Market update & Focuslist - 07/02

Evening Market Update & Strategic Insights

Thought of the day

If you don’t have a written system, trust me—you’ll end up making emotional decisions the moment the market punches you in the face. That’s when discipline gets tested. That’s when FOMO kicks in and your brain starts finding reasons to break your own rules.

Sit down, write your framework. Define how you enter, how you exit, what trend structure you follow, how you manage risk. Put it all on paper—remove the gray areas. And don’t just do it once. Each market cycle, you revisit and refine it. Add what worked, cut what didn’t.

That’s how you evolve from reacting to the market… to controlling how you respond to it. That’s how you shift from hobbyist to professional.

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

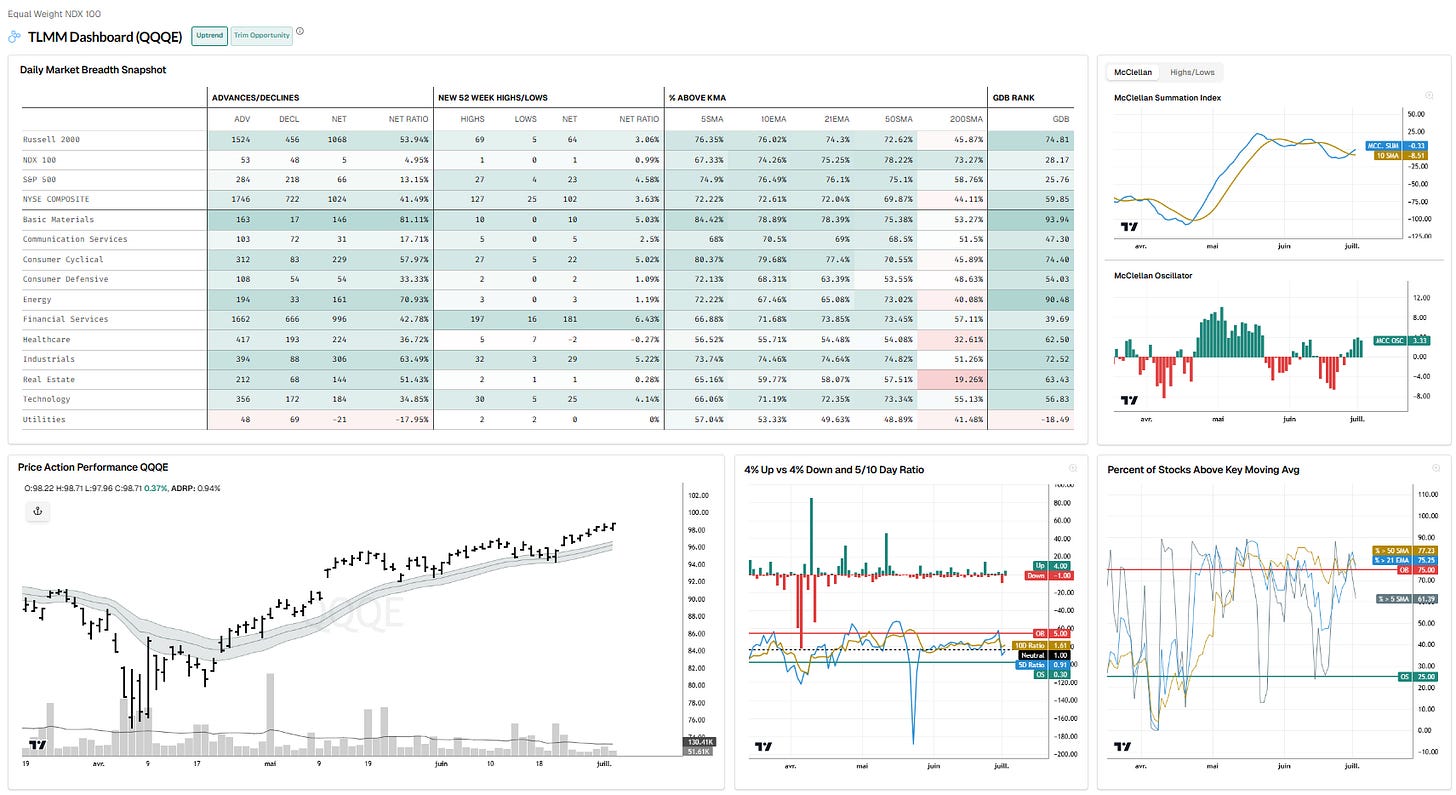

The market remains really impressive… We couldn’t follow-through on yesterday’s selling and bounce right back up with growth stocks finding support after the selloff.

We’re really in an environnement to follow price action and the setups, but we have to recognize that both price is extended from the 21 & 50dma, and breadth is overbought as well.

Note the negative divergence with VST to MT breadth ext. hooking down from OB today. Can we digest the recent move with a grind higher in the indices, and some narrow participation like last month? Action will tell.

For now, I remain in a mindset to be lighter in exposure (no margin), until we pullback in the 21dma-structure area (price not extended), and at least VST/ST breadth ext. get in oversold area. That’s when I’ll be more aggressive.

QQQ Price Cycle Statistics (Trend > 21dma-structure):

Cycle Count (days): 48

10Y cycle average (days): 19.53

Z-Score: +1.45

ATR Extension from 21 DMA: 2.3 (extended)

ATR Extension from 50 DMA: 5.79 (extended)

TLMM DASHBOARD NASDAQ (MODEL: UPTREND)

MARKET INTERNALS

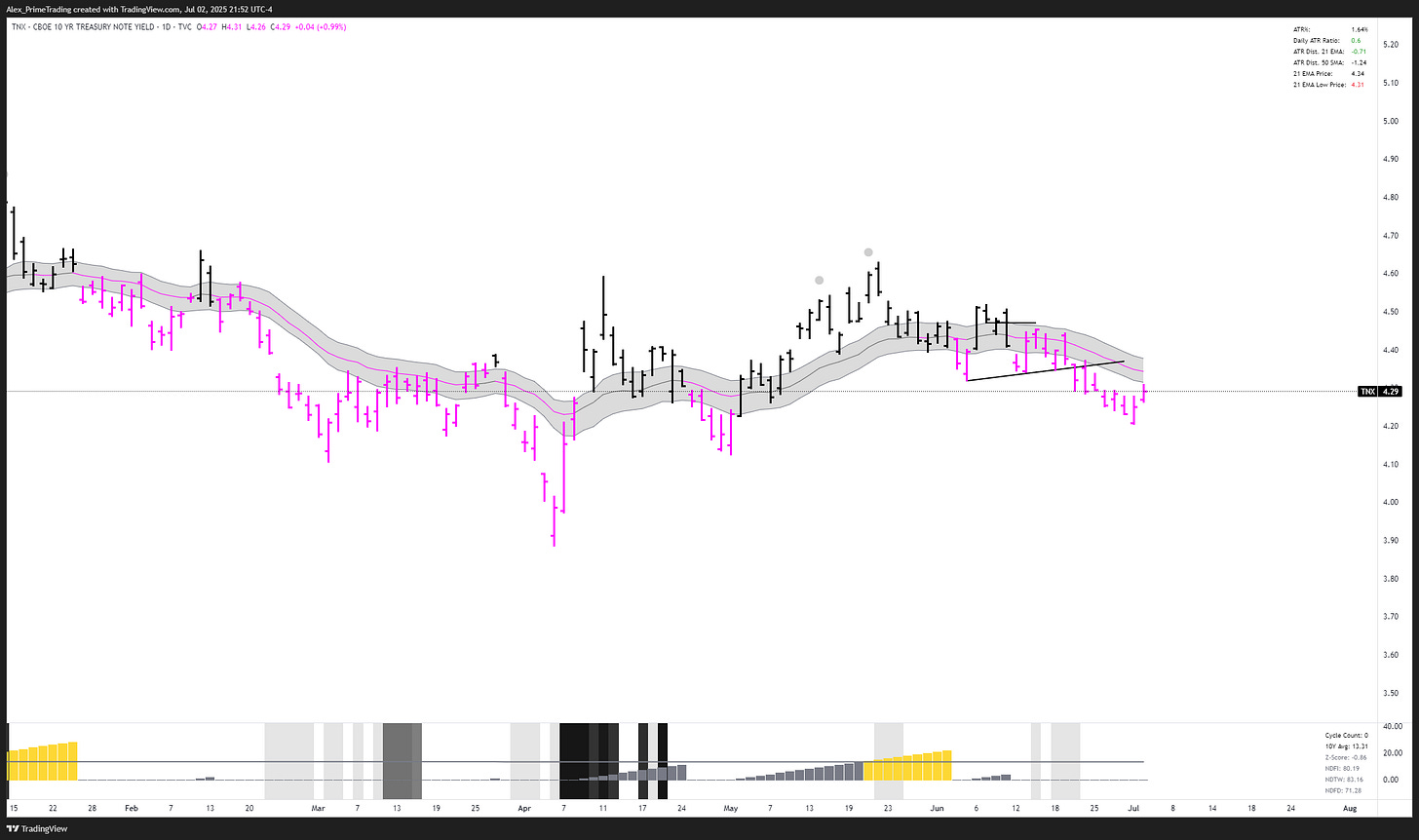

Downtrend below declining 21dma-structure.

Downtrend below declining 21dma-structure.

10Y Bond Yields (TNX)

Downtrend below declining 21dma-structure.

/BTC (Bitcoin)

Just like that, we have a daily reversal and breakout from the 21dma-structure and higher low. I executed that long setup on the reversal pivot this morning. Looks good in that larger base.

Hey, tonight's report is packed!

Sector breakdowns, focus setups with alert levels, fresh scans, my latest portfolio moves, and a look at the week ahead.

Join in to get the full scoop and stay on top!

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.