Market update & Focuslist - 09/02

Evening Market Update & Strategic Insights

Thought of the day

@BrocksStocks1

It's highs and lows in trading. At the highs, everything you buy works. At the lows, doesn't matter the entry, the tightness of risk, but you just get on a continuous losing streak.

Makes position sizing critical (small in drawdowns), (large in upswings).

It can be draining

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

The market picture is at risk, so I’m keeping it light and defensive.

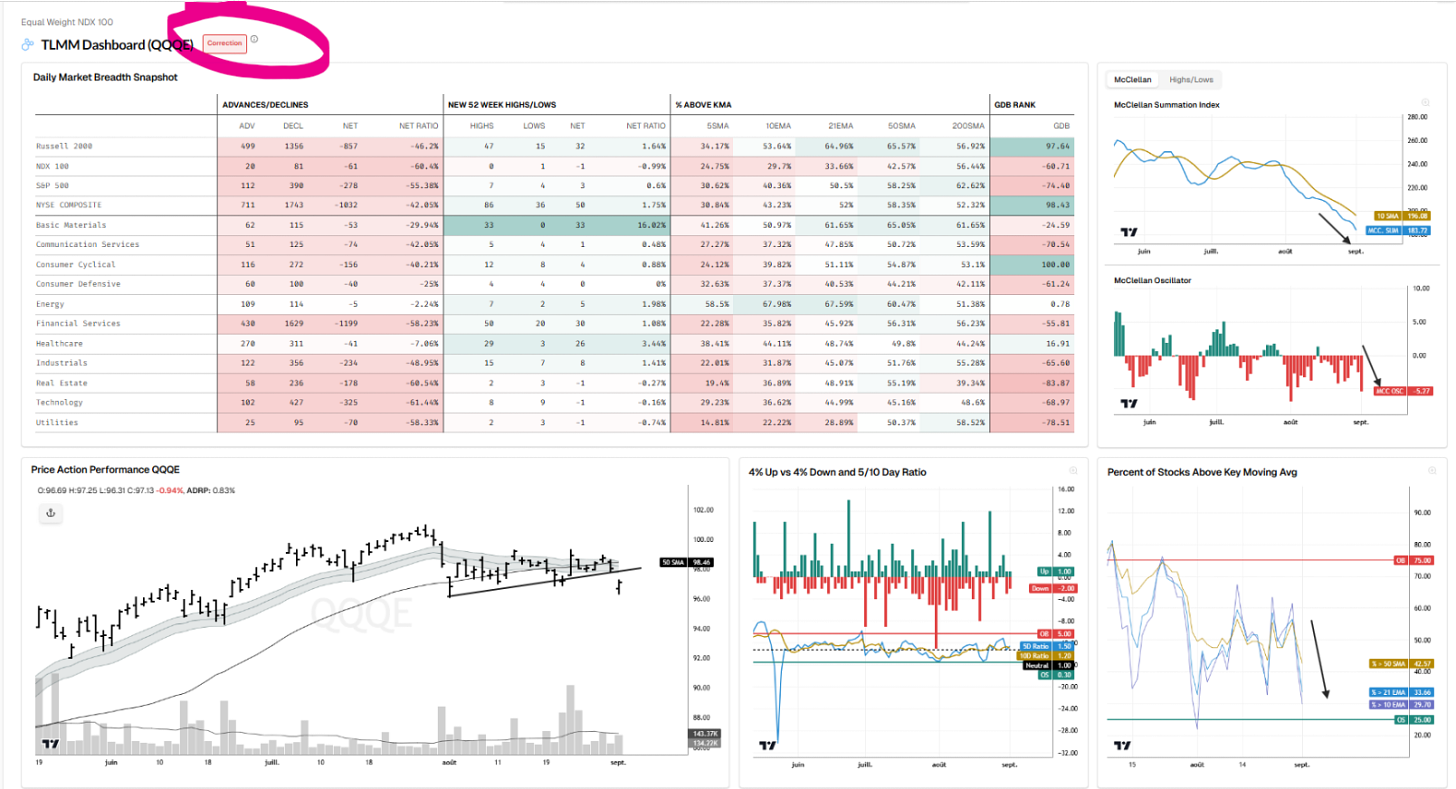

QQQE is below the 21dma-structure after breaking down from UTL → lower highs building; sellers in control.

10 < 21 < 50 DMA → moving averages are downtrend-aligned.

MCO (McClellan Oscillator) hooked back down after a neutral retest → re-acceleration of selling.

MCSI (Summation) is below a falling 10-DMA and accelerating lower → breadth deterioration remains broad.

Breadth extensions: contracting but not oversold → no washout yet; bounces are fragile.

Momentum indicators hooked down as well.

TLMM Model: regime = Correction.

Implications: Run lighter gross/net, keep hedges, and sell rips into the 10/21-DMA cluster.

What flips it: a breadth thrust, MCO > 0 with MCSI flattening/reclaiming its 10-DMA, and QQQE back above the 21dma-structure.

TLMM DASHBOARD NASDAQ

MARKET INTERNALS

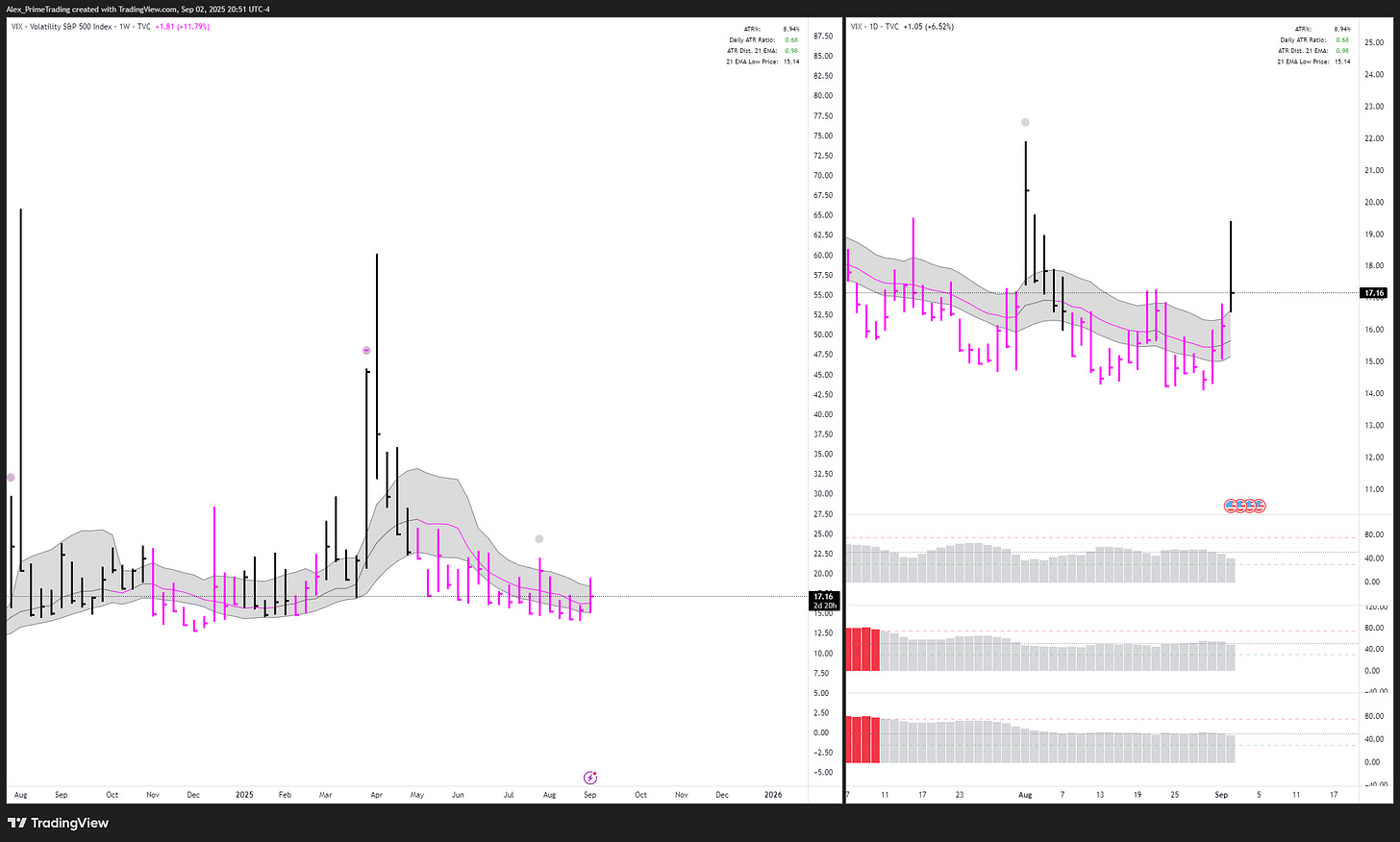

Spike above daily structure - caution.

Spike above daily structure - caution.

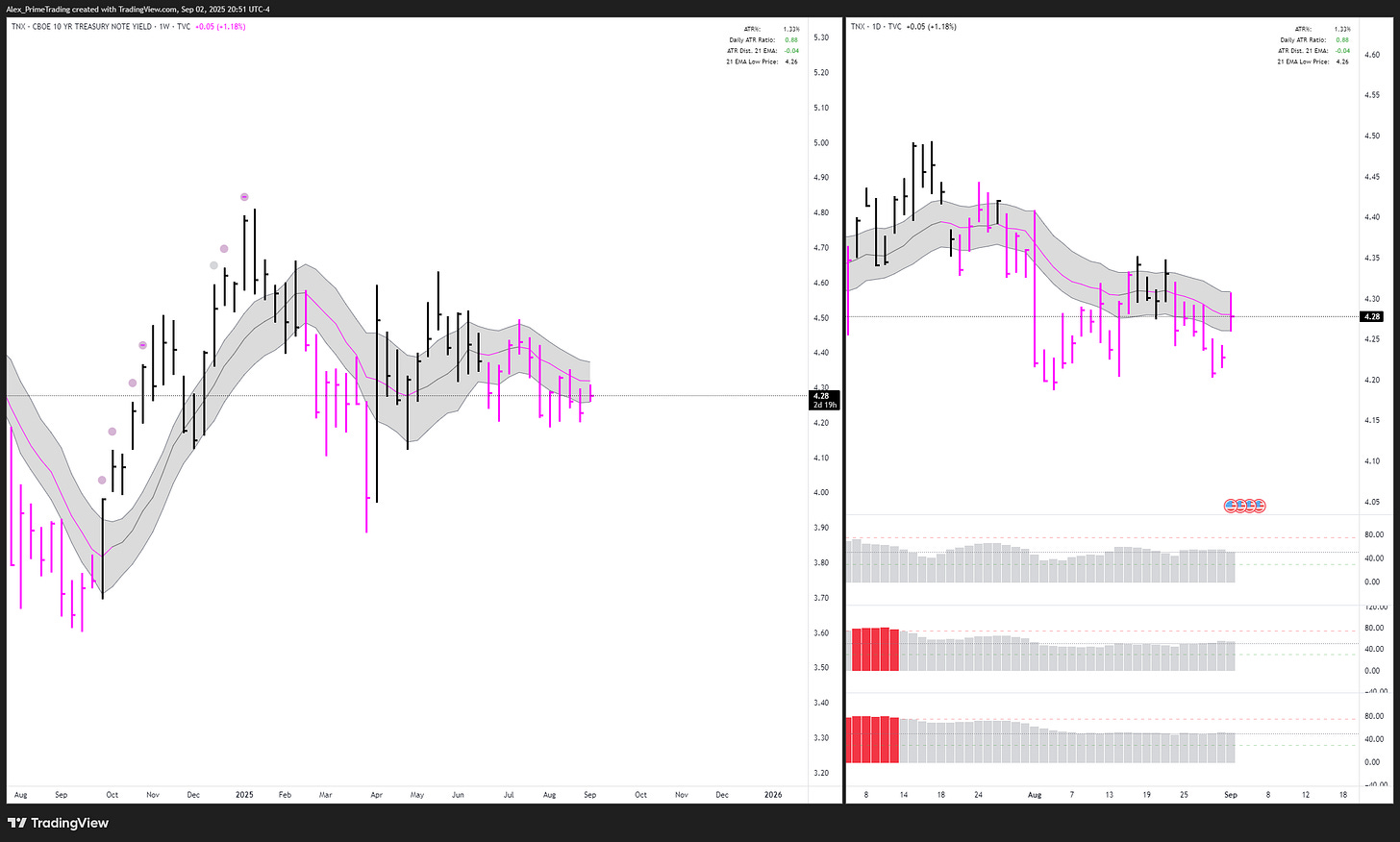

10Y Bond Yields (TNX)

Downtrend below daily & weekly structures. All good.

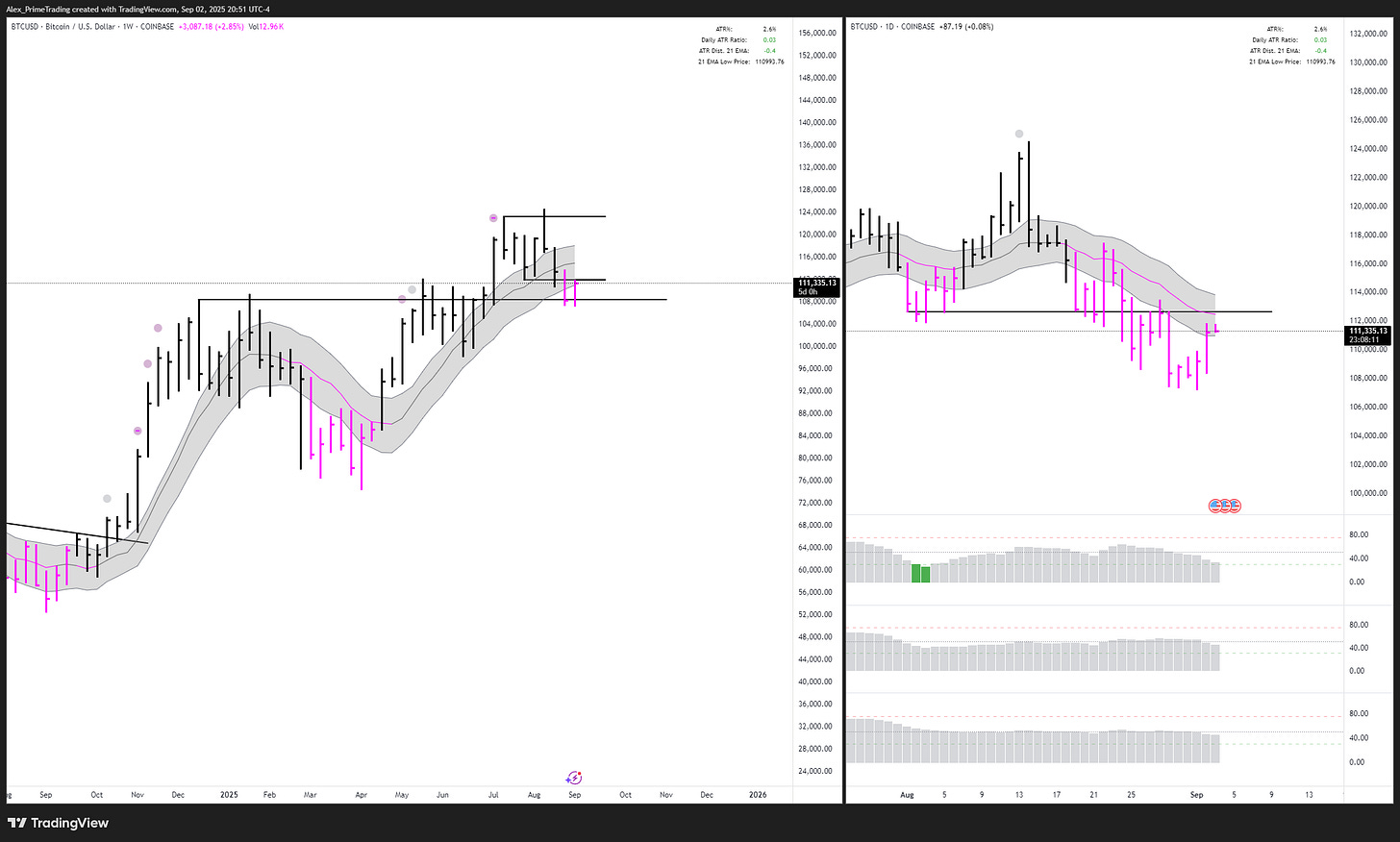

/BTC (Bitcoin)

BTC made a nice move today, but all I still see is a rally into declining daily structure. Until we reclaim both the 21dma-structure, and range structure...we're still in a downtrend with LLs & LHs

Hey, tonight's report is packed!

Sector breakdowns, focus setups with alert levels, fresh scans, my latest portfolio moves, and a look at the week ahead.

Join in to get the full scoop and stay on top!

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.