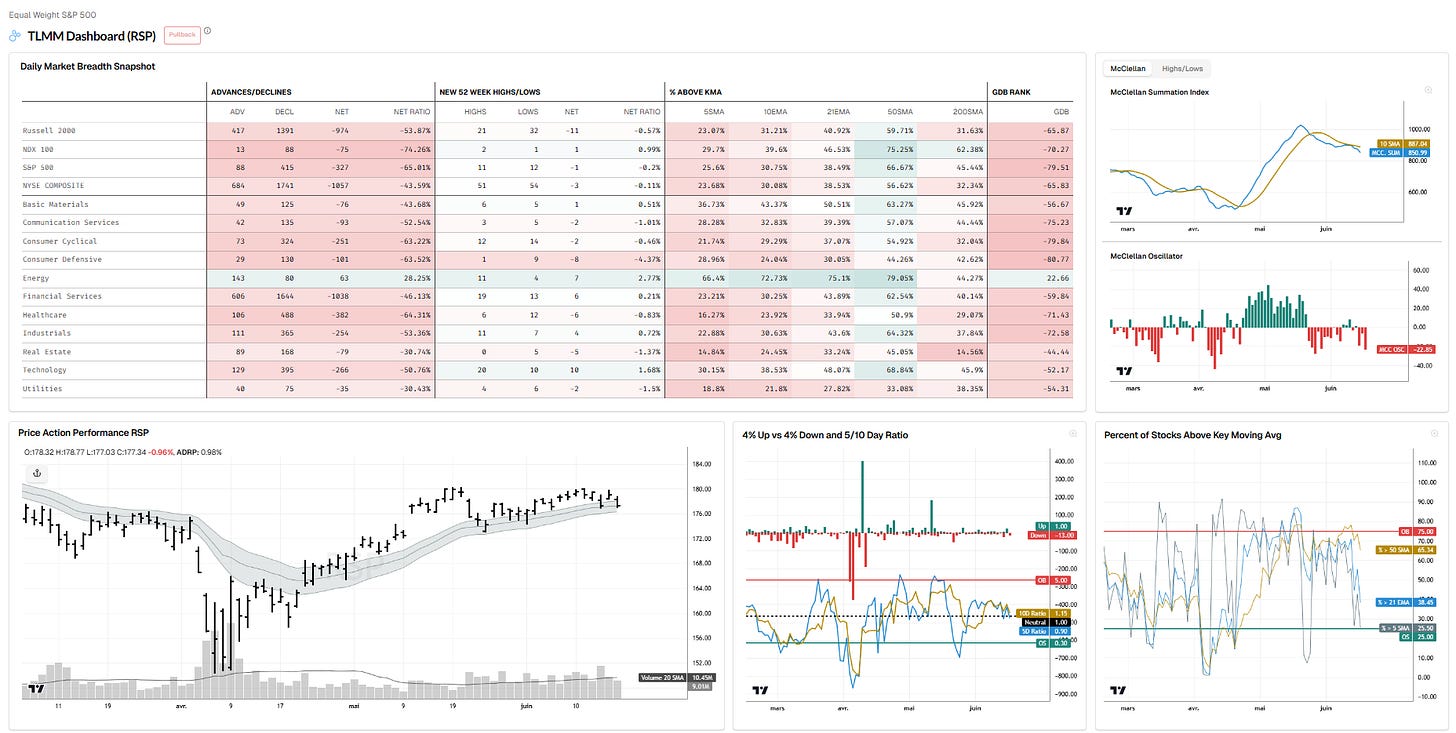

We couldn’t follow-through on the daily reversal attempt of yesterday, and we are once again closing weak as we reject the base top area.

We are still above the 21dma-structure, so I remain bullish focused, but with MCSI re-accelerating down below the 10dma, with recent trades feedback, and with VIX confirming a bounce off the 21dma-structure retest…I am rather denfensive going into FOMC tomorrow. We’ll continue to focus on price action and especially if we can get a bit more weakness to flush the breadth into oversold and price right into the 21dma-structure…that could be the shakeout needed to resume that uptrend.

Let’s see how we react to FOMC tomorrow, and potentially some US/IRAN/ISRAEL news too.

Market Cycle Statistics (Trend > 21dma-structure):

Cycle Count (days): 38

10Y cycle average (days): 33.35

Z-Score: -+0.13

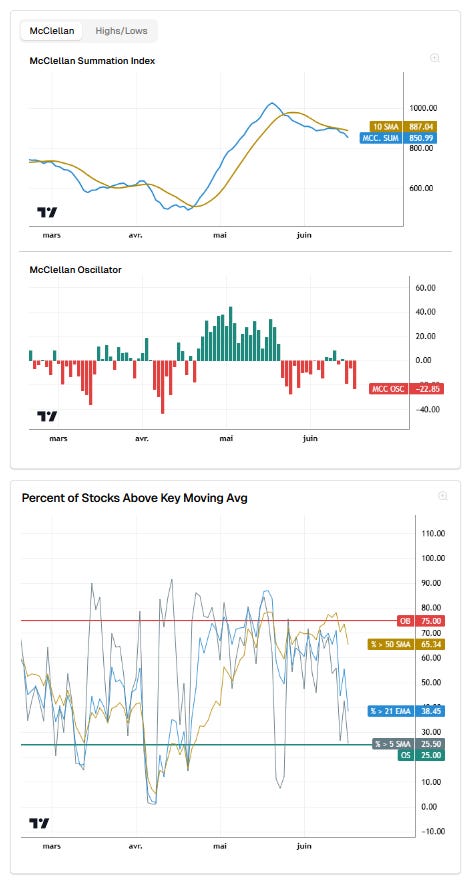

BREADTH

Final flush and we have breadth oversold...might just need a shakeout on FED or US/Iran war.

TLMM DASHBOARD S&P 500 (MODEL: PULLBACK)

MARKET INTERNALS

Downtrend below 21dma structure. Bounce off recent low structure again.

VIX has that 21dma-structure reclaim & retest look….

10Y Bond Yields (TNX)

21dma-structure retest & rejection.

/BTC (Bitcoin)

Failed to push and back at the lows and in the 21dma-structure…invalidating the long setup for now.

Hey, tonight's report is packed!

Sector breakdowns, focus setups with alert levels, fresh scans, my latest portfolio moves, and a look at the week ahead.

Join in to get the full scoop and stay on top!

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.