NO PRIME REPORT TOMORROW 10/22

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

Try it 1-month FREE with the code “TRIAL25”.

MARKET ANALYSIS

Good evening,

Price uptrend above rising 21dma-structure. (New closing ATH)

MCSI uptrend above the 10dma.

Breadth extensions are getting pretty VST overbought, look for potential stress-test.

TLMM Model = Uptrend

With the price above a rising daily structure and MCSI in an uptrend above the 10-day moving average, I’m back in a mode where I don’t want to overanalyze the market and just manage my exposure based on each position’s action.

That section will be quieter again, unless red flags start to develop.

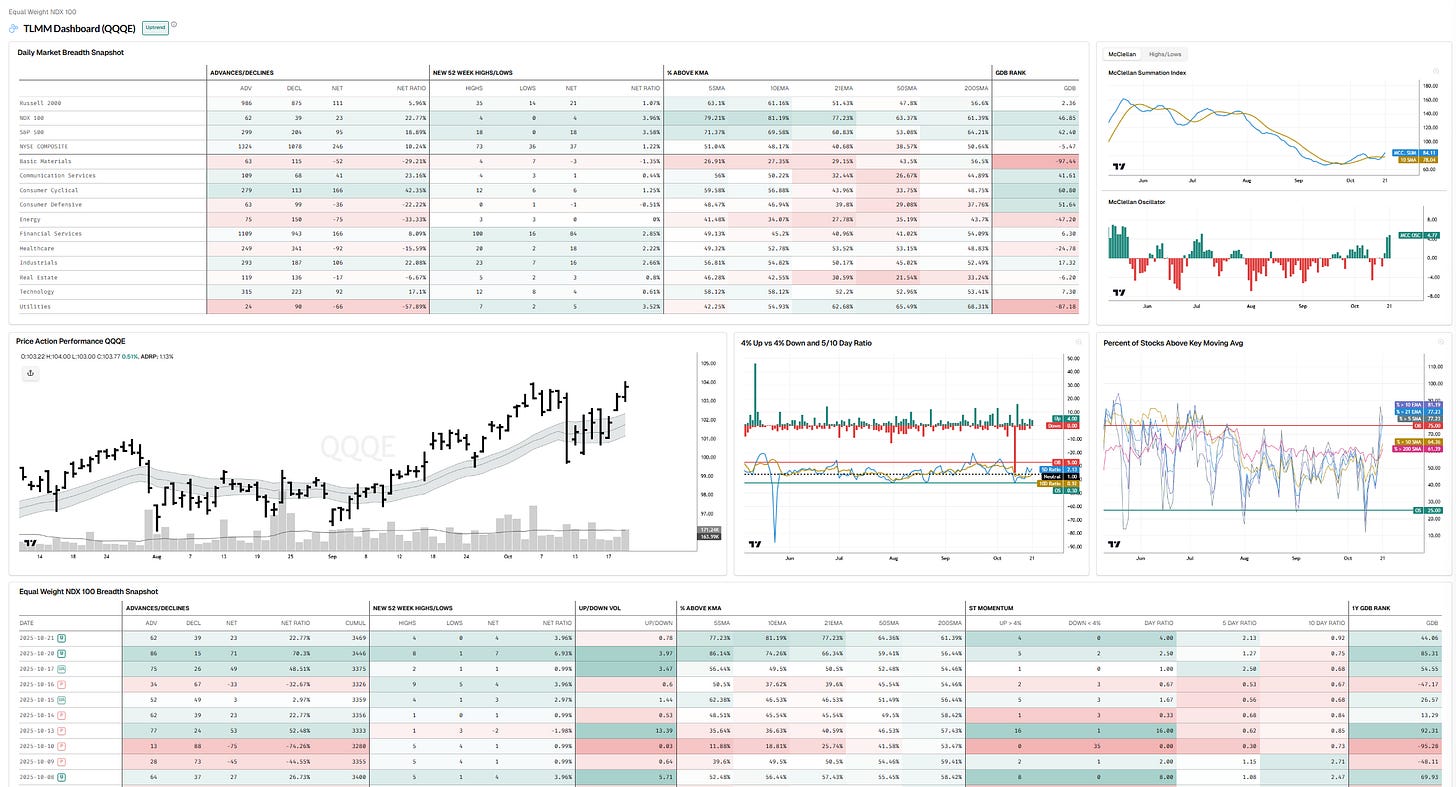

TLMM DASHBOARD NASDAQ

MARKET INTERNALS

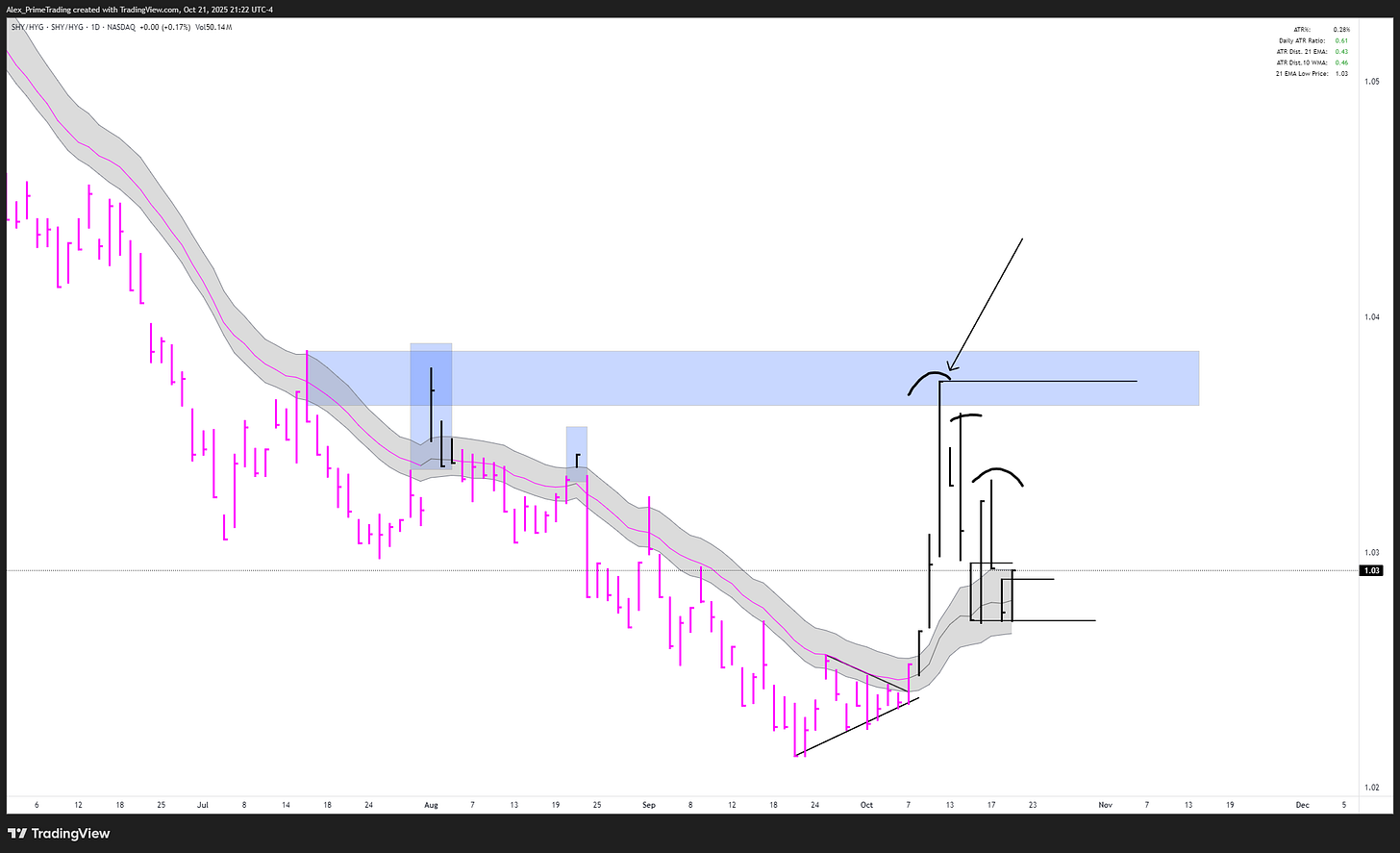

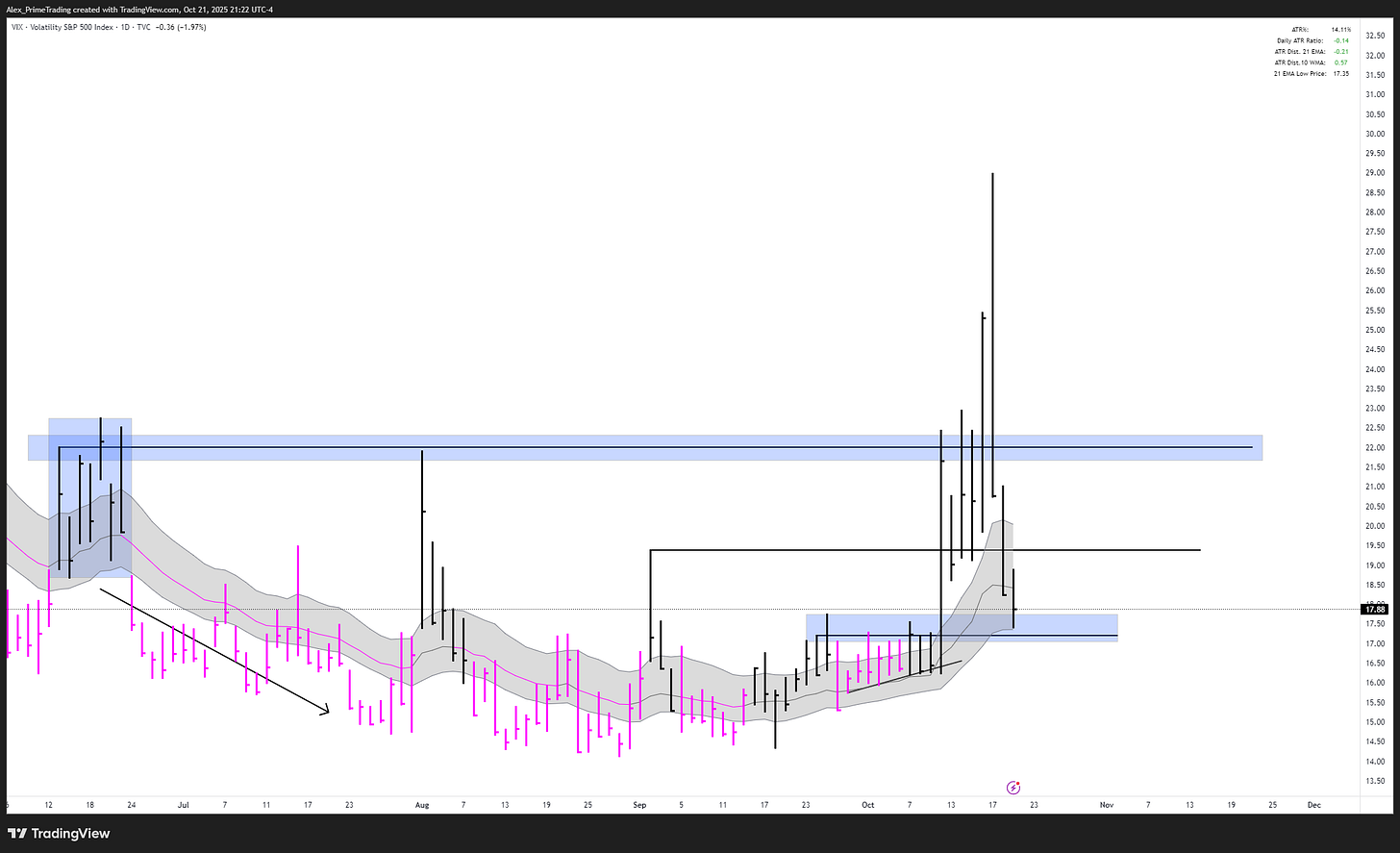

Finding support in the 21dma-structure again… we don’t want this to bounce from here.

Support at the recent structure area… we don’t want this to bounce from here.

/BTC (Bitcoin)

Downtrend below a declining 21dma-structure.

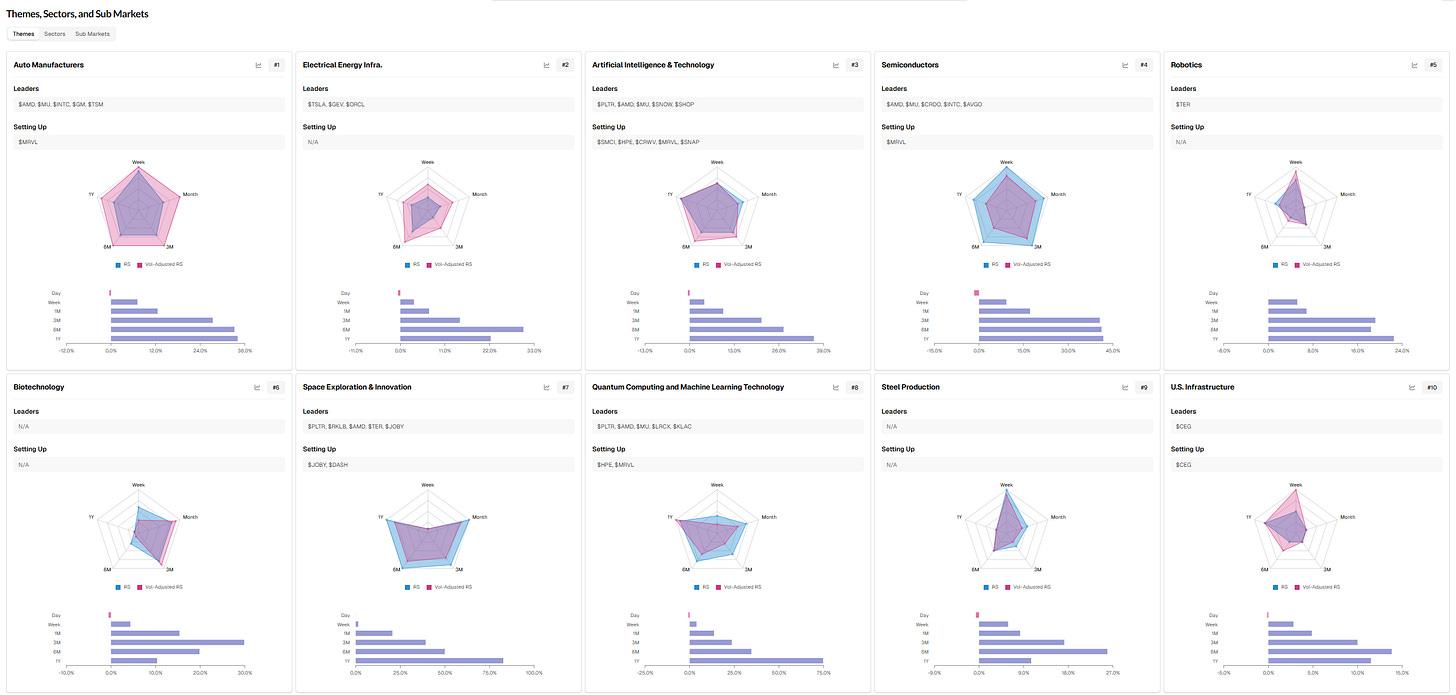

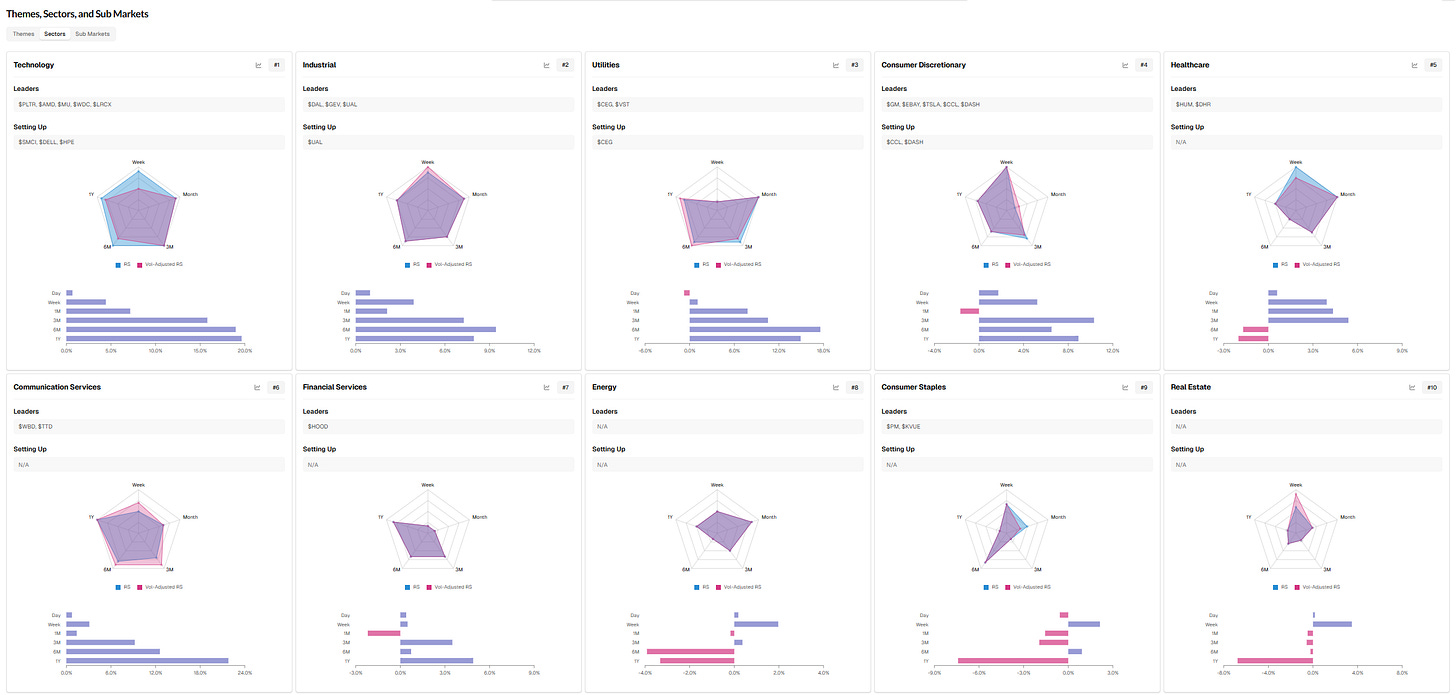

SECTORS & THEMES

Top 10 Leading THEMES - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

Top 10 Leading SECTORS - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

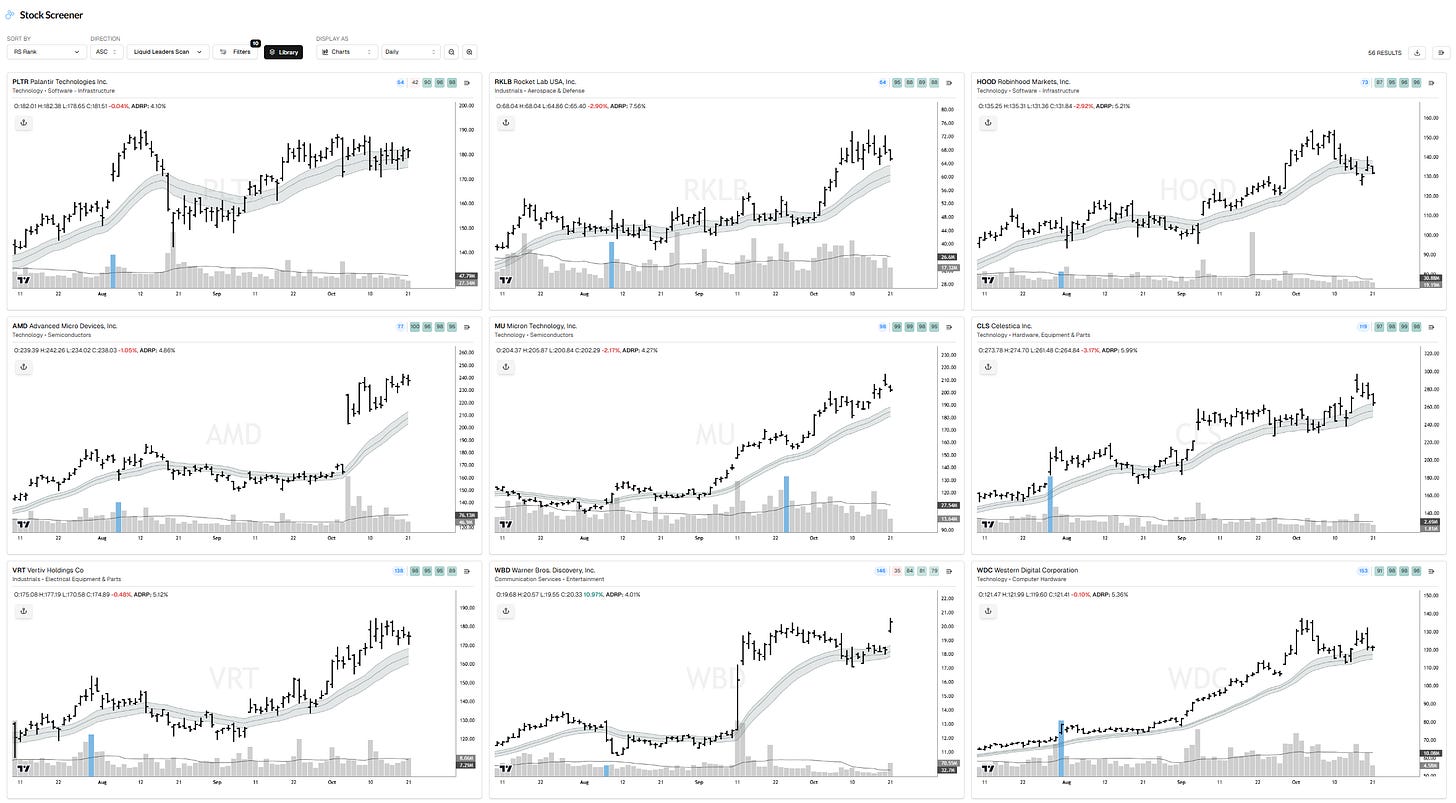

LEADERS STALKLIST

Liquid Leaders Universe (top RS)

PLTR, RKLB, HOOD, AMD, MU, CLS, VRT, WBD, WDC, OKLO, LRCX, KLAC, SNOW, NBIS, SHOP, CRDO, INTC, RBLX, AMAT, GM, TSM, TER, ASTS, AVGO, SMCI, ARM, DELL, MP, DDOG, ANET, TEM, STX, MDB, EBAY, TSLA, HUM, NEM, CCL, JOBY, CEG, CVNA, IONQ, DAL, DASH, AEM, NU, GEV, APP, HPE, SMR

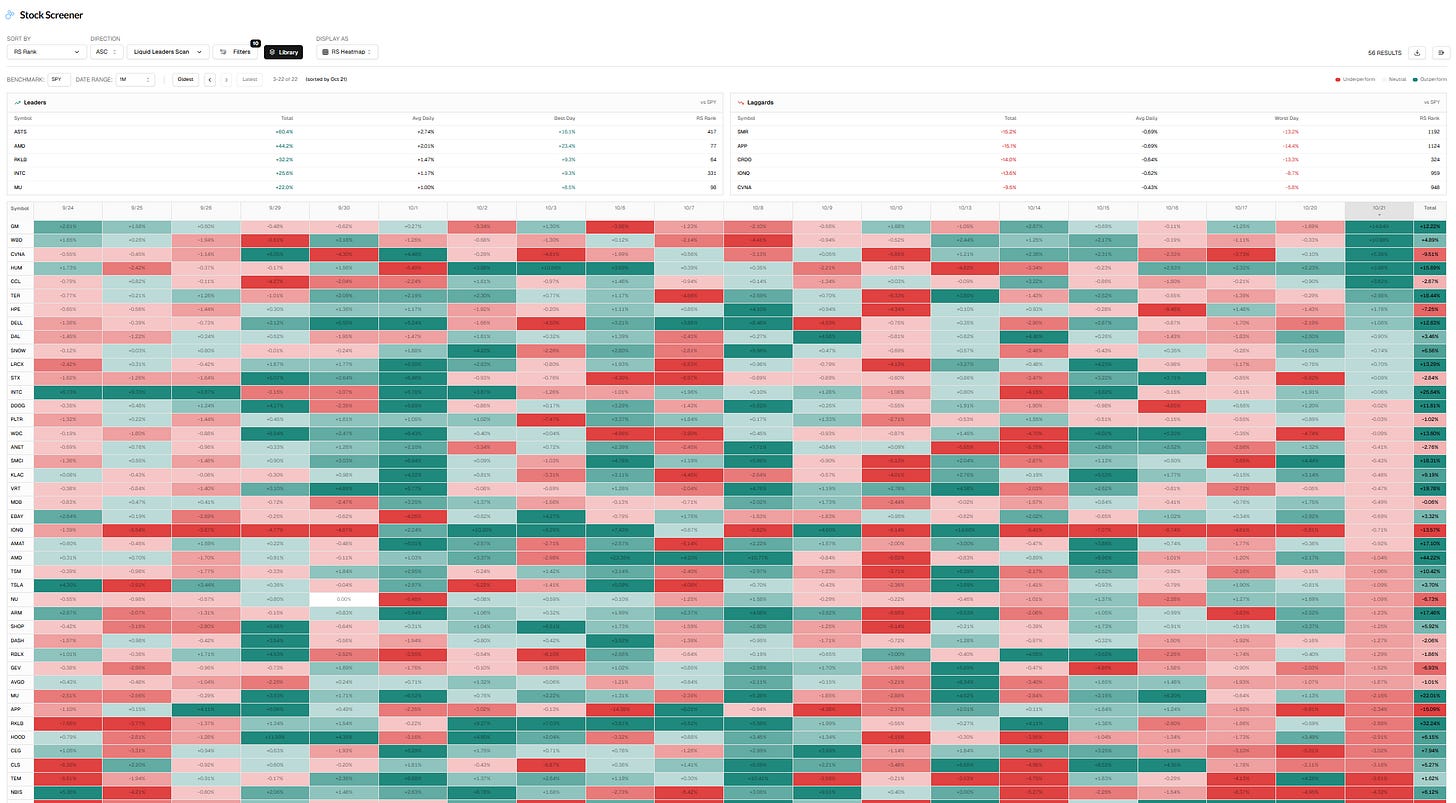

Liquid Leaders RS Heat Map

A quick visual of daily Relative Strength vs SPY, helping you spot which stocks are leading or lagging on any given day.

That WL is shared as a community WL that you can access in Tlab.

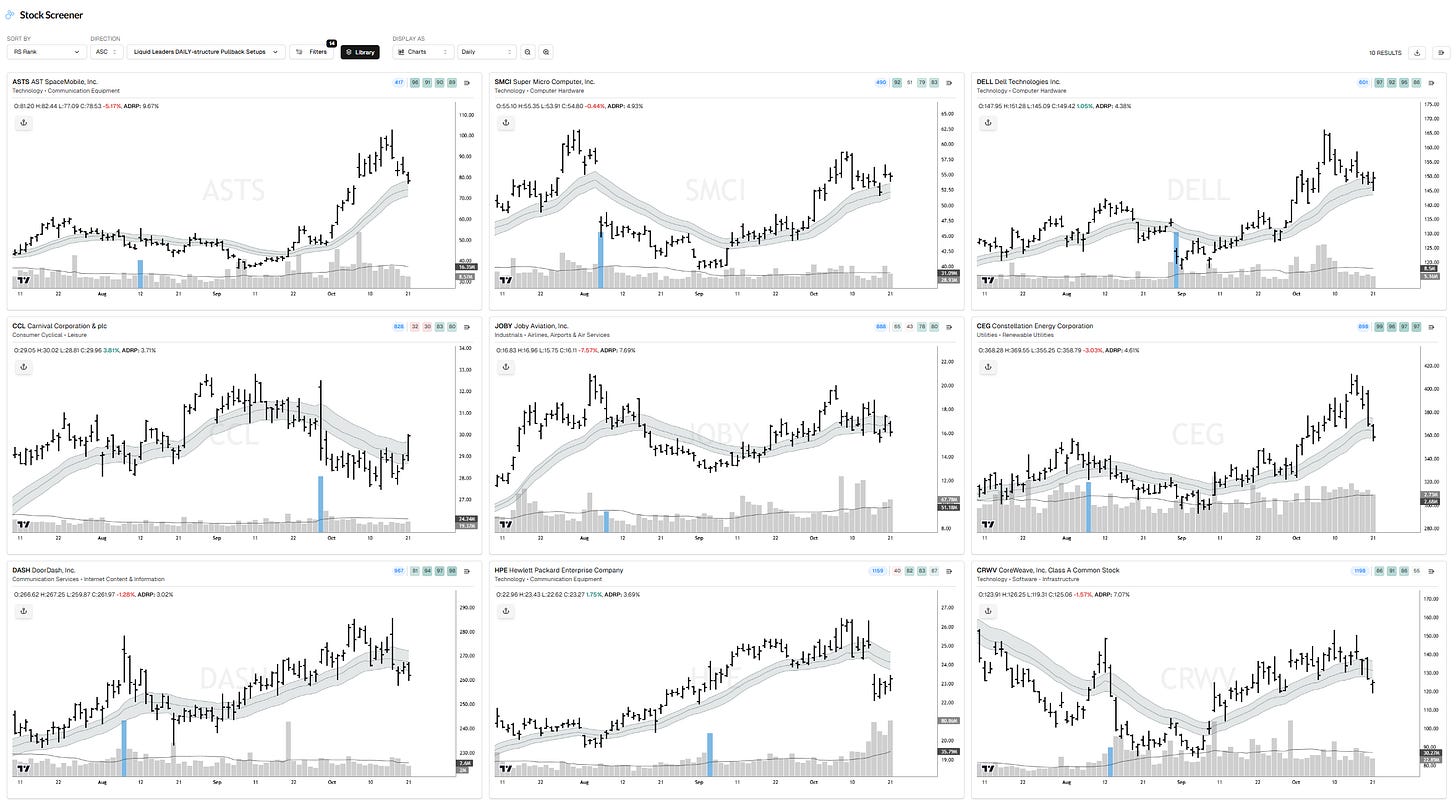

Liquid Leaders DAILY-structure Pullback scan

ASTS, SMCI, DELL, CCL, JOBY, CEG, DASH, HPE, CRWV, UAL

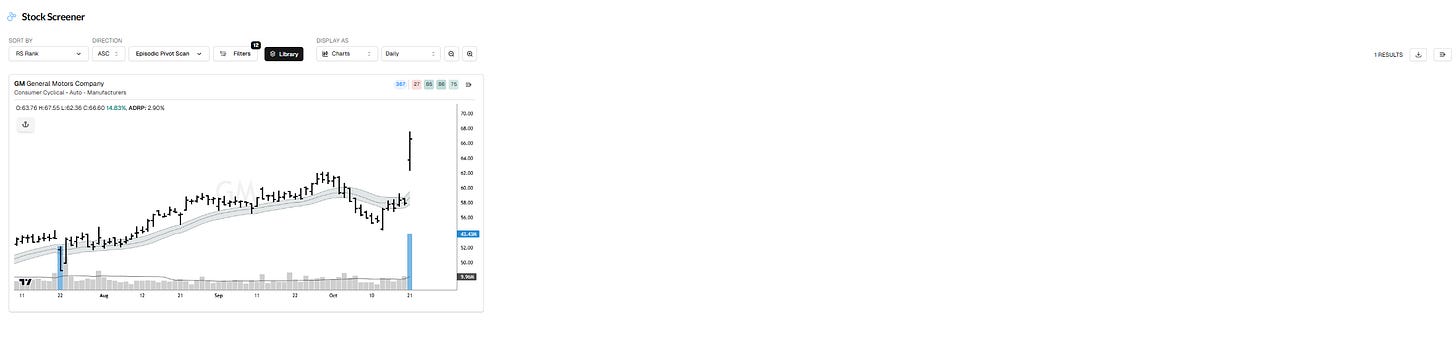

Episodic Pivot scan (Potential new Leaders)

GM

PORTFOLIO UPDATE

Hey guys!

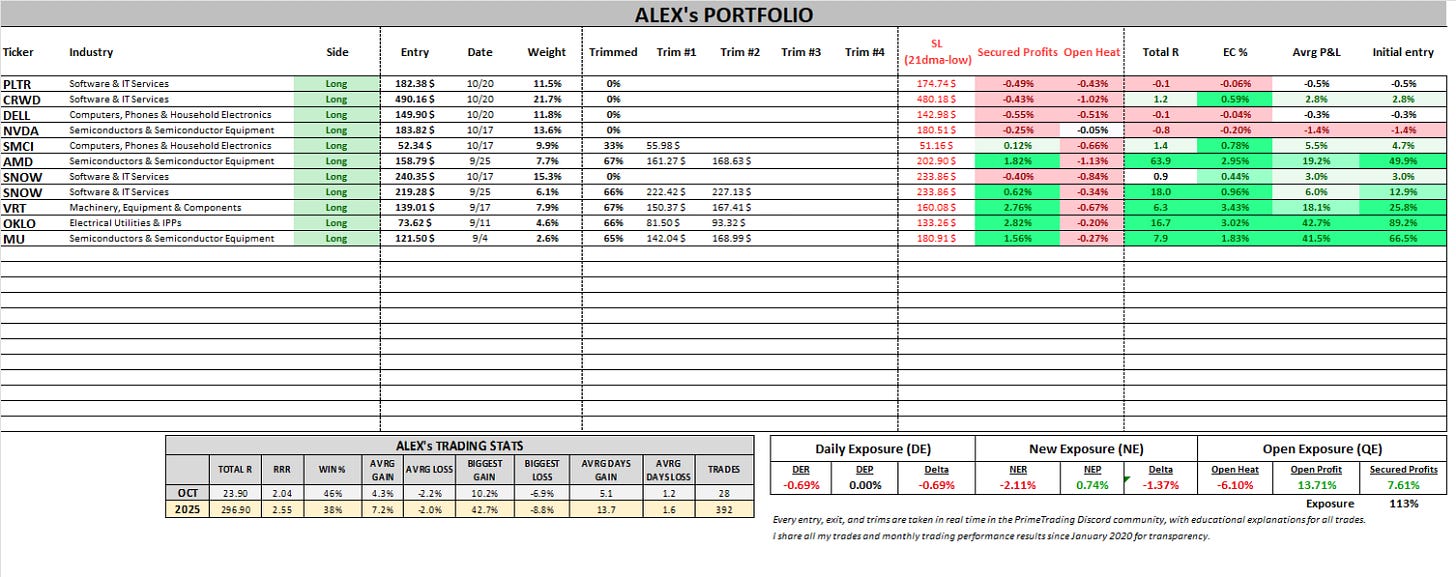

Not great feedback on new buy attempts today, at -0.67%ec, but overall the PF is holding very well, and apart from MP closing below the 21dma-structure, I have no reasons to adjust more exposure. CRDO will remain in FL, but I had to close to bring down NER in the 2% area.

New exposure from the last few days is green and acting well. SMCI, DELL, SNOW, CRWD, PLTR. So, trusting QQQE making a new ATH close, MCSI pushing higher above the 10-day moving average, and CS/VIX cooling off. “Trusting the trend” and being patient with my exposure, while minimizing new exposure risk.

NER is at -2.20%, with a -6.1% Open Heat and +7.61% Secured Profits on this cycle.

Cheers, HAGN!

NEW:

ADDED:

TRIMMED:

INTRADAY ATTEMPTS: OKLO (add), CRDO

OUT: MP

POSITIONS/TRADES LIVE EXPLANATIONS REVIEW (Shared live in Discord):

Try TradersLab.io — your faster research workflow.

Build your plan in minutes with top-down market dashboards, sector/money-flow views, and screeners that drill down to leading stocks—all in one platform.

It’s the same set of TradersLab scans I use to build my Focuslist, now in an app built for every swing or position trader’s daily routine.

Open the app → TradersLab.io

Try it 1-month FREE with the code “TRIAL”.

Want to keep reading The Prime Report? Subscribe below to see my game plan and top ideas for tomorrow.

See you there!

FOCUSLIST 10/21

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.