Good evening, everyone!

Enjoy tonight’s report.

Cheers, Alex! ✌️

Tonight’s report content

Market Analysis

Sectors & Themes Analysis

Focuslist including setups, alert levels & explanation (long & short)

Scans (technicals, fundamentals & potential TMLs)

My Portfolio Update + bi-weekly full positions update

Economic & Earnings Calendar

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

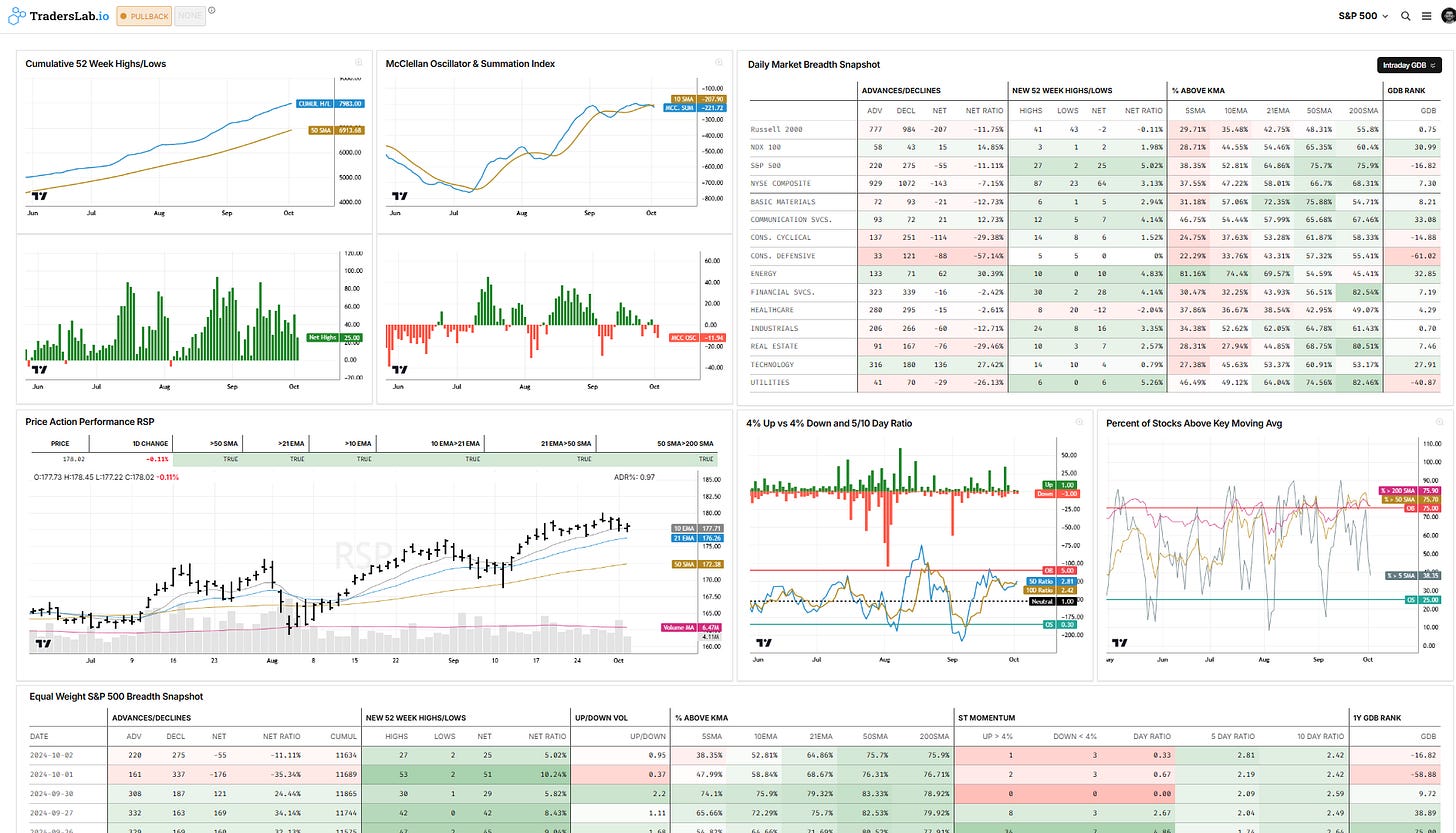

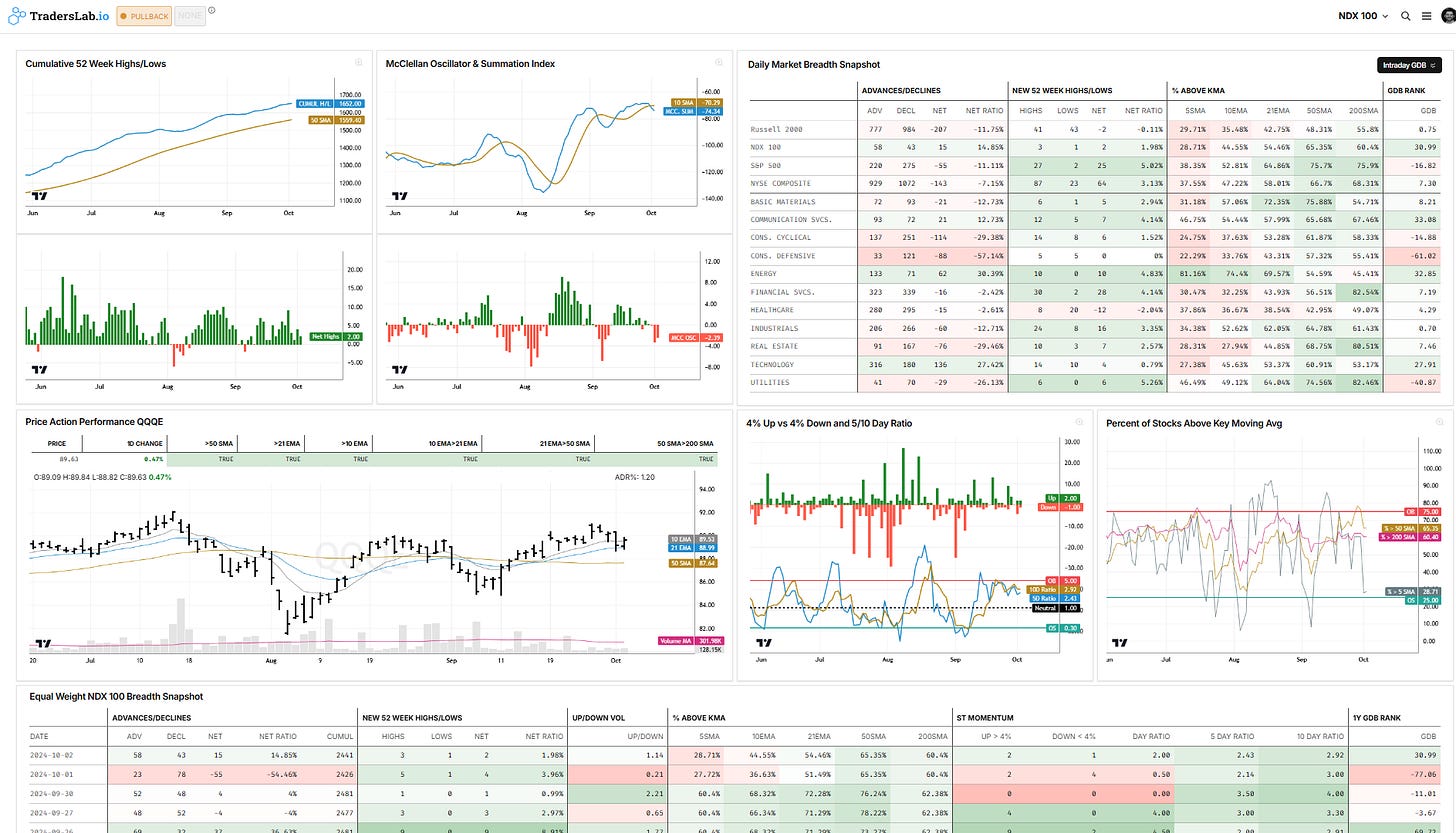

Breadth contraction is following through below the 10dma today, and we see an acceleration in the rate of change as well. (MCC osc)

Sure, the market can go higher from here as we’re getting close to an ST oversold reading, but with MT/LT breadth that elevated in OB condition and MCSI accelerating below the 10dma, that's fighting the wrong fight for me on the long side. Flip that breadth extension chart upside down, and that's where I want to look for intermediate long swing.

It's an interesting market, for sure, but I started to consider testing the short side today as I followed my tools/rules.

Market Model #PTMM

S&P500 (RSP)

PTMM Signal: PULLBACK

NASDAQ (QQQE)

PTMM Signal: PULLBACK

RUSSELL 2K (IWM)

PTMM Signal: PULLBACK

Market Internals

Above all kma’s with today’s spike - warning.

Downtrend - below all declining kma’s.

10/21dma reclaim…but still below 50dma - warning.

US dollar index (DXY)

Downtrend - below all declining kma’s.

Retest of 50dma

Downtrend - below all declining kma’s.

Spike into kma’s, to be monitored but nothing too concerning yet.

/BTC (Bitcoin)

Sliced through the 10/21dma, retesting the swing low_AVWAP & 50dma. This support need to hold.

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.