Thought of the day

I used to get shaken out by every normal reaction. (still do from time to time)

The trick was flipping the mindset, buying where I’d usually sell, leaning into the discomfort and emotional response instead of running from it.

Funny thing is, the trades that feel the worst usually end up being the best.

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

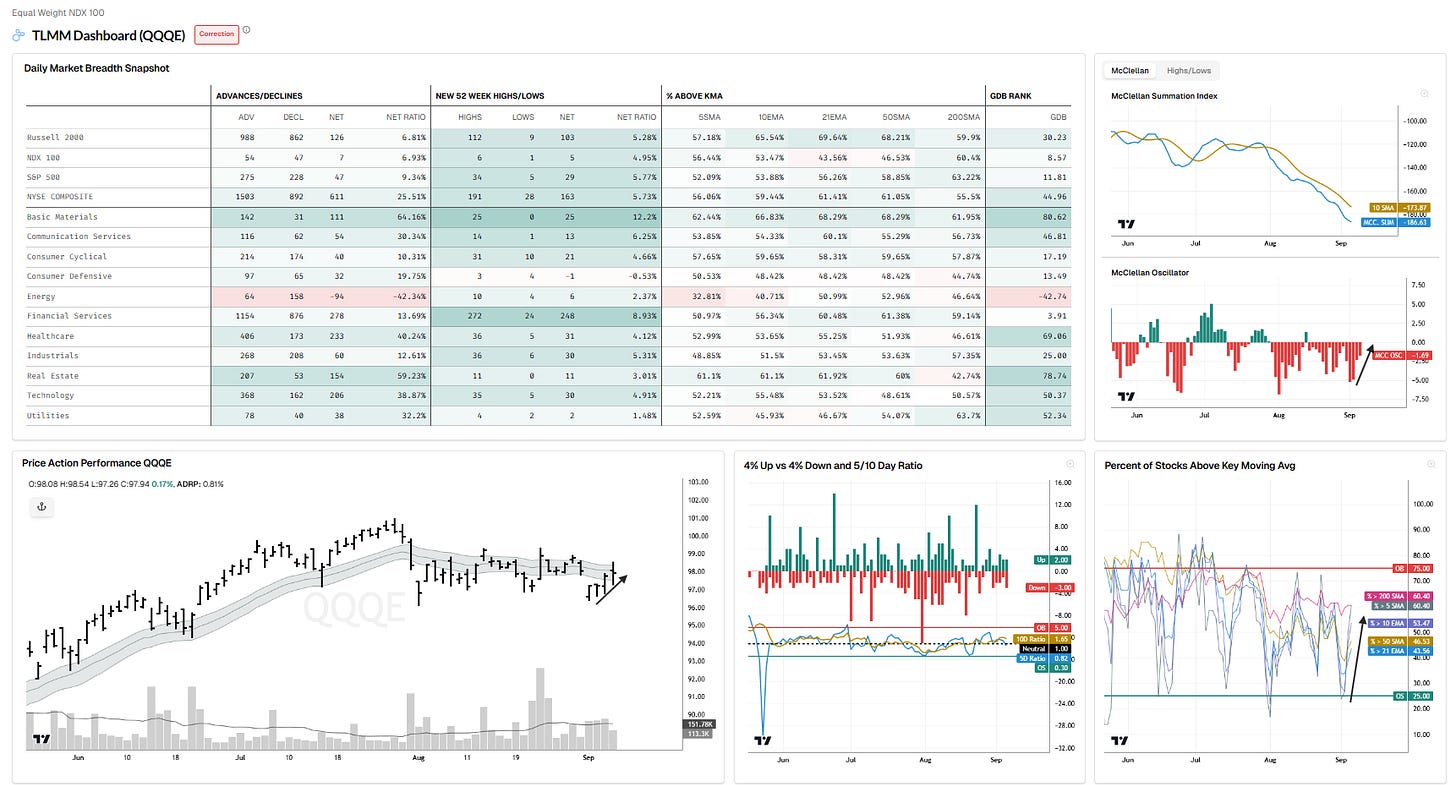

We are still on our anticipation setup here for Nasdaq, with the breadth extension hook-up after an oversold condition, and MCO improving for the 4th day on Friday, despite an early-day shakeout.

Price is hanging at the declining 21dma, so we’ll need to see either a clear reclaim & push higher from here, or maybe some higher low being made to setup the reclaim.

Either way, we should have more confirmation as to whether MCSI confirms or not the hook-up.

One day at a time.

TLMM Model: regime = Correction. (but anticipation setup based on breadth hook-up from OS)

Implications: Run lighter, but test the market. Increase exposure if we get MCSI+Price confirmation.

What flips it: A breadth thrust, MCO > 0 with MCSI flattening/reclaiming its 10-DMA, and QQQE back above the 21dma-structure.

TLMM DASHBOARD NASDAQ

MARKET INTERNALS

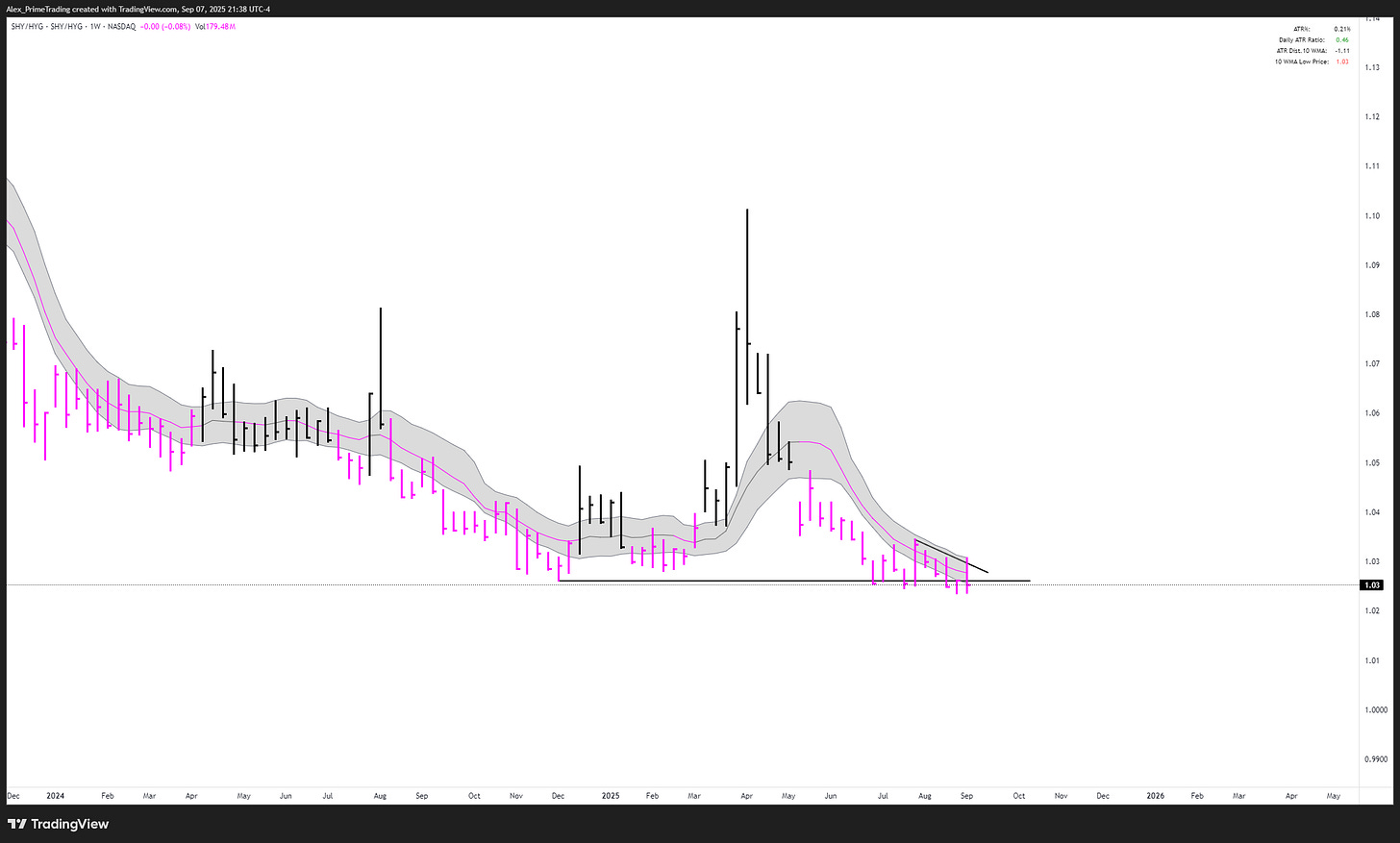

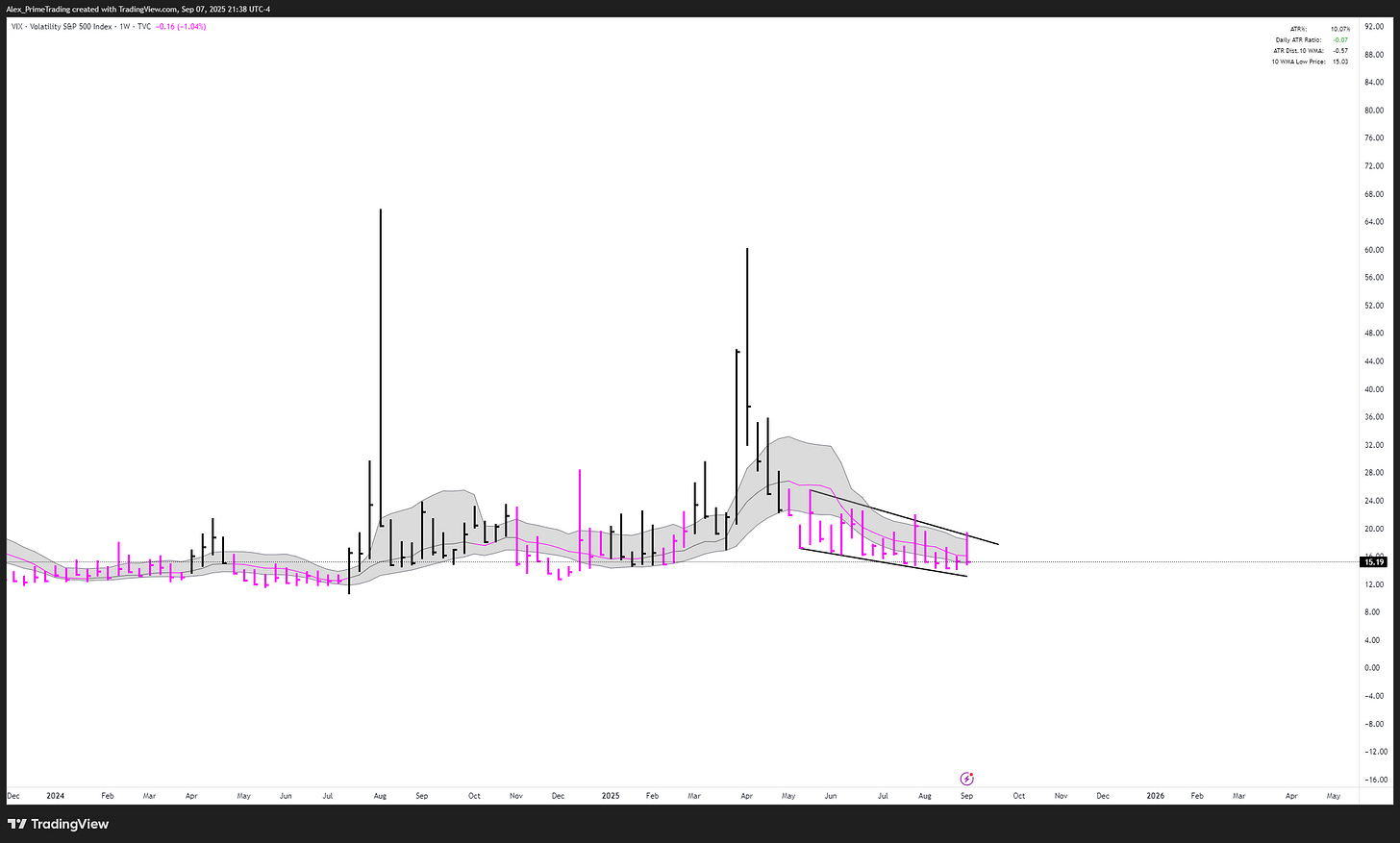

Rejected at weekly structure. Good

Rejected at weekly structure. Good

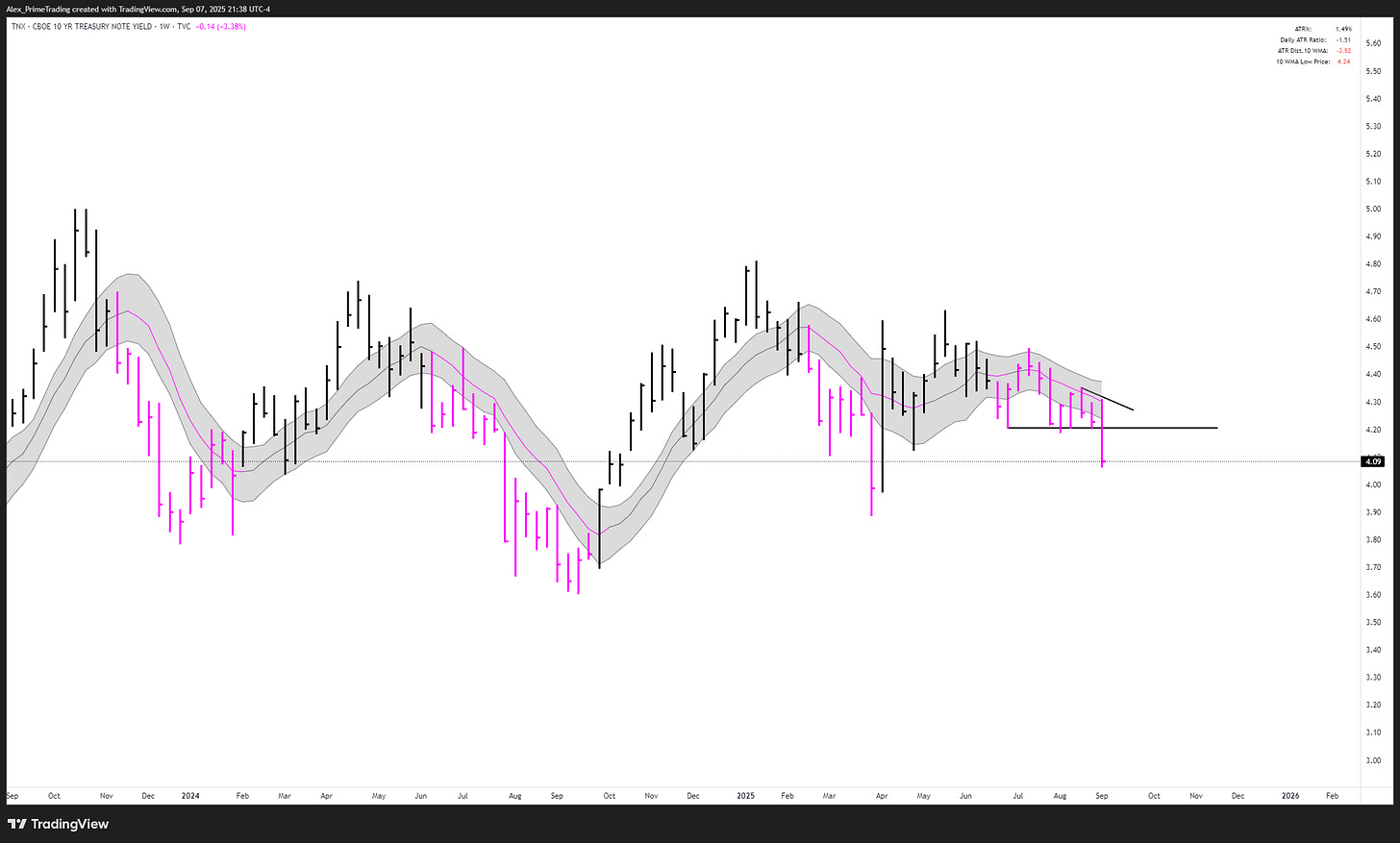

10Y Bond Yields (TNX)

Downtrend below weekly structure with a breakdown confirmed.

/BTC (Bitcoin)

Still below weekly-structure, but the base top area holds.

Hey, tonight's report is packed!

Sector breakdowns, focus setups with alert levels, fresh scans, my latest portfolio moves, and a look at the week ahead.

Join in to get the full scoop and stay on top!

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.