Market update & Focuslist - 11/28

Evening Market Update & Strategic Insights

Good evening, everyone!

Enjoy tonight’s report.

Cheers, Alex! ✌️

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

THE BLACK FRIDAY sale is HERE @ PrimeTrading

25% OFF - NEW USERS for the first 3 months (monthly plan)

Use the promo code "BF2024" until Saturday.

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

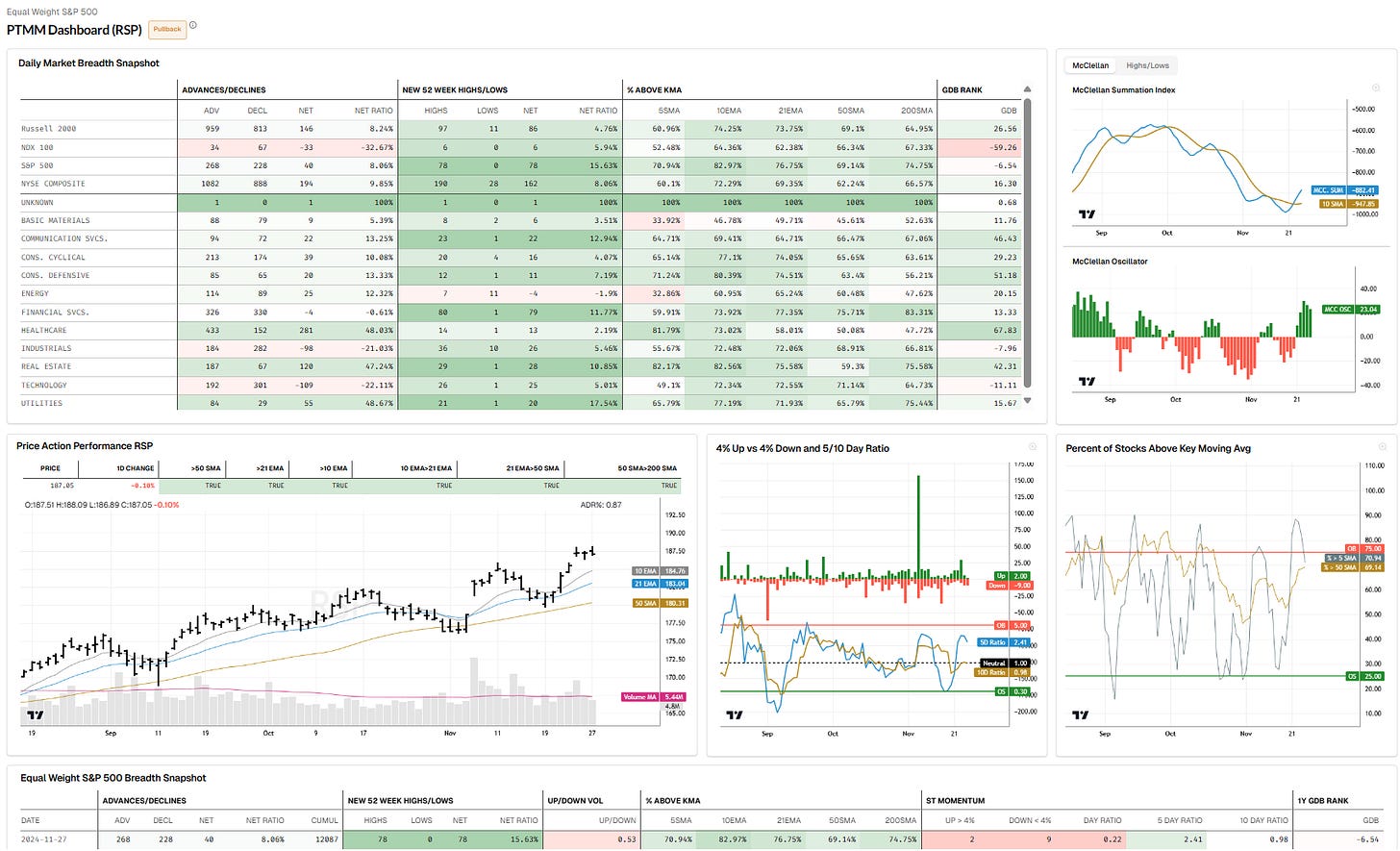

Clearly more digestion was needed with Wed's action, but I remain focused on the broader market despite the tech/semis weakness showed by a still solid trend above all kma's on SPX/RSP. Breadth is still expending with MCSI firmly up and price above all trending kma's. We were expecting that digestion, it's all good and normal so far.

Market Model #PTMM

S&P500 (RSP)

NASDAQ (QQQE)

Market Internals

Below all kma’s

Credit Spreads are one of my top internal indicator. And once again plays out well on this market digestion. Good rejection of the kma's, and could set up a nice bounce in the market Friday morning. I like what I see and that is giving me some confidence into the close, and potentiallly carry more exposure even into holiday with that look.

Rejection & downside reversal follow through. Very constructive action.

Uptrend - Above all kma’s.

First 21dma undercut for the first time of this uptrend.

US dollar index (DXY)

Uptrend - Above all kma’s.

Right at the 21dma…will it hold or break like the Yields?

/BTC (Bitcoin)

Uptrend - Above all kma’s.

Looking very good for a continuation breakout here.

Hey, tonight's report is packed!

Sector breakdowns, focus setups with alert levels, fresh scans, my latest portfolio moves, and a look at the week ahead.

Join in to get the full scoop and stay on top!

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.