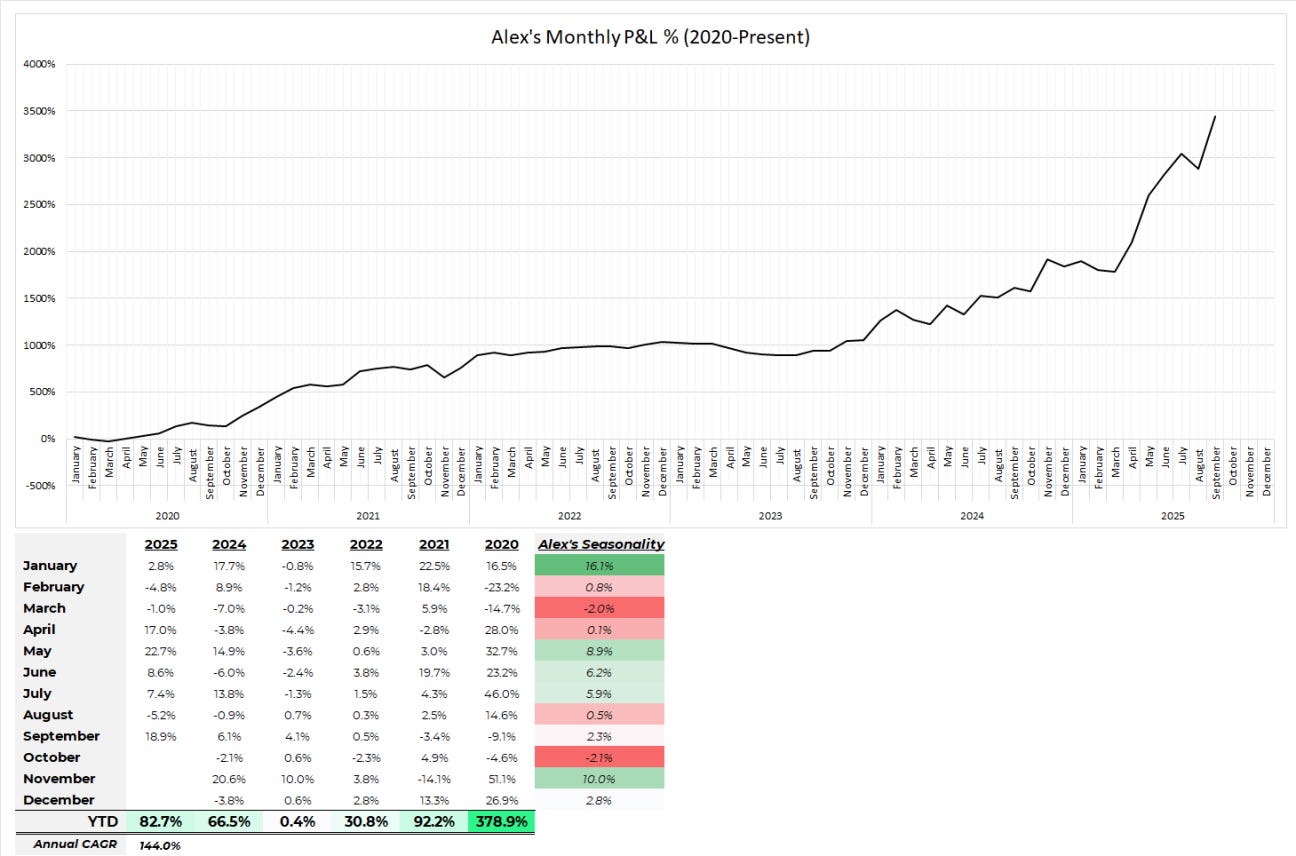

Alex’s PF performance. - September 2025 📑🛡️

MTD ( +18.92% )

YTD ( +82.67% )

YTD benchmark QQQ (+17.88%)

Hey guys!

Couldn’t be happier with this month’s execution. Sometimes everything clicks and works, and this one was like that. I executed my system with precision, engaging at the right size at the right time, and being patient in a choppy environment. Moving to 2/5R trim targets also helped me become more disciplined about trimming into strength, and gave me the mental break of simply placing limit orders and letting the trades run until they trigger them. 2R is also quicker to hit, which helped me de-risk the trades more quickly and move the money around in fresh setups.

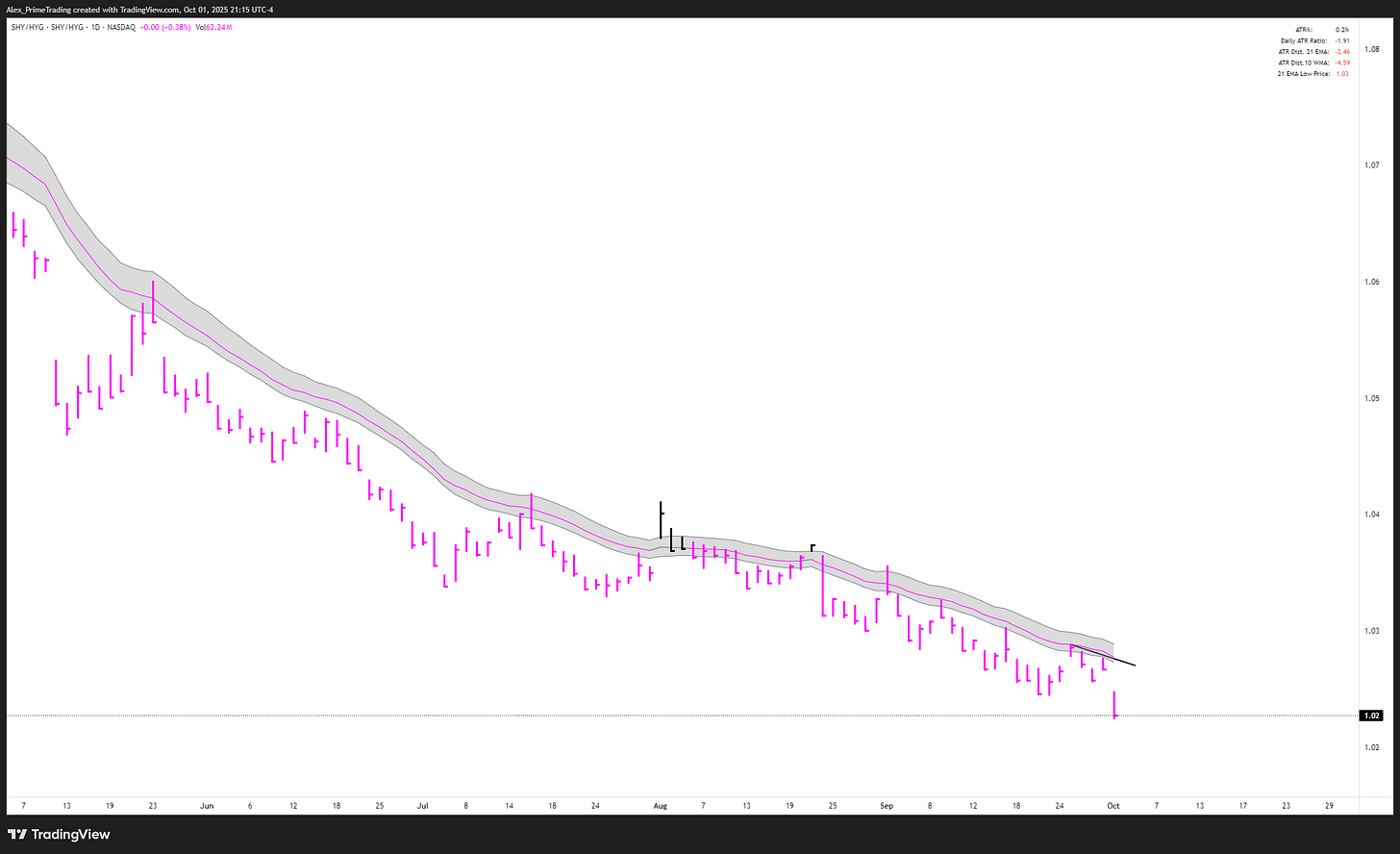

MTD stats:

Simply the best stats of the year across the board...

Double digits RRR at 10.51

Lowest trades at 31

Biggest R-multiples at +66

Highest win rate at 61%

Biggest avrg gains & losses

Everything was there this month, so I am happy to give myself a pat on the back and call this a good job, Alex 🙂 haha

Let’s go try to get that triple-digit year now. 🔥

Congrats to everyone, and if you didn’t get the results you wanted, then don’t hesitate to ask around in the community. We are here to help.

Cheers HAGN!

Alex ✌️

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

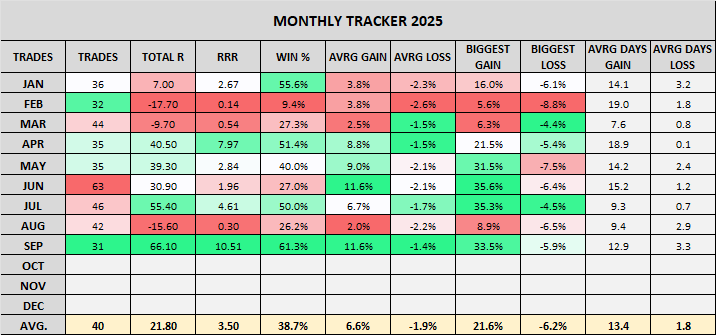

MARKET ANALYSIS

Good evening,

Price > rising 21dma-structure. New ATH!

MCSI uptrend > rising 10dma.

Breadth extensions neutral

TLMM Model = UPTREND

When I get that price & breadth picture, along with the UPTREND signal, I tend to keep it simple until we either get a MCSI hook-down or price breaks the 21-day structure. Until then, you can expect these market analyses to be relatively fast.

Day by day.

TLMM DASHBOARD NASDAQ

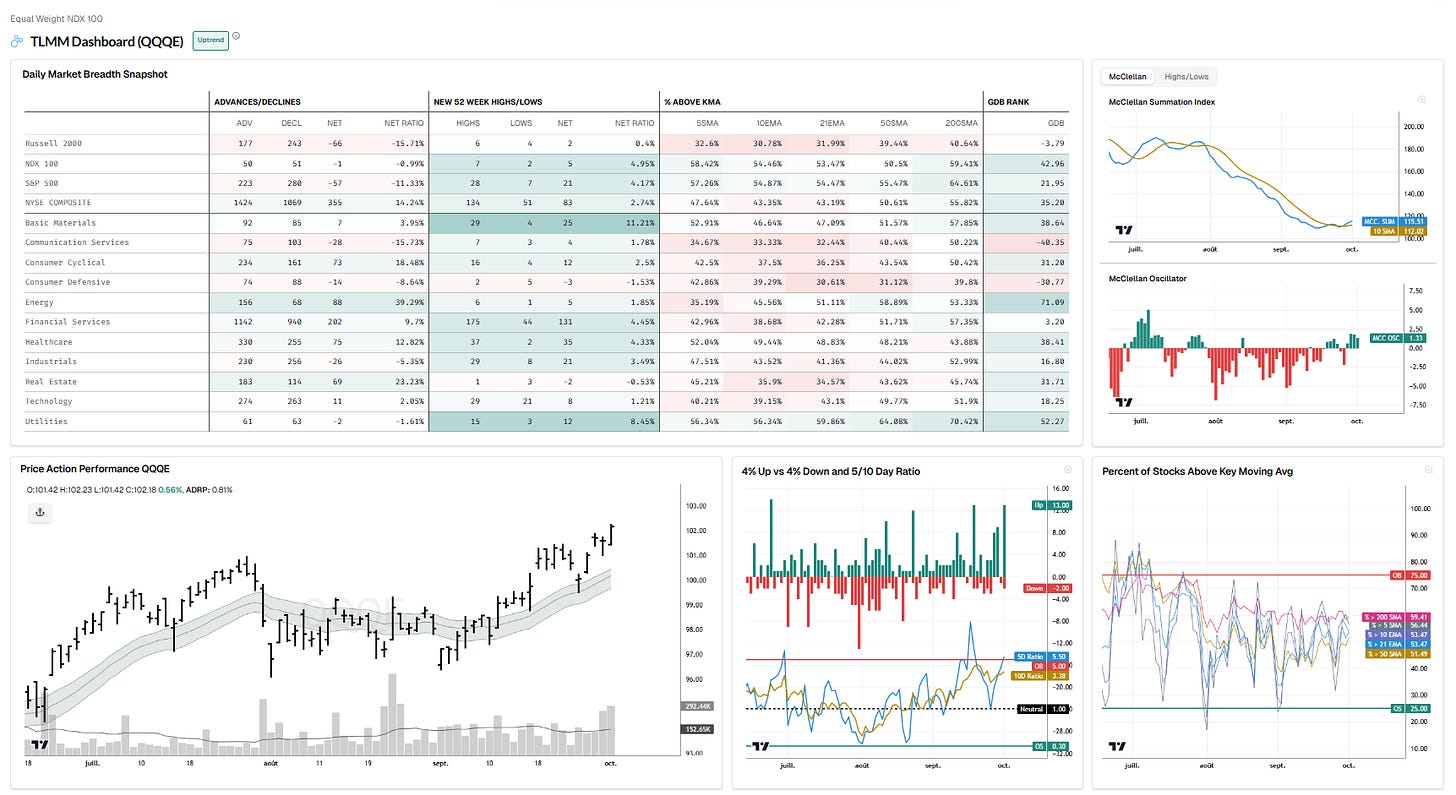

MARKET INTERNALS

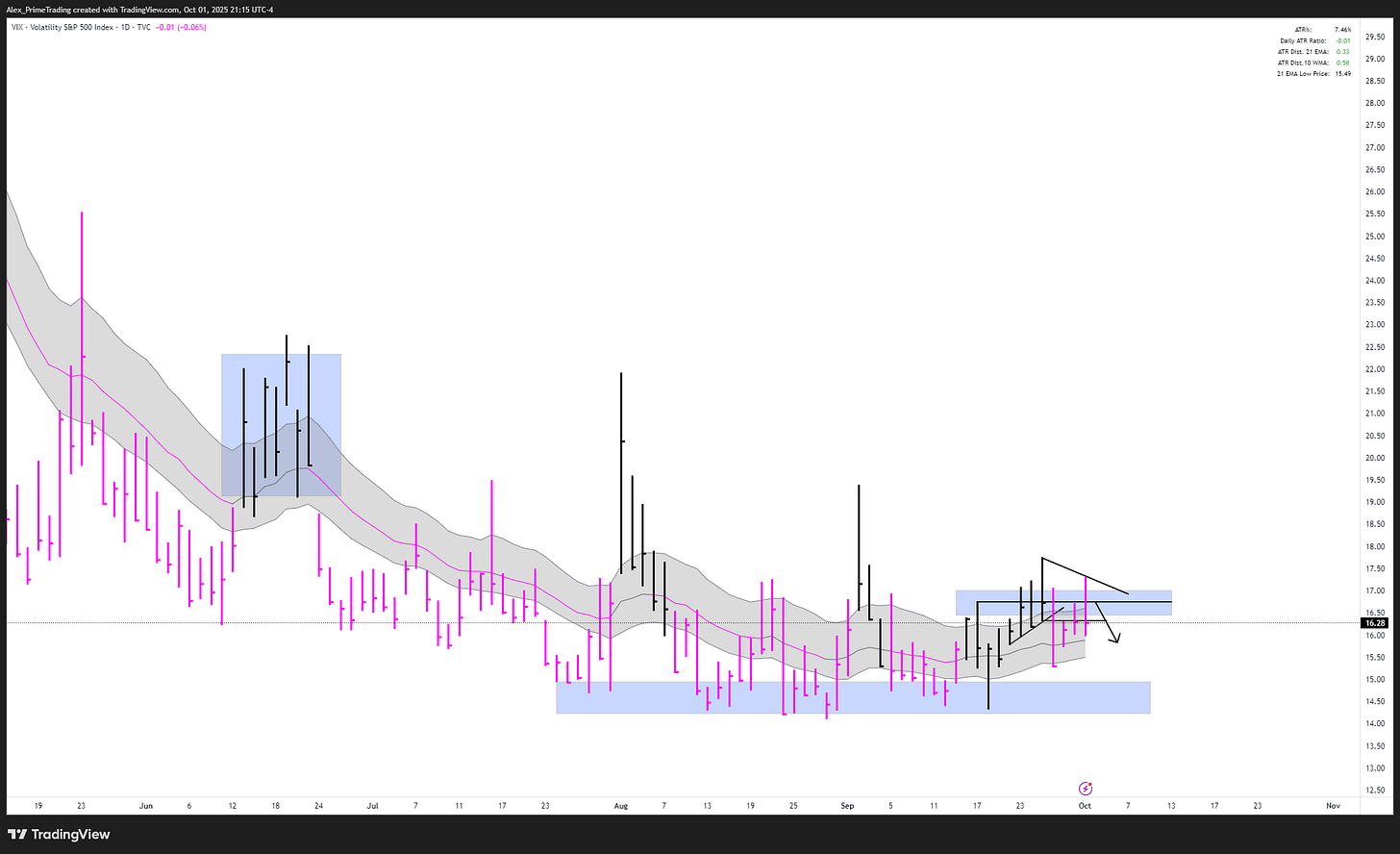

New low - good!

Rejection of structure with lower high…good!

/BTC (Bitcoin)

Longer-term wedge DTL breakout. Need to rest a bit to provide entry now.

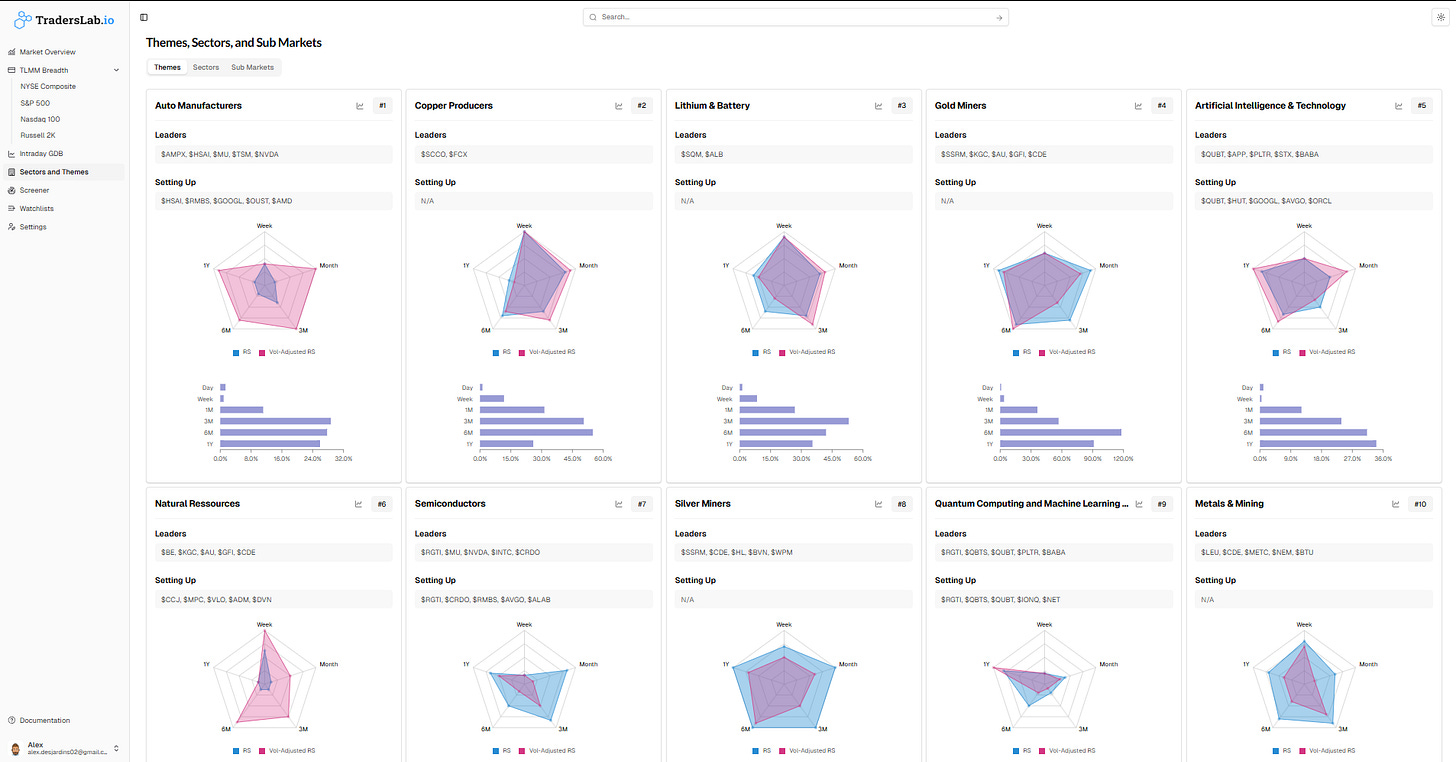

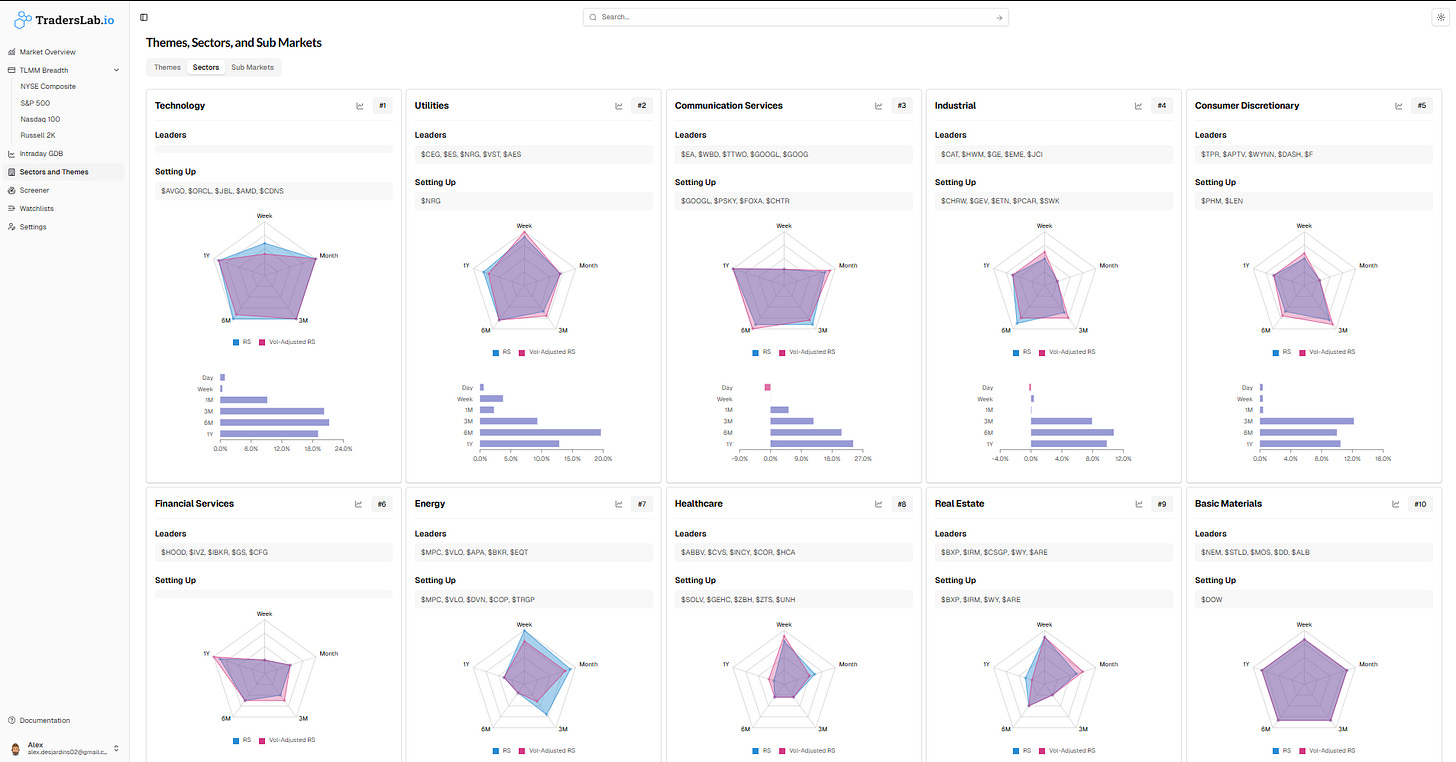

SECTORS & THEMES

Top 10 Leading THEMES - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

Top 10 Leading SECTORS - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

LEADERS STALKLIST

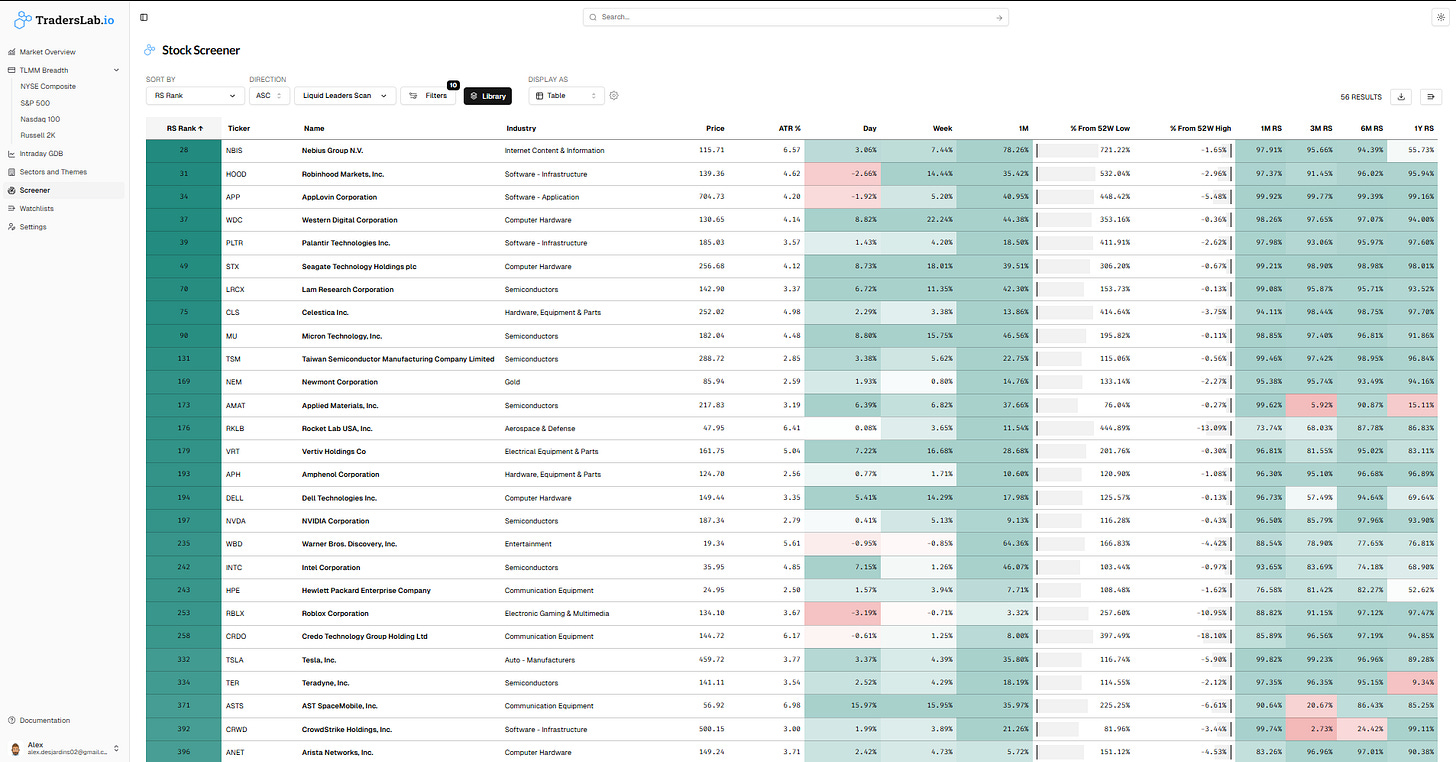

Liquid Leaders Universe (top RS)

NBIS, HOOD, APP, WDC, PLTR, STX, LRCX, CLS, MU, TSM, NEM, AMAT, RKLB, VRT, APH, DELL, NVDA, WBD, INTC, HPE, RBLX, CRDO, TSLA, TER, ASTS, CRWD, ANET, CVNA, CEG, EME, B, CVS, DASH, MP, ZS, SHOP, TEM, AVGO, SMCI, SNOW, FSLR, GEV, ORCL, VST, JOBY, HIMS, DDOG, UBER, SE, AMD

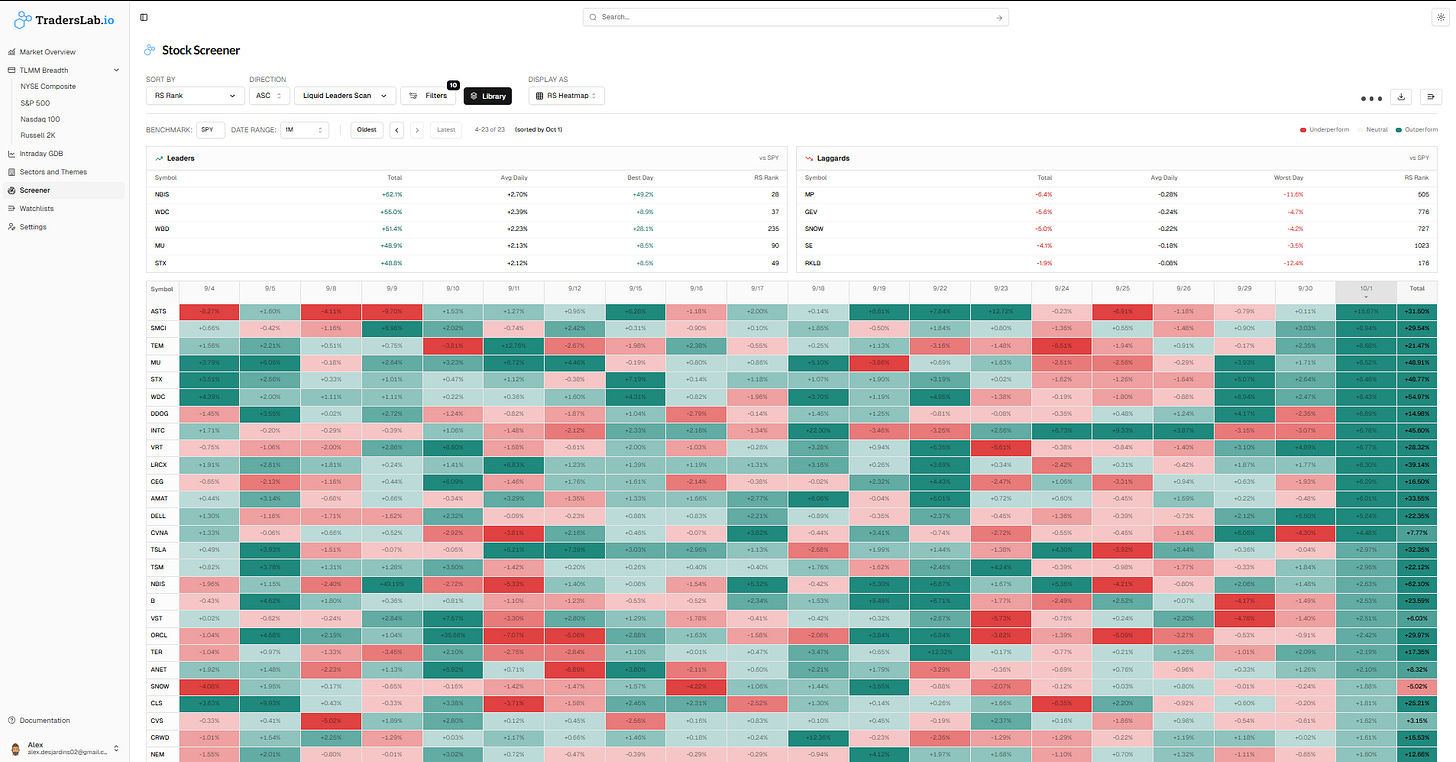

Liquid Leaders RS Heat Map

A quick visual of daily Relative Strength vs SPY, helping you spot which stocks are leading or lagging on any given day.

That WL is shared as a community WL that you can access in Tlab.

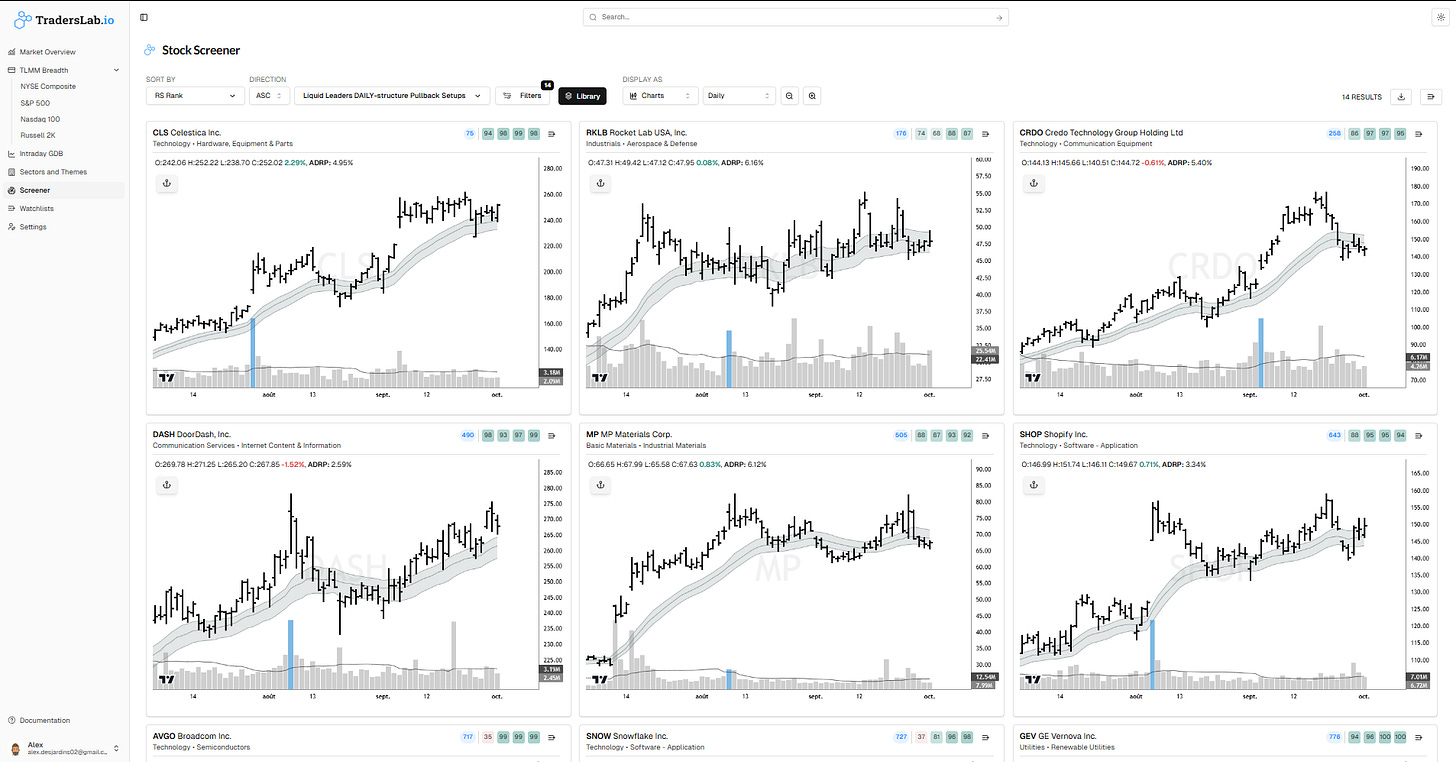

Liquid Leaders DAILY-structure Pullback scan

CLS, RKLB, CRDO, DASH, MP, SHOP, AVGO, SNOW, GEV, ORCL, VST, JOBY, HIMS, RKT

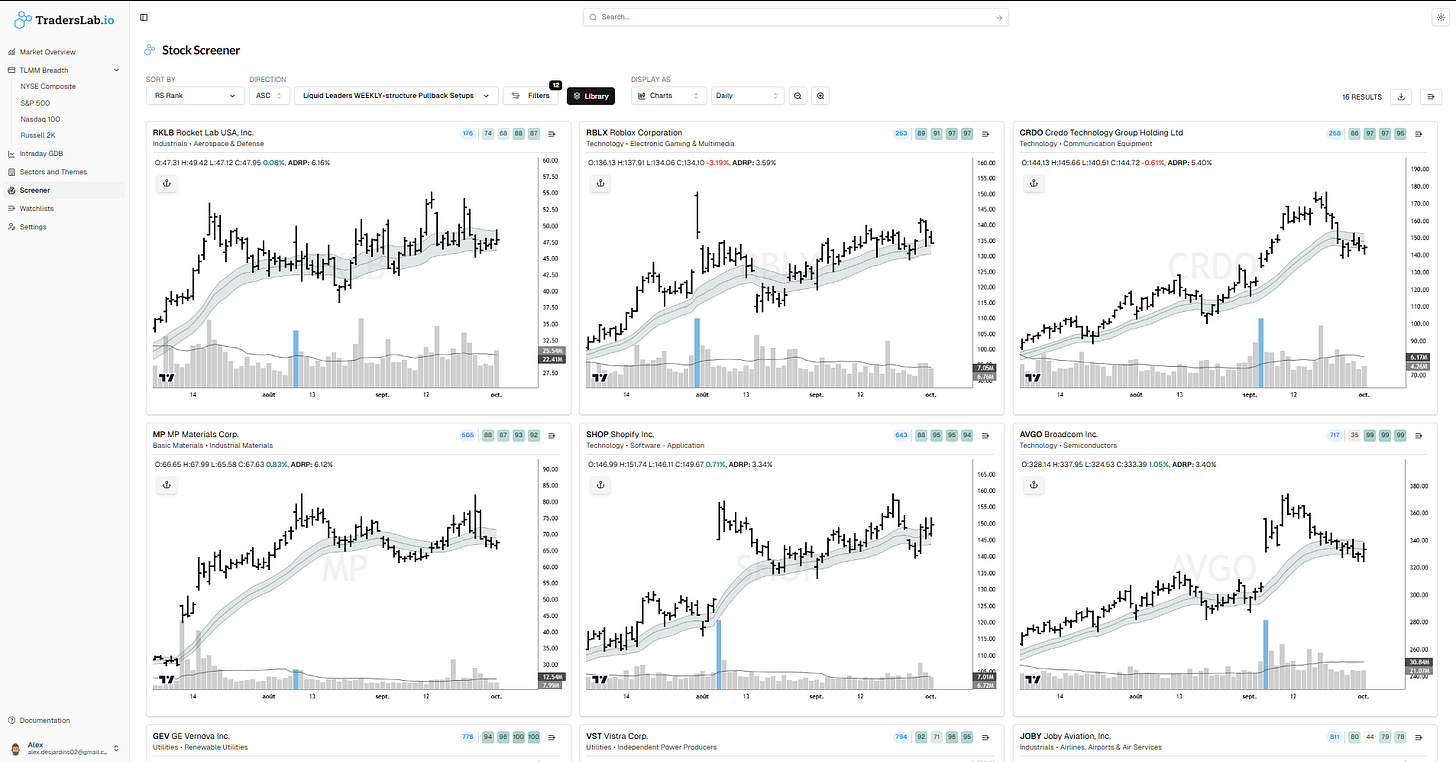

Liquid Leaders WEEKLY-structure Pullback scan

RKLB, RBLX, CRDO, MP, SHOP, AVGO, GEV, VST, JOBY, HIMS, UBER, SE, AMD, CDNS, SPOT, RIVN

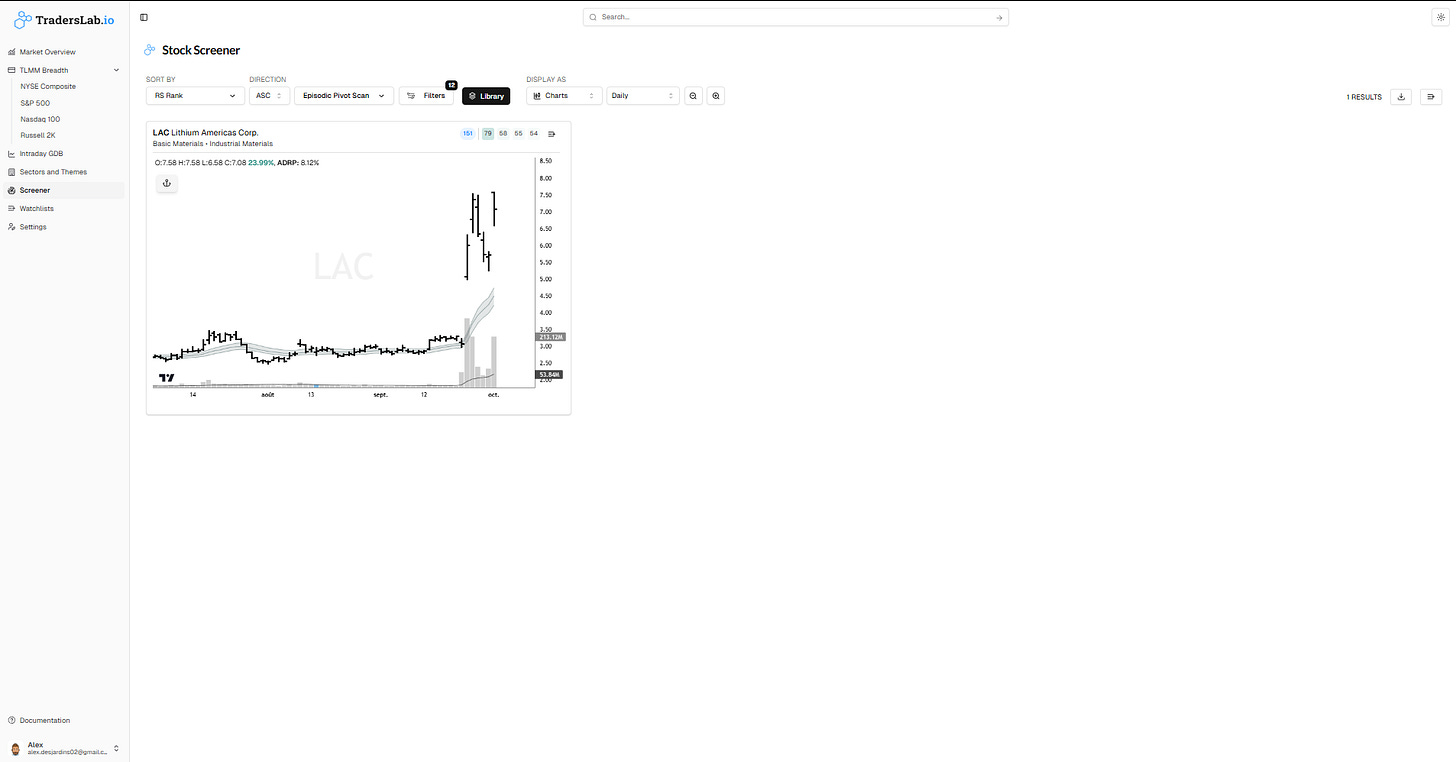

Episodic Pivot scan (Potential new Leaders)

LAC

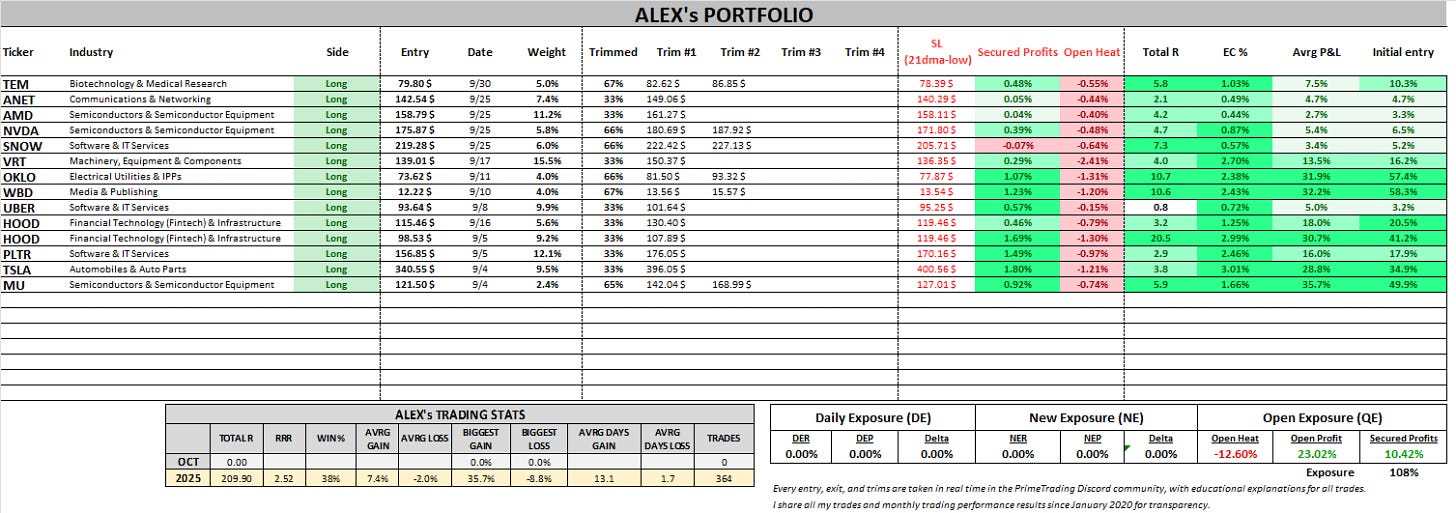

PORTFOLIO UPDATE

Hey guys!

Another solid day today, with the market continuing its uptrend a new ATH on QQQE, and breadth still expending. Not over thinking it, and just following my plan to not adding to much risk along the way, and trimming into strength to slowly get off margin by the end of the week. So far the plan is going well, with 4 trims today, and NER being back at 0%...meaning I don’t have any new position at risk of taking a loss if stopped out. For me, that’s a big step in my exposure cycle, so I’m happy we’re at this point in time as we continue to have constructive action in PF.

Gameplan will continue to trim into strength, raise my stops at daily/weekly structures, and manage that Open Heat while I realize my gains along this trend.

NER is now null at 0%, with a -12.6% Open Heat and +10.42% Secured Profits on this cycle.

Cheers!

NEW:

ADDED:

TRIMMED: TEM (2/3), NVDA (1/3), ANET (1/3)

INTRADAY ATTEMPTS:

OUT:

POSITIONS/TRADES LIVE EXPLANATIONS REVIEW (Shared live in Discord):

Try TradersLab.io — your faster research workflow.

Build your plan in minutes with top-down market dashboards, sector/money-flow views, and screeners that drill down to leading stocks—all in one platform.

It’s the same set of TradersLab scans I use to build my Focuslist, now in an app built for every swing or position trader’s daily routine.

Open the app → TradersLab.io

Try it 1-month FREE with the code “TRIAL”.

Want to keep reading The Prime Report? Subscribe below to see my game plan and top ideas for tomorrow.

See you there!

FOCUSLIST 10/01

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.