Thought of the day

One of the easiest traps to fall into as a trader is breaking your own rules. The moment you stop following your system, you invite randomness into your trading, and random actions lead to random results.

A trading system isn’t about perfection, it’s about consistency. Rules exist to protect you from emotional decisions in the heat of the moment. Every time you override them, chasing an entry, skipping a stop, sizing impulsively, you chip away at your edge and replace it with chance.

The solution? Commit to discipline. Execute your plan as written, review it regularly, and only change rules deliberately, not mid-trade. Over time, consistency compounds. Without discipline, there is no system, only luck.

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

MARKET ANALYSIS

Good evening,

Price daily reversal above Thursday’s high. Powerful day.

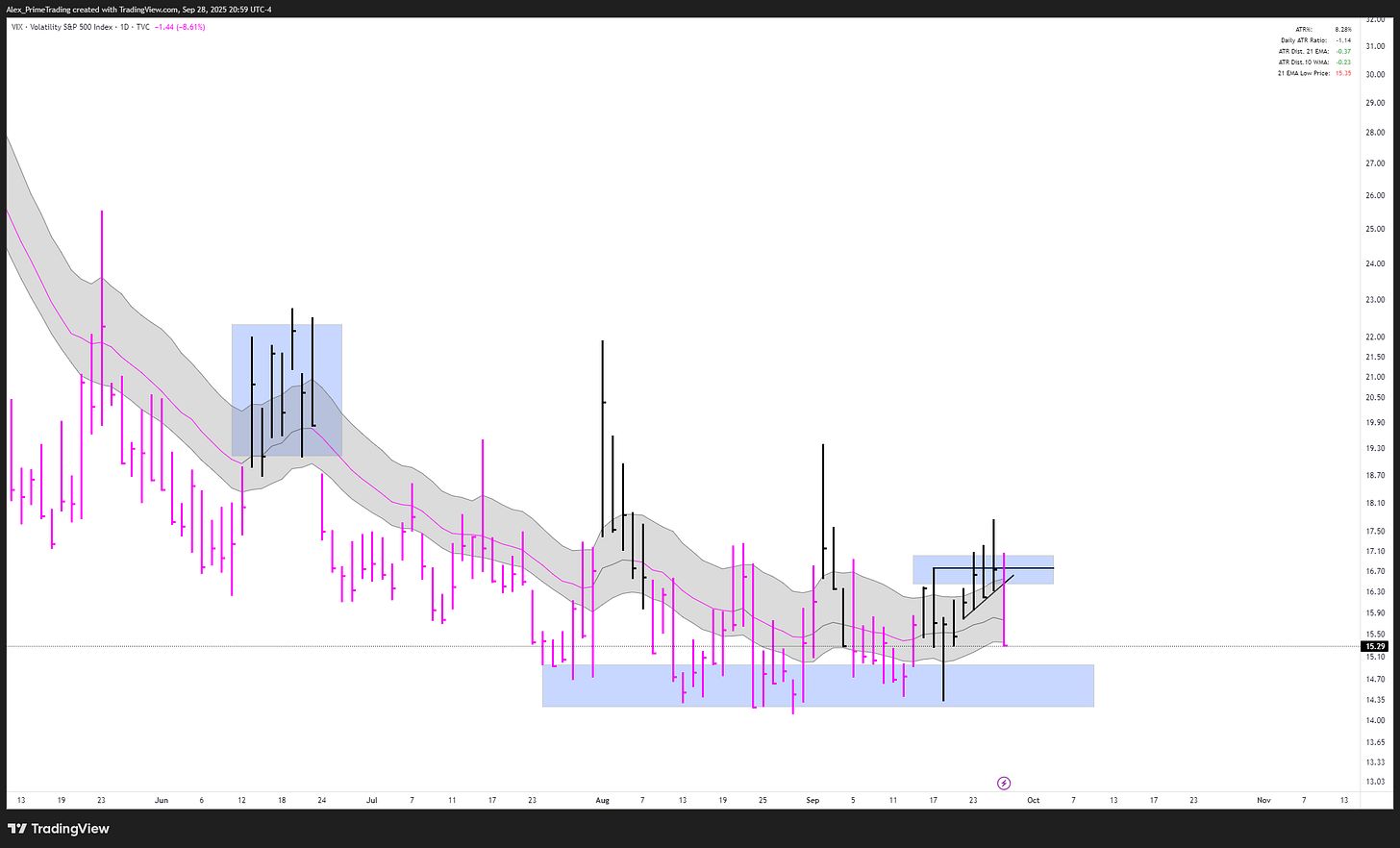

MCSI hook-up!! Good.

Breadth extensions hooked UP again after an intraday oversold

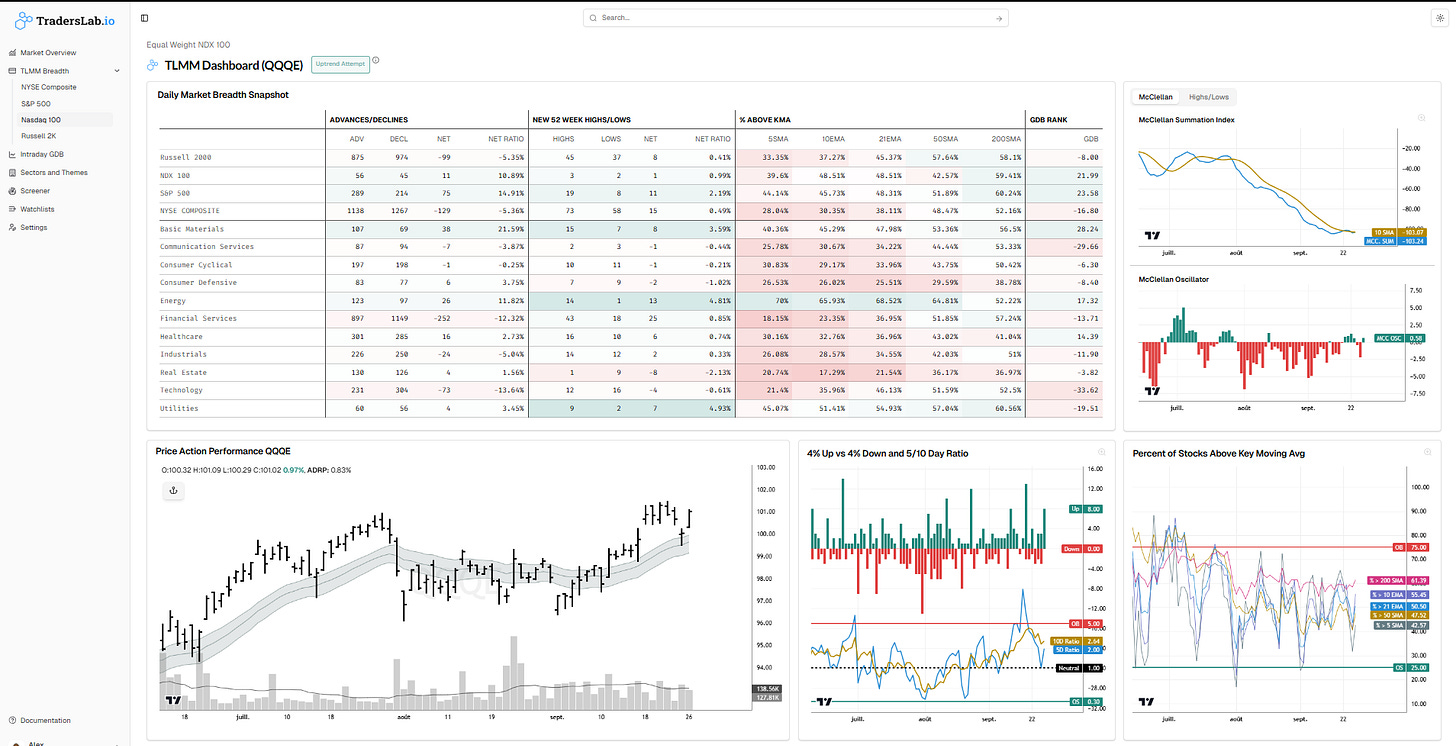

TLMM Model = Uptrend Attempt

This is my anticipation setup right here… A price bounces off rising daily-structure, daily reversal (Friday), confirmed by a MCSI and Breadth ext. hook-up.

We’ll need to see if we follow-through and we finally see better action as last week on the MCSI 10dma reclaim. We need to see broader participation with breadth expending way larger than the initial bounce attempt last week.

Day by day, but I remain cautiously optimistic.

TLMM DASHBOARD NASDAQ

MARKET INTERNALS

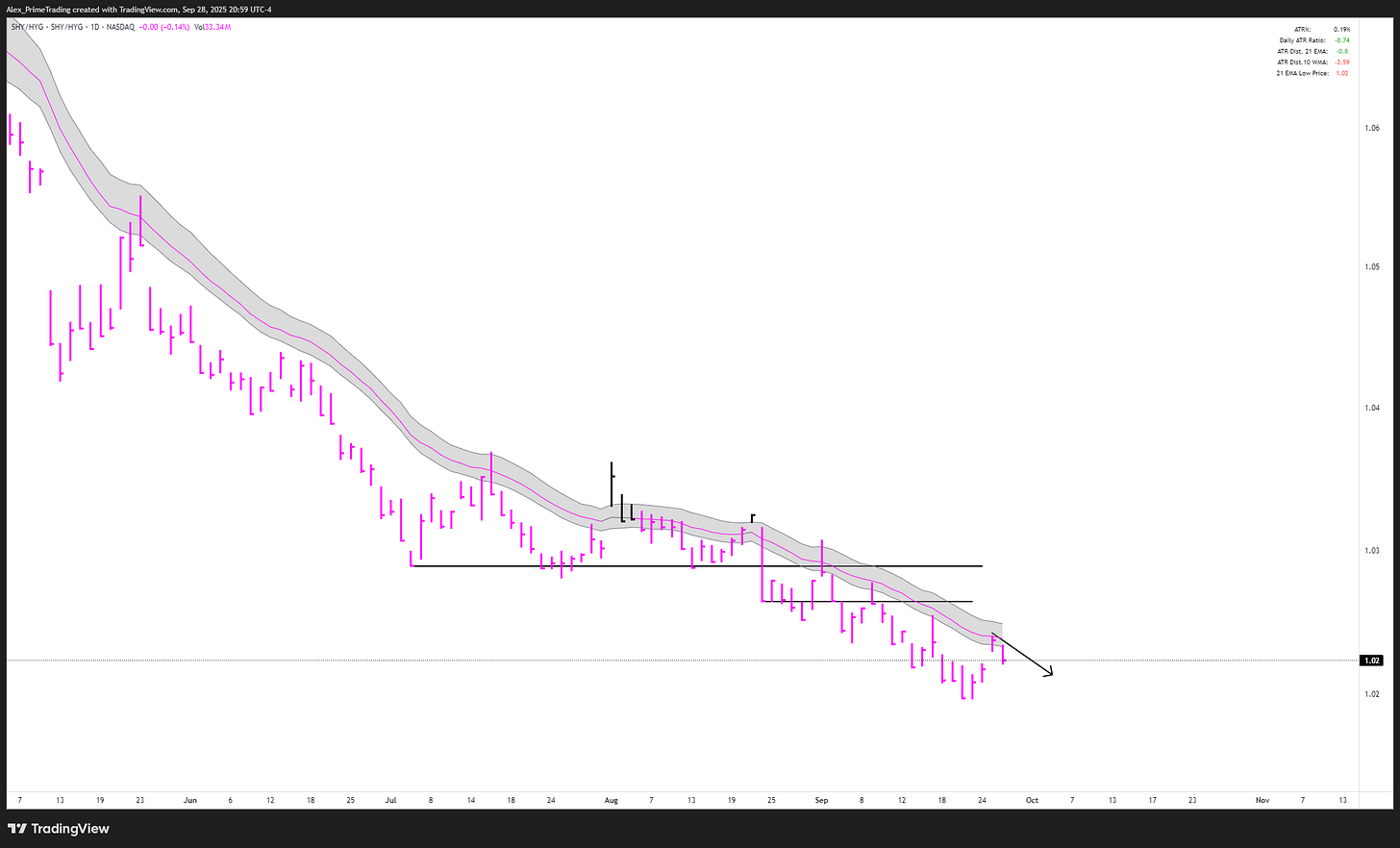

Rejection of the daily-structure with a reversal confirmation. Good!!

Rejection of recent swing-high structure, with a breakdown of the daily-structure on Friday. Good!!

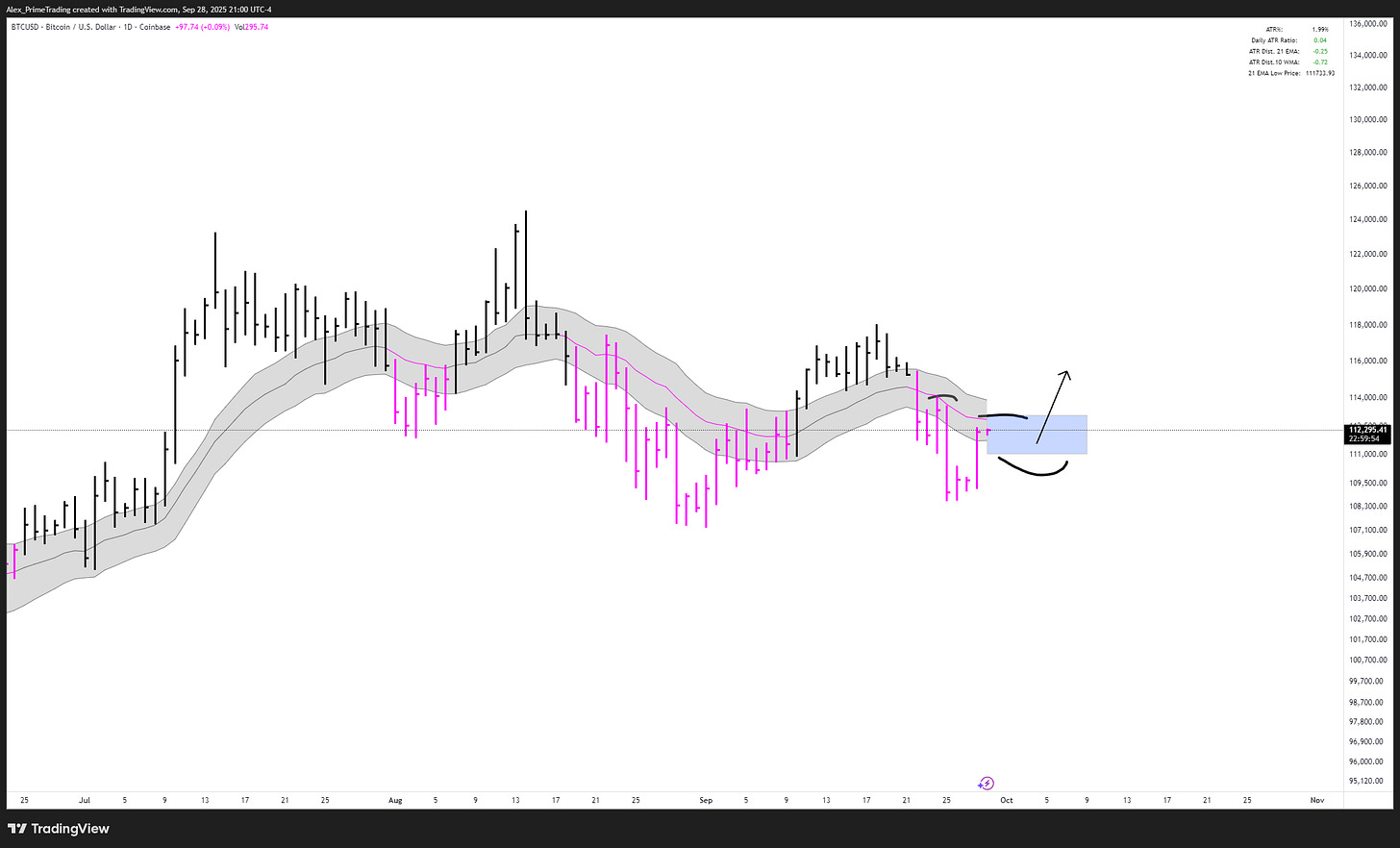

/BTC (Bitcoin)

Looking for a tight right side before or after the 21dma-structure reclaim is made. If we get a rejection of the structure, then more time is probably needed to setup. But it looks good with a higher low being confirmed on the weekly.

SECTORS & THEMES

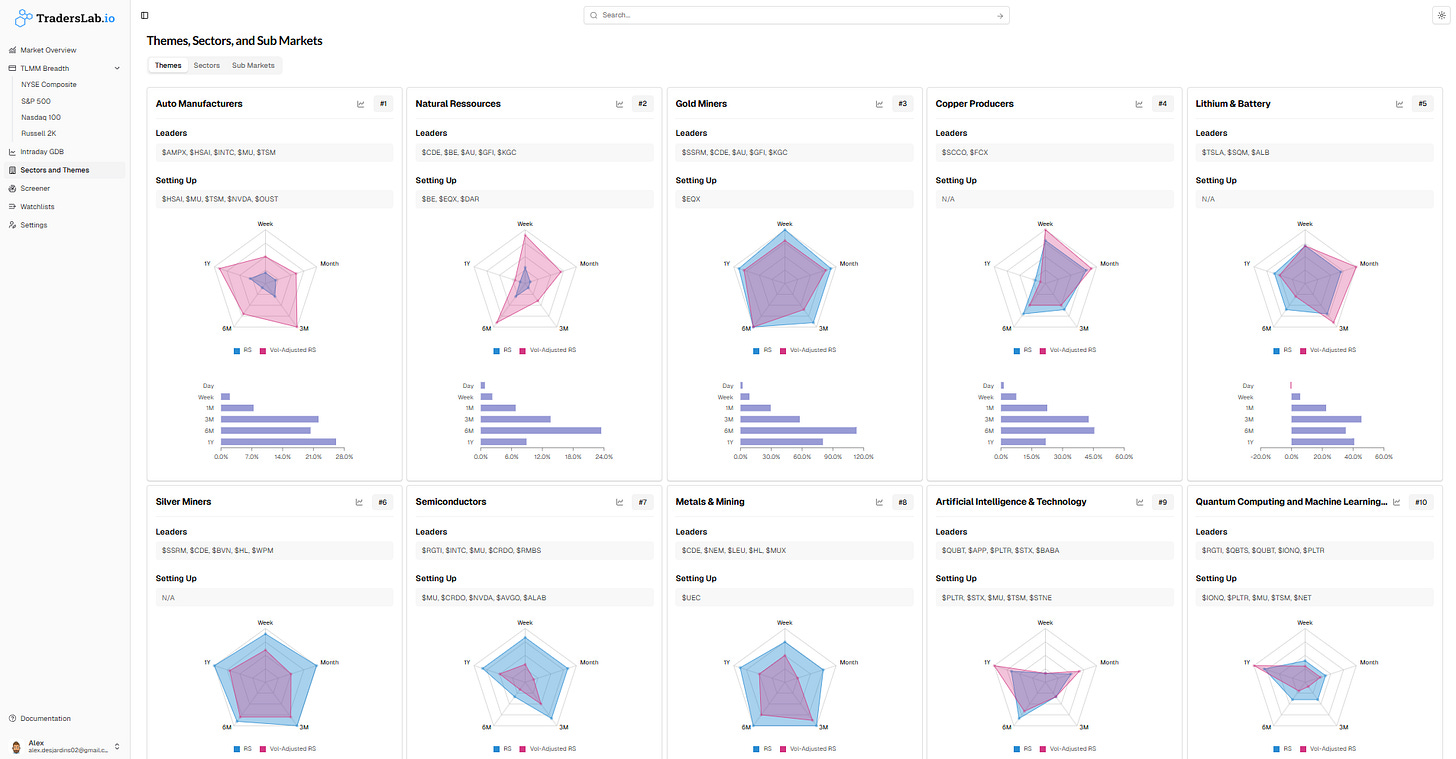

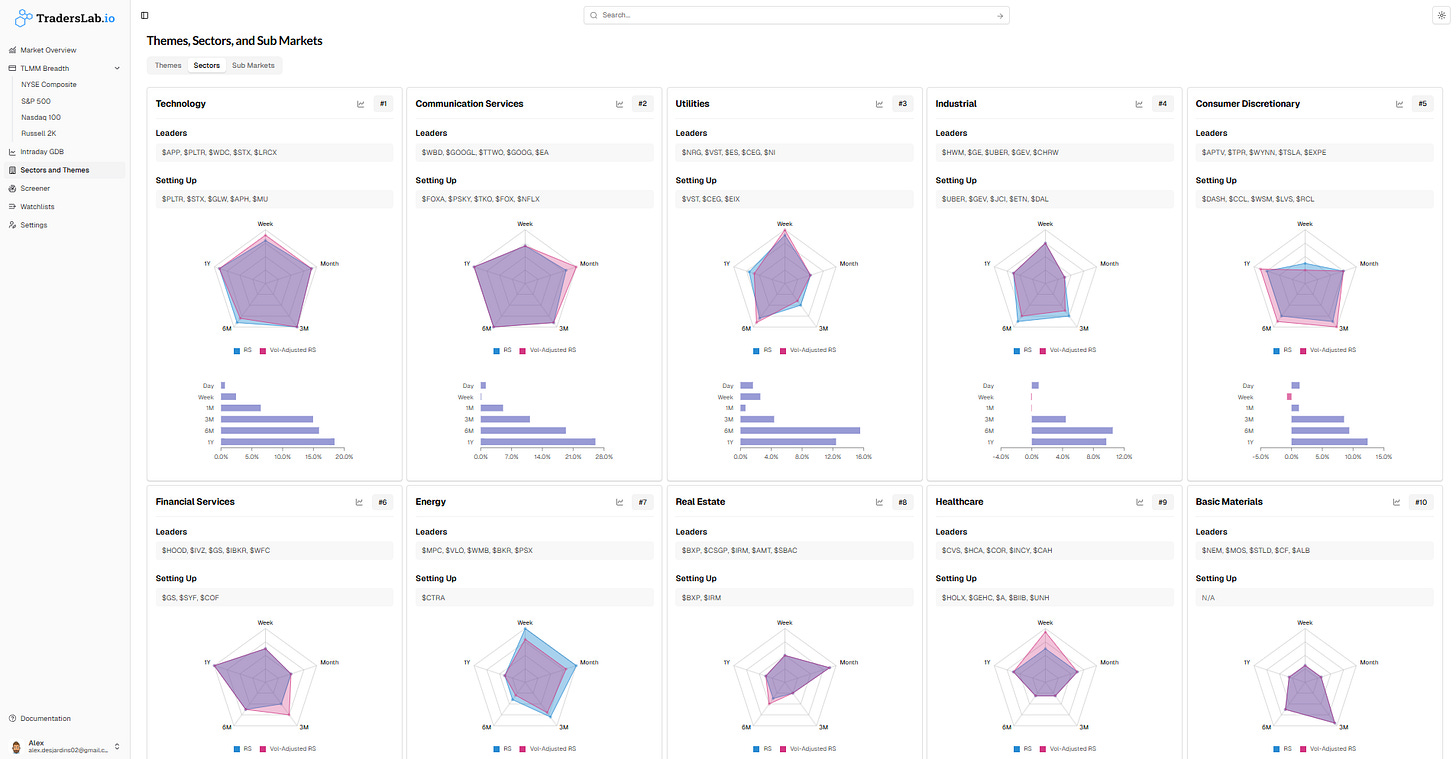

Top 10 Leading THEMES - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

Top 10 Leading SECTORS - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

LEADERS STALKLIST

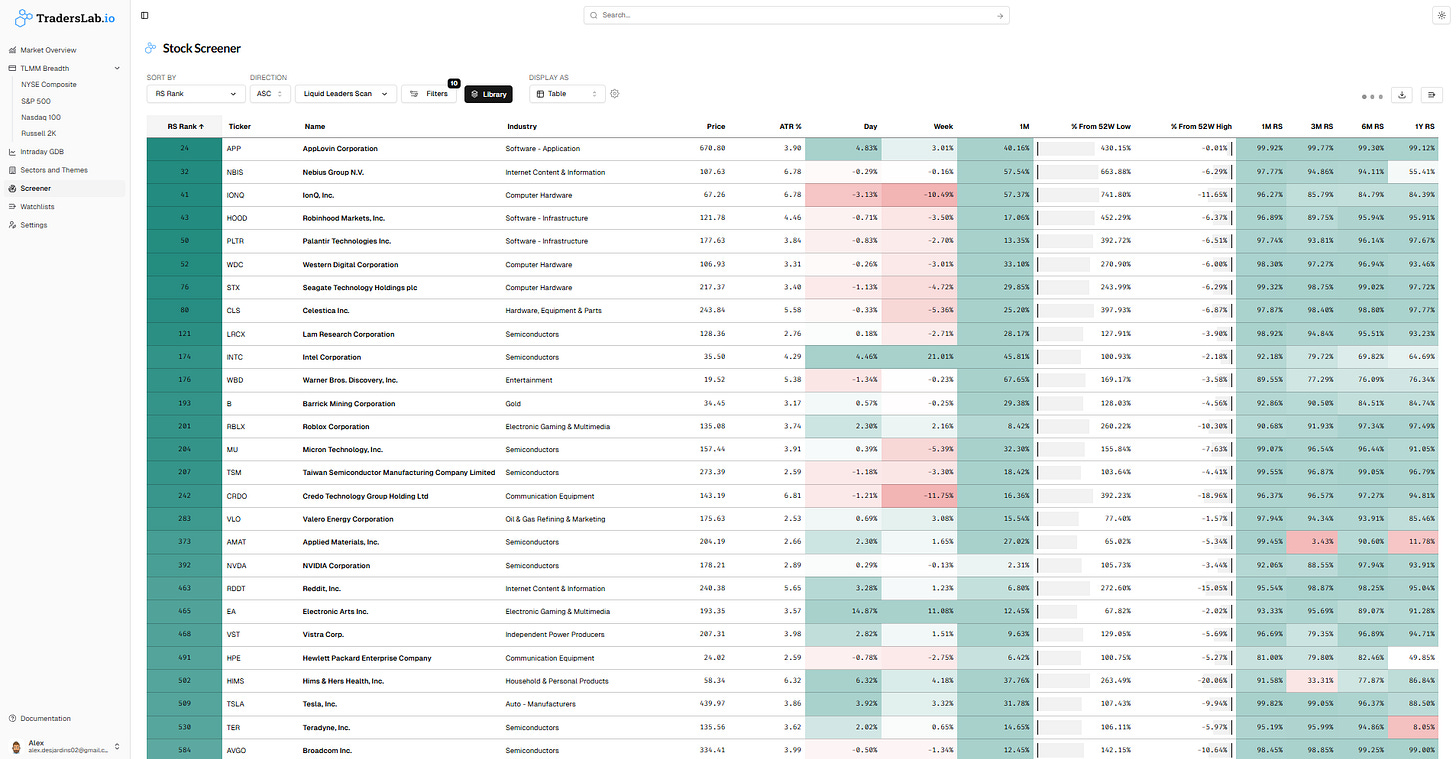

Liquid Leaders Universe (top RS)

APP, NBIS, IONQ, HOOD, PLTR, WDC, STX, CLS, LRCX, INTC, WBD, B, RBLX, MU, TSM, CRDO, VLO, AMAT, NVDA, RDDT, EA, VST, HPE, HIMS, TSLA, TER, AVGO, NU, DASH, ANET, COR, VRT, CEG, UBER, CRWD, CCL, CVNA, GEV, SPOT, SE, JOBY, ORCL, RIVN, DELL, MDB, SNOW, CDNS, TEM, SHOP, FSLR

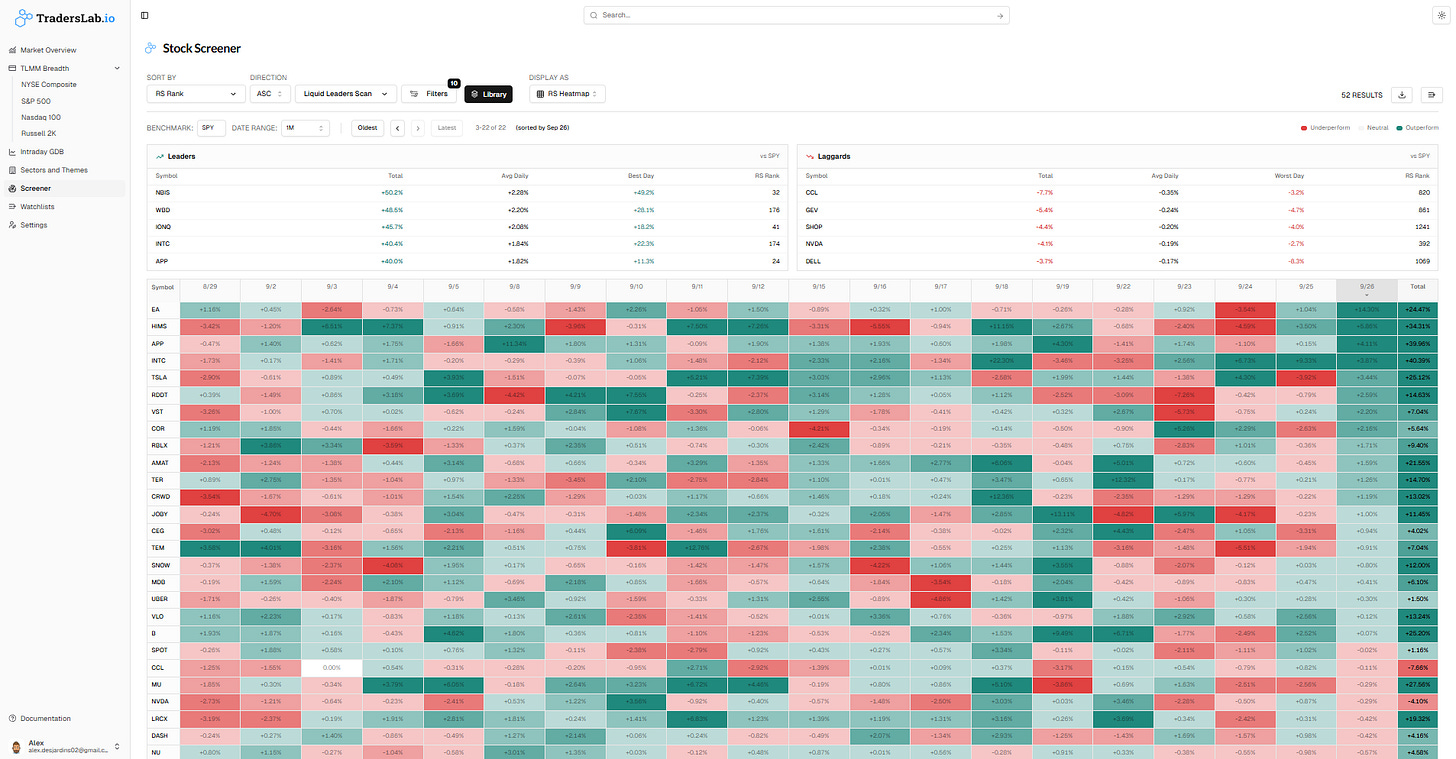

Liquid Leaders RS Heat Map

A quick visual of daily Relative Strength vs SPY, helping you spot which stocks are leading or lagging on any given day.

That WL is shared as a community WL that you can access in Tlab.

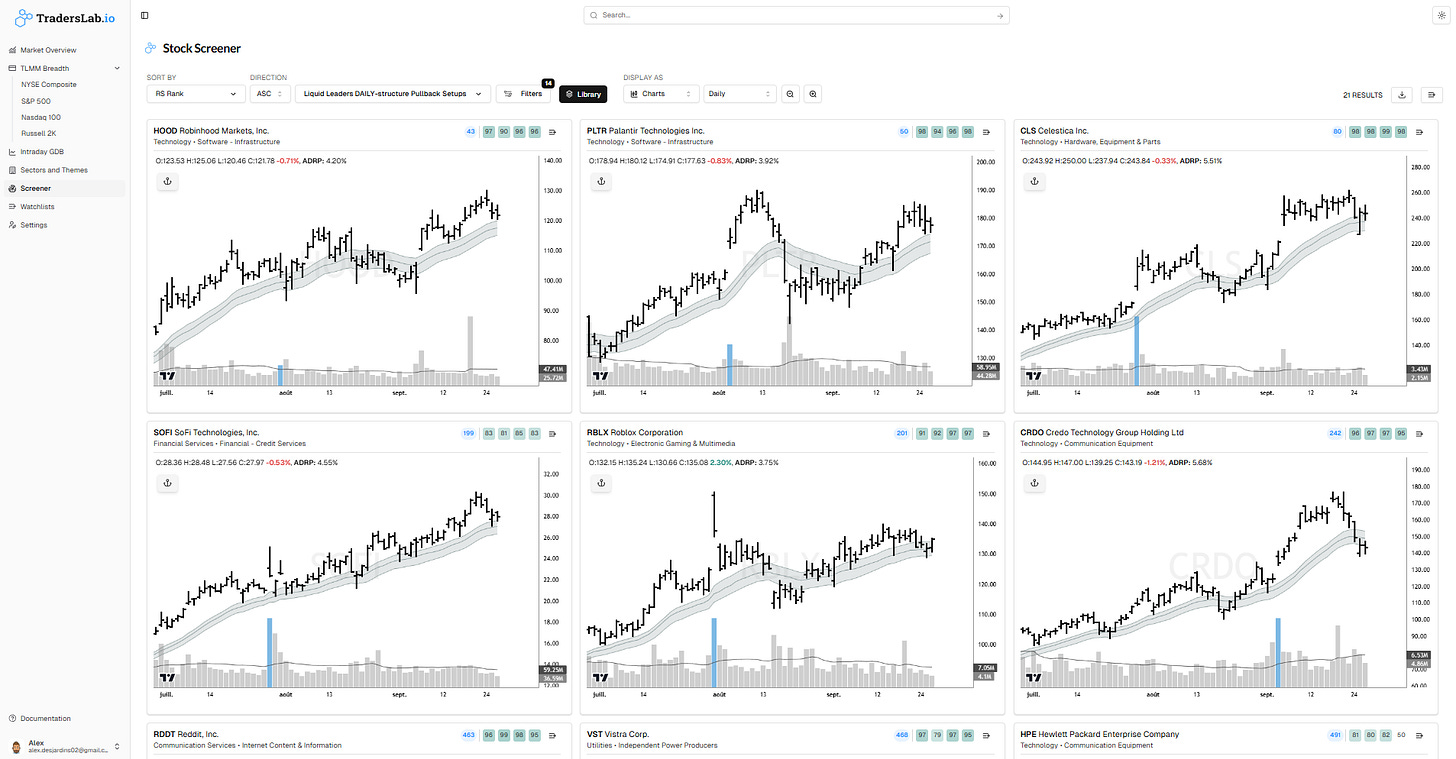

Liquid Leaders DAILY-structure Pullback scan

HOOD, PLTR, CLS, SOFI, RBLX, CRDO, RDDT, VST, HPE, AVGO, NU, DASH, ANET, VRT, CEG, UBER, CVNA, GEV, SPOT, SE, JOBY

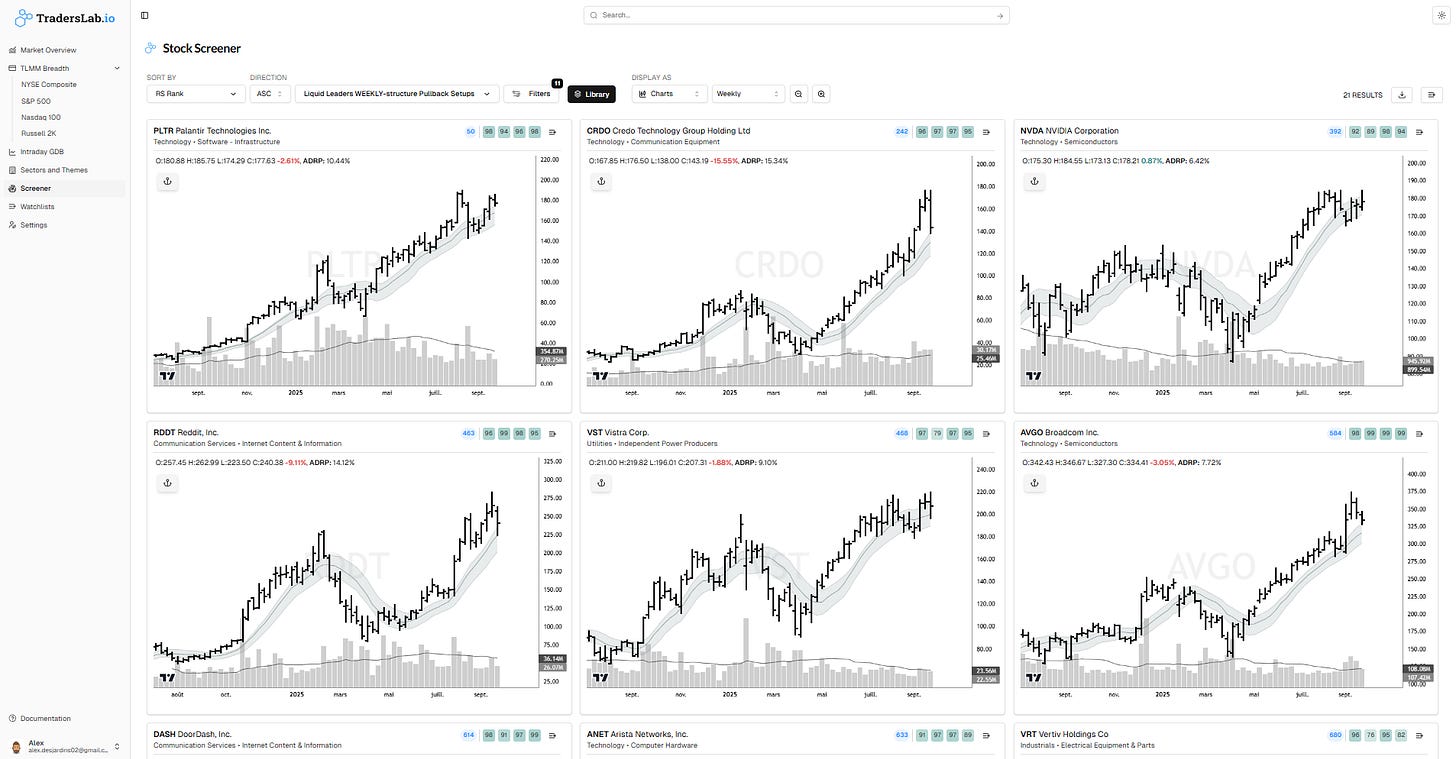

Liquid Leaders WEEKLY-structure Pullback scan

PLTR, CRDO, NVDA, RDDT, VST, AVGO, DASH, ANET, VRT, CEG, CVNA, GEV, SPOT, SE, JOBY, DELL, SNOW, CDNS, TEM, AMD, RCL

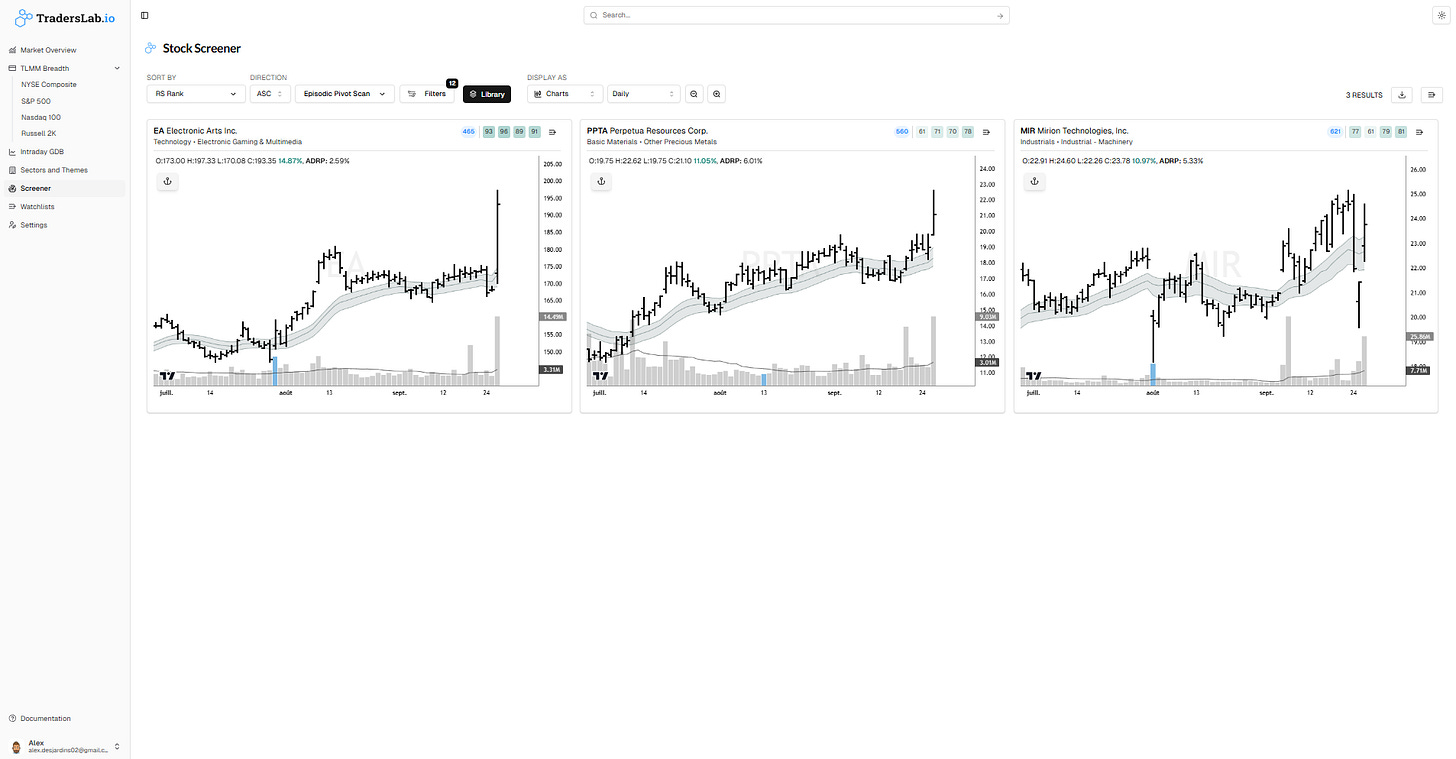

Episodic Pivot scan (Potential new Leaders)

EA, PPTA, MIR

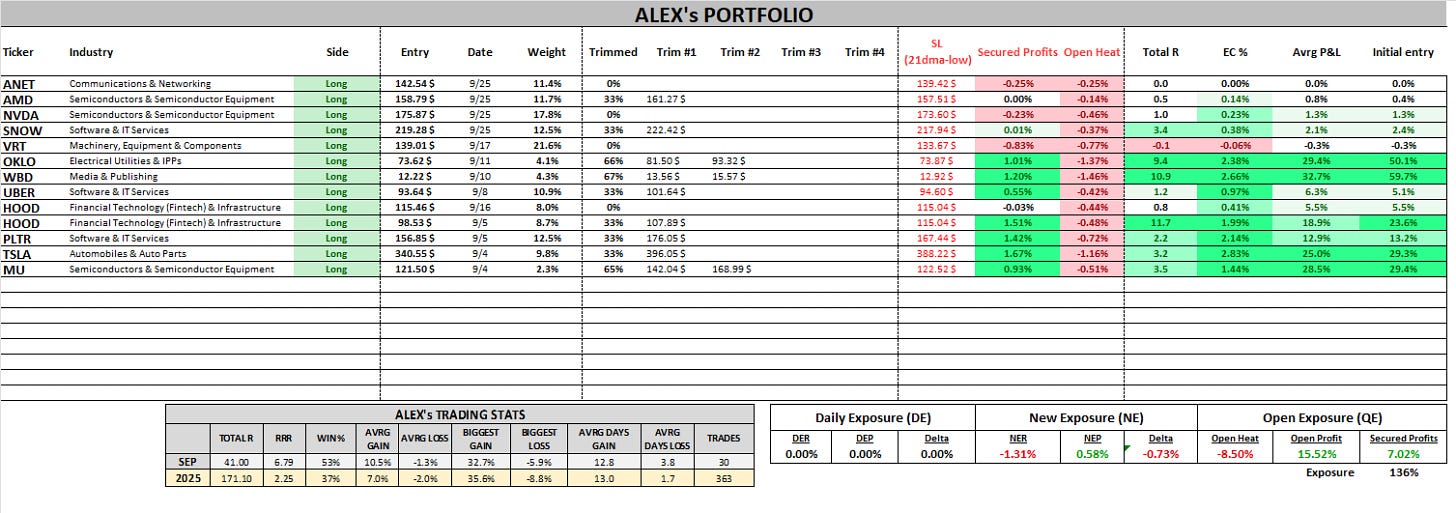

PORTFOLIO UPDATE

Hey guys!

No trades for me last Friday. I like how the market is setting up, especially in the Liquid Leader names I’m trading. We saw some constructive action after last Thursday’s bounce attempt, with some daily reversal confirmation on Friday, or some tight and firm inside day. If we get confirmation of breadth coming in, MCSI turning back up, and finally starting to trend higher above the 10dma (meaning we are in breadth expansion), then I will look to be a bit more aggressive, but I won’t add anything until that happens. So I’m taking it day by day, but patient as the market continues to build that right side constructively.

NER lowered at -1.3% with a -8.5% Open Heat and +7.02% Secured Profits on this cycle.

NEW:

ADDED:

TRIMMED:

INTRADAY ATTEMPTS:

OUT:

POSITIONS/TRADES LIVE EXPLANATIONS REVIEW (Shared live in Discord):

Try TradersLab.io — your faster research workflow.

Build your plan in minutes with top-down market dashboards, sector/money-flow views, and screeners that drill down to leading stocks—all in one platform.

It’s the same set of TradersLab scans I use to build my Focuslist, now in an app built for every swing or position trader’s daily routine.

Open the app → TradersLab.io

Try it 1-month FREE with the code “TRIAL”.

Want to keep reading The Prime Report? Subscribe below to see my game plan and top ideas for tomorrow.

See you there!

FOCUSLIST…

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.