Traders always talk about “how big” they go — but rarely about how hot their portfolio really is.

You can size up all you want, but if your Open Heat is off the charts, you’re not managing risk — you’re managing stress.

Open Heat is that invisible pressure in your book. It’s how much unrealized PnL, volatility, and correlation you’re sitting on when the market breathes against you. Most traders don’t even measure it — they just feel it in their chest when things go red.

That’s why I care less about how big your positions are, and more about your New Exposure Risk (NER) — how much new heat you’re adding to your book when you open fresh trades.

You can have 5 small positions that collectively add more NER than one big name, depending on their volatility and correlation. That’s how traders quietly overexpose themselves without realizing it — the book looks “diversified,” but it’s moving as one when stress hits.

Everyone loves to talk about conviction and pressing when they’re right.

But conviction only matters if your Open Heat stays within a level you can handle emotionally.

If you can’t sit through normal back-and-forth without flinching, your sizing or NER is too high.

The goal isn’t to max out exposure — it’s to find that balance where your portfolio can move freely, breathe with the market, and you can stay rational while it does.

Because in this game, it’s not the biggest size that wins — it’s the one who can carry the most heat without losing their cool. 🥁😂

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

Try it 1-month FREE with the code “TRIAL25”.

MARKET ANALYSIS

Good evening,

Price uptrend above rising 21dma-structure. Was unable to bounce from structure today; tomorrow is key for holding or breaking.

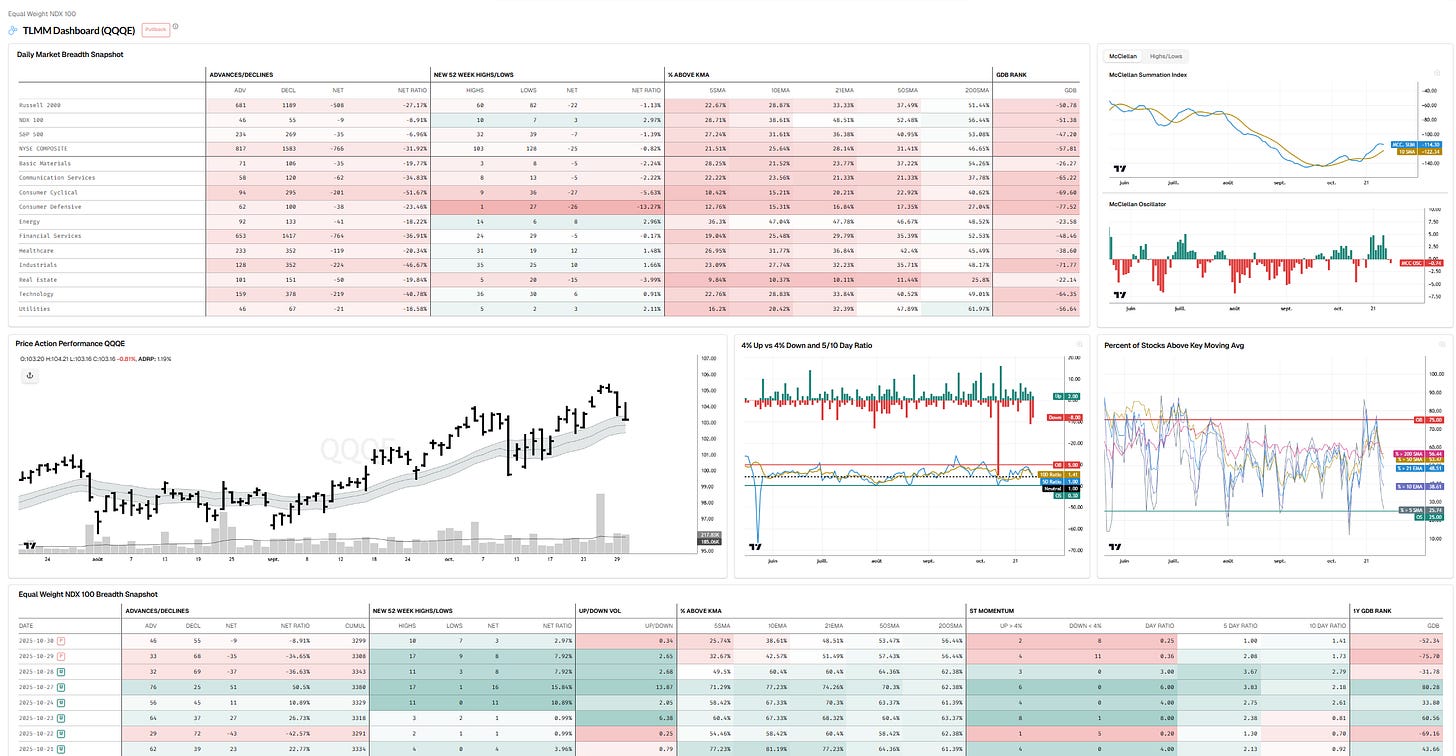

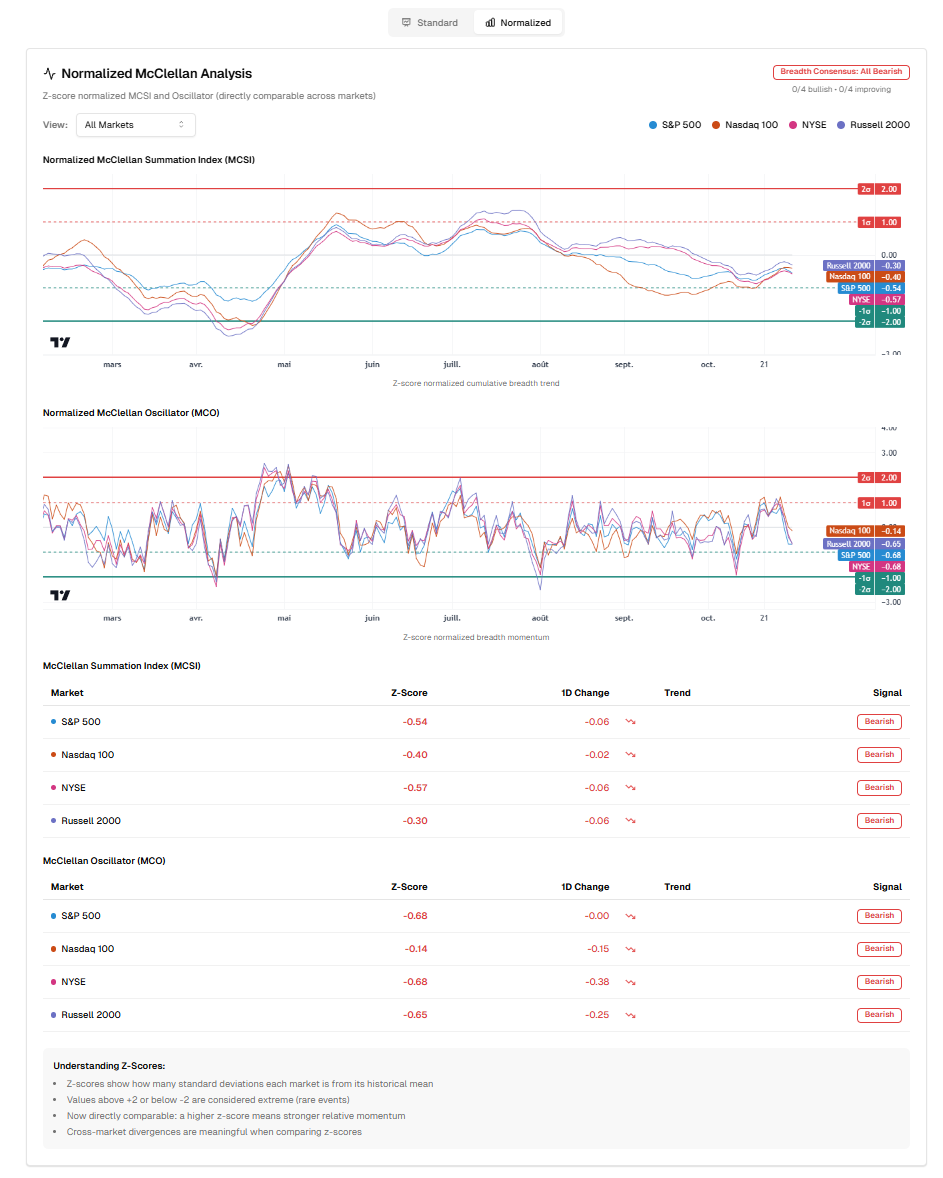

MCSI hook-down follow-through; not what I wanted to see, but we are still above a rising 10-day moving average. Defensive signal to take some profits. Breadth contracting for now.

MCO is not yet oversold.

TLMM Model = Pullback (day #2)

A pullback is confirmed with a follow-through today, or at least was before AMZN, AAPL, and NFLX earnings came in with beats, and the market gaps up overnight. We’ll need to see if that gap up holds first, and how we close the day, week, and month tomorrow.

I remain optimistic that it’s only a short-term pullback to remove the recent excess, but traction is definitely hard with some red flags starting to show here & there. Nothing serious yet, but it’s not the action I wanted to see to remain aggressive on the margin.

Day by day, let’s see how we react to that structure retest tomorrow.

TLMM DASHBOARD NASDAQ

MARKET INTERNALS

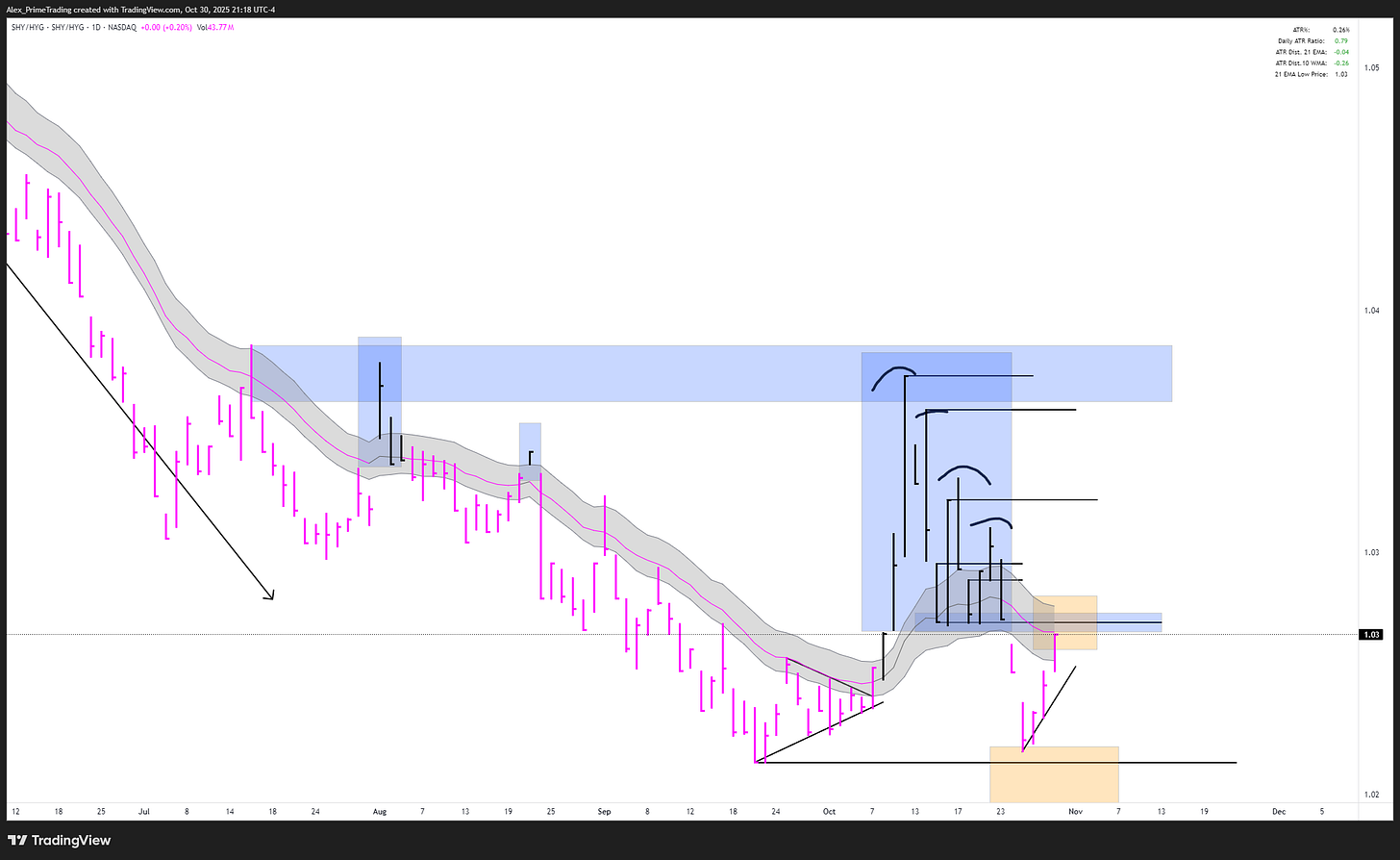

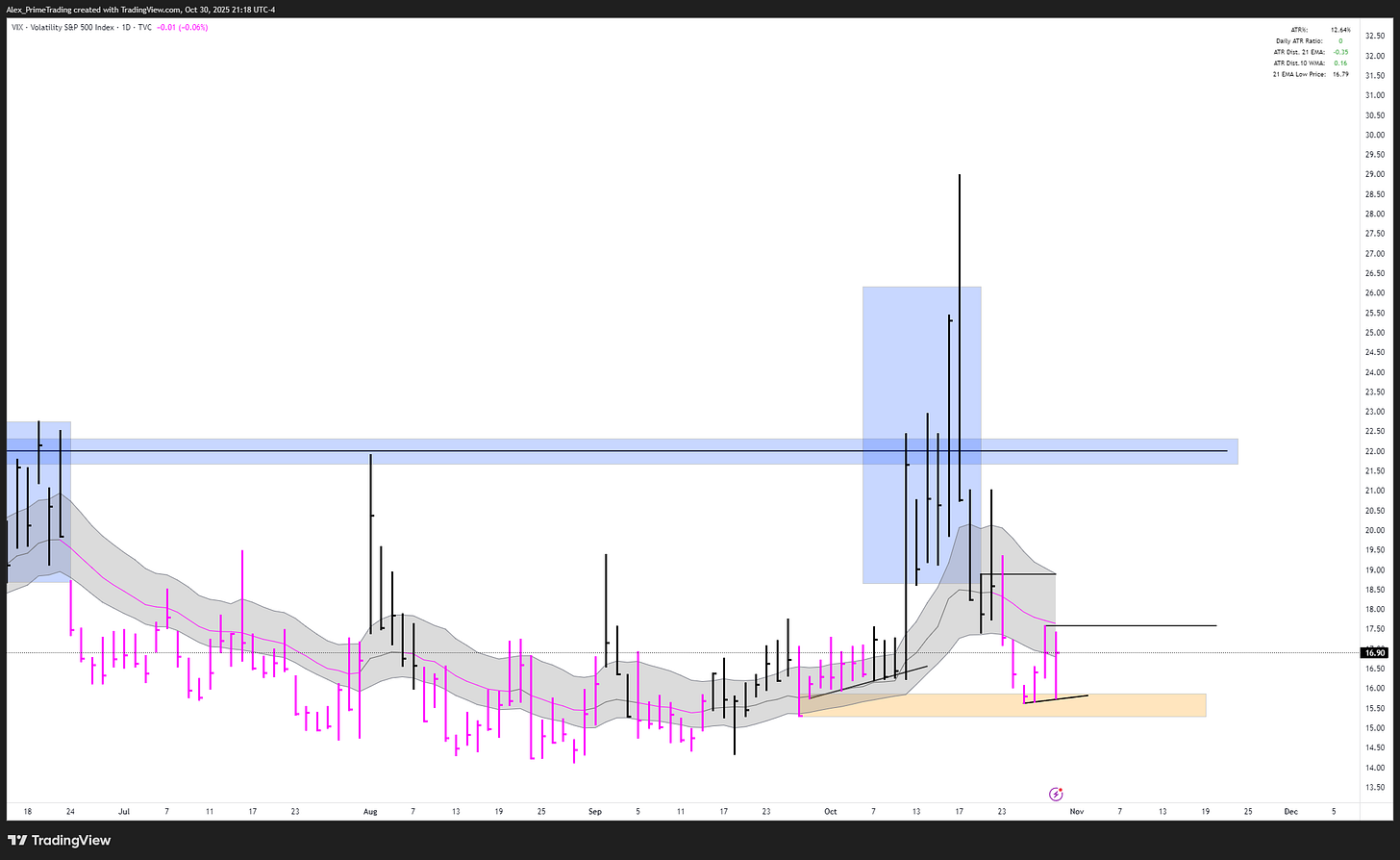

Downtrend below declining 21dma-structure. Retest of declining structure…love that spot for reversal and re-confirming the uptrend. If we reclaim, then it’s a red flag.

Downtrend below declining 21dma-structure. Retest of declining structure…love that spot for reversal and re-confirming the uptrend. If we reclaim, then it’s a red flag.

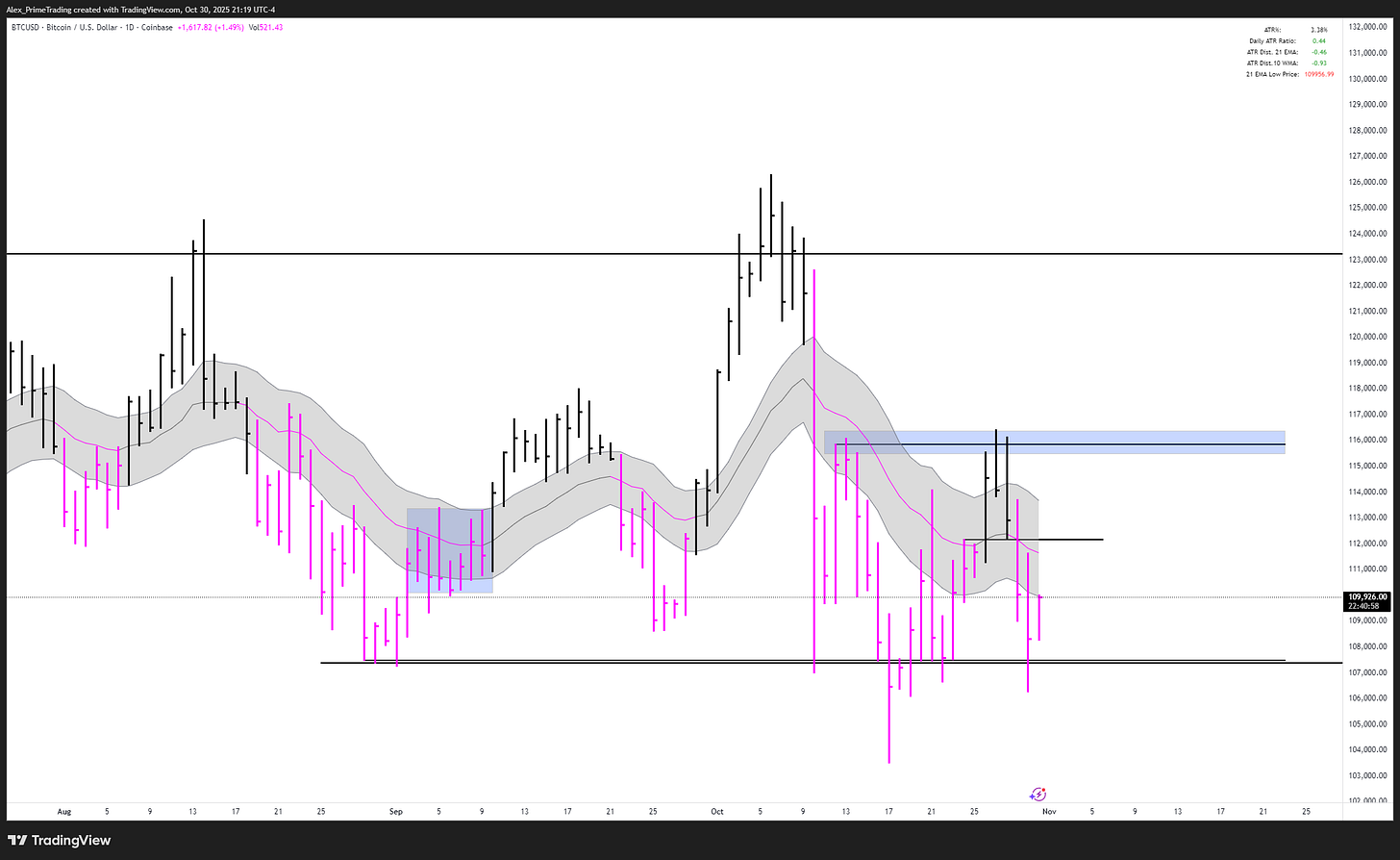

/BTC (Bitcoin)

Back below the 21dma-structure, it’s a lagging chop fest… not interested at all.

SECTORS & THEMES

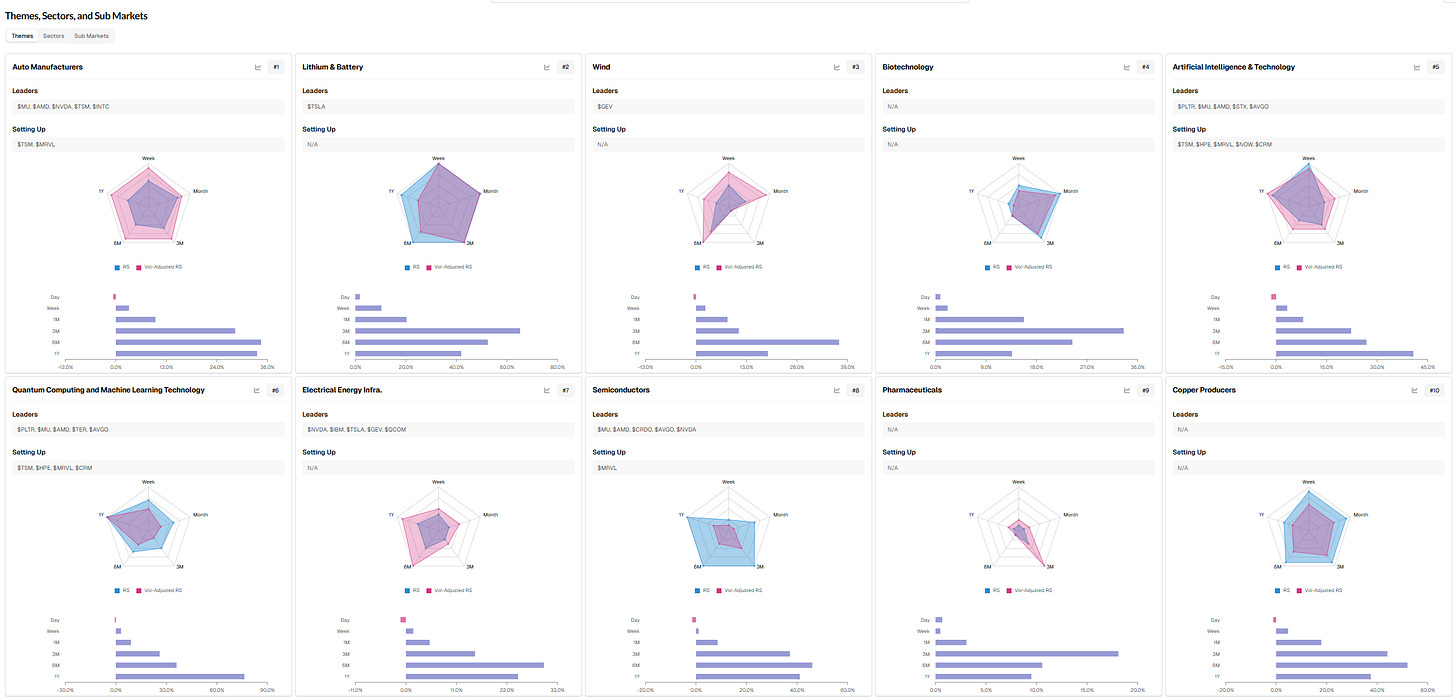

Top 10 Leading THEMES - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

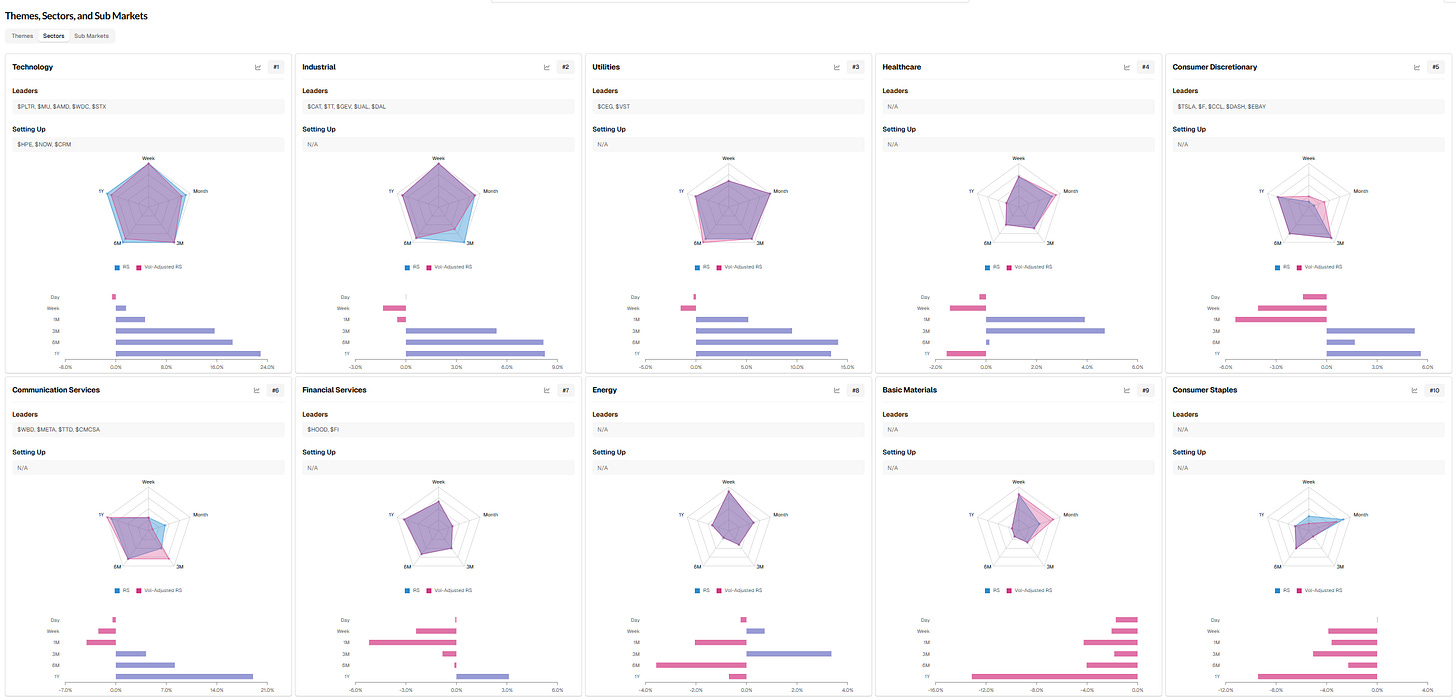

Top 10 Leading SECTORS - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

LEADERS STALKLIST

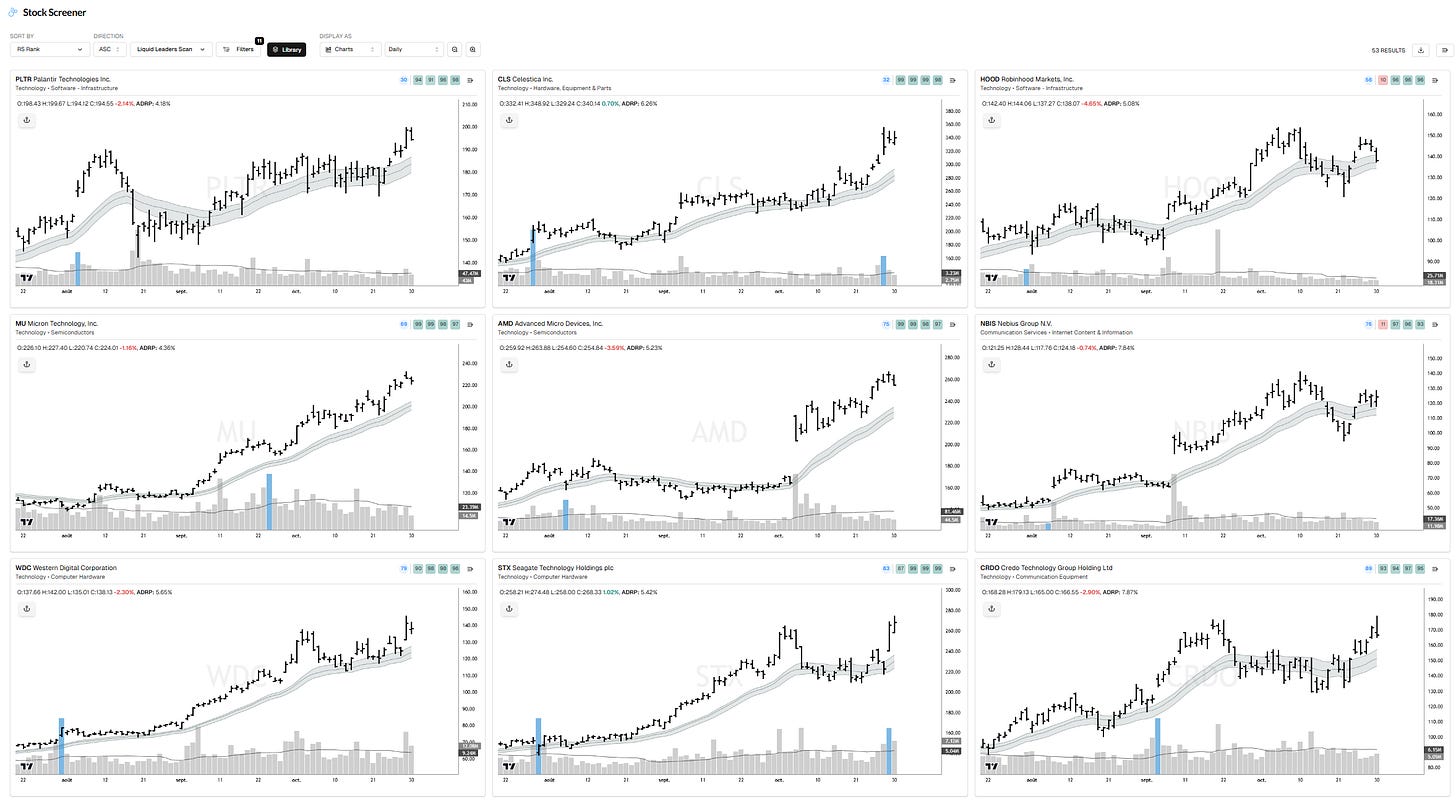

Liquid Leaders Universe (top RS)

PLTR, CLS, HOOD, MU, AMD, NBIS, WDC, STX, CRDO, WBD, TER, VRT, AVGO, CAT, LRCX, SNOW, GLW, RKLB, NVDA, OKLO, NET, TSM, ANET, DELL, SHOP, MDB, CRWD, KLAC, INTC, AMAT, APP, CEG, IBM, ASTS, HPE, DDOG, ARM, SMR, TSLA, JOBY, TT, F, IONQ, CRWV, GEV, VST, SMCI, CCL, DASH, CDNS, ALAB, QCOM, UAL

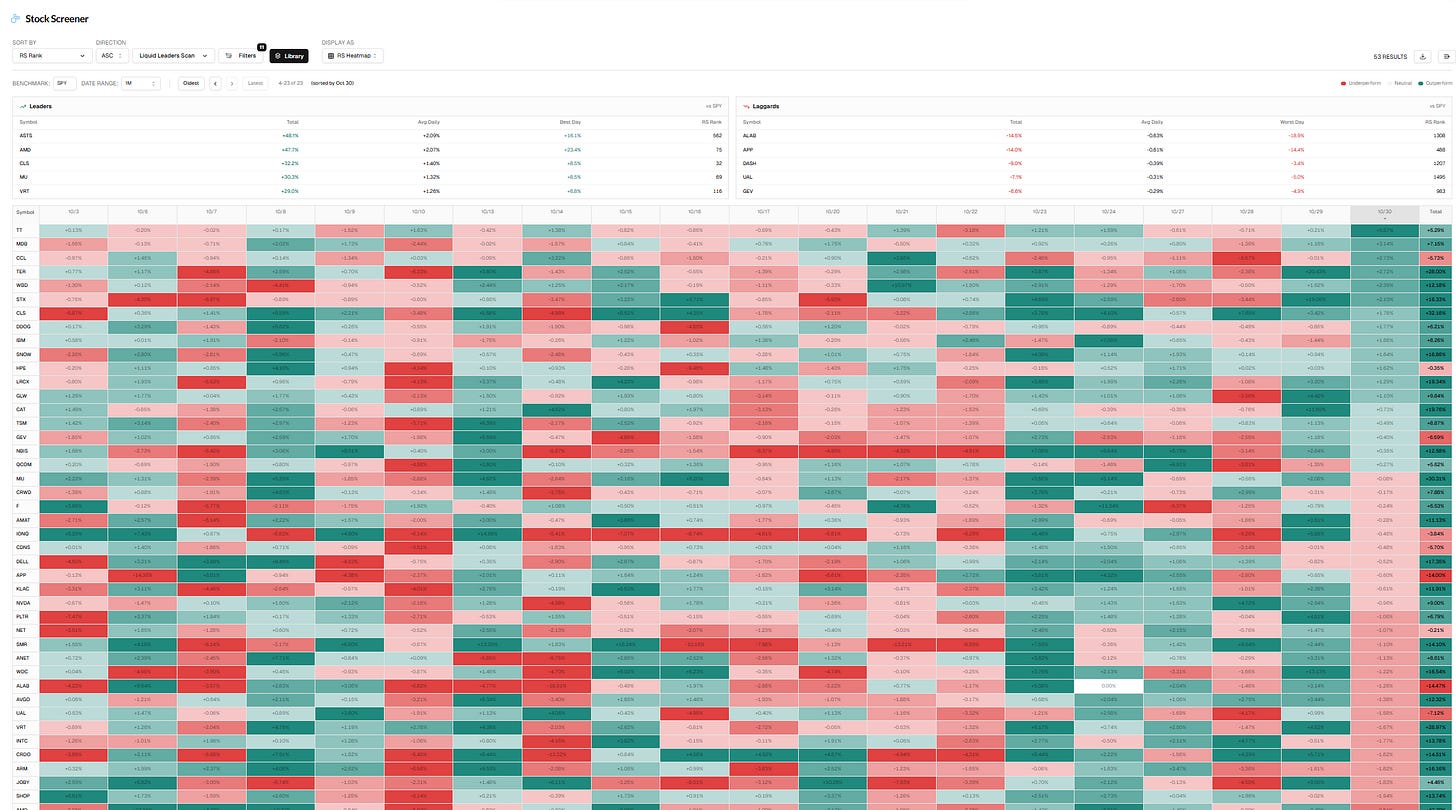

Liquid Leaders RS Heat Map

A quick visual of daily Relative Strength vs SPY, helping you spot which stocks are leading or lagging on any given day.

That WL is shared as a community WL that you can access in Tlab.

Liquid Leaders DAILY-structure Pullback scan

NBIS, OKLO, TSM, ASTS, HPE

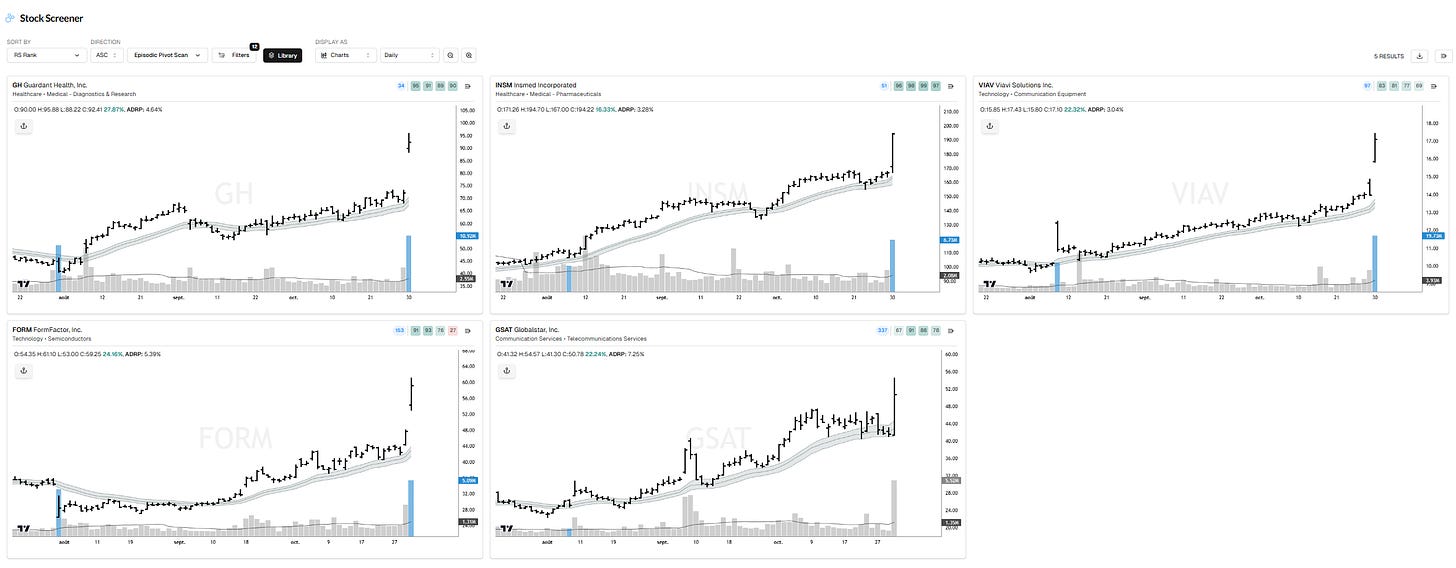

Episodic Pivot scan (Potential new Leaders)

GH, INSM, VIAV, FORM, GSAT

PORTFOLIO UPDATE

Hey guys!

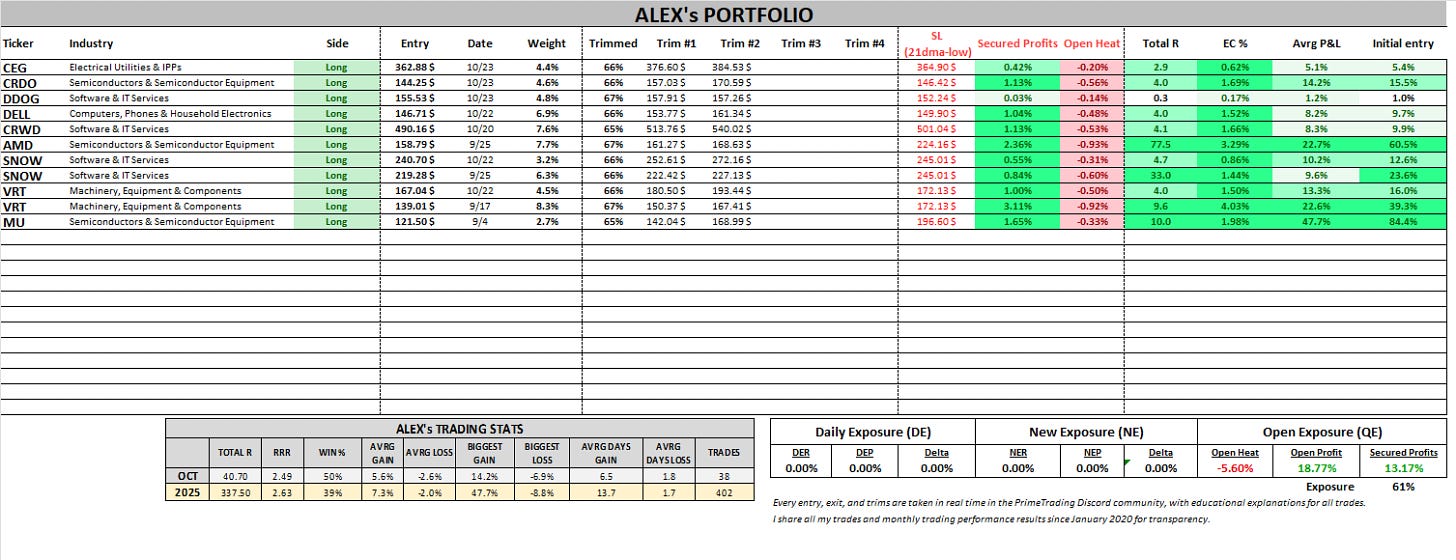

Alright, picture changed, and I decided to be more active today and manage my PF risk into the close. The market was extended, and due for a pullback, but I had some positions just without the cushion needed to weather a deeper pullback here, and just some red flags starting to pill in a bit here & there. No idea what will happen, but I had a great run in the last few weeks, and my job is to make sure I don’t give it back if the market decides to pullback for larger & longer.

I decided to cut all new exposure (TSLA/RKLB), and reduce DDOG down to a runner size. I did the same with some older positions by adjusting my 2nd target down to 4/5R, that’s where I feel better instead of 7R. I will probably change that 7R back to 5R like it was before. I would have hit a lot of those in the last few days around the highs. I like where that 5R gets me based on my entries.

The market can gap up tomorrow, who knows. If the market firms up, QQQE finds support at the 21dma-structure, and MCSI flips up on an oversold MCO, then I will be there to ramp back up exposure...but for now, the right move was to reduce that exposure and wait for more clarity.

QQQE right into the 21dma-structure

MCSI followed-through on the hook-down

MCO further contraction into negative

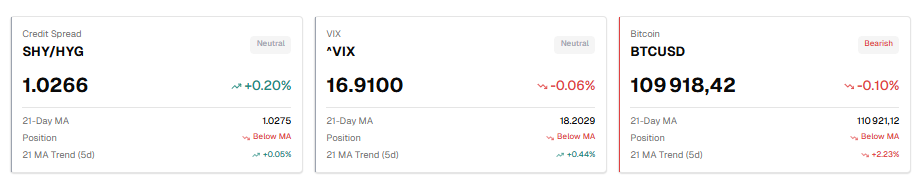

VIX potential higher low and closed strong. (Still below recent swing high, but just need to be watched)

Credit Spreads closed stronger than I would have wanted to see after an initial 21dma-structure rejection this morning. (We don’t want to see CS spike above)

BTC potential multi-week base breakout and showing crazy weakness while the market was at highs

RSP 2nd close below declining 21dma-structure

Recent trades just not having the push and traction I wanted to see to keep big exposure while the market is still extended and my older positions are extended.

NER down at 0%, with an Open Heat of -5.6%.

Cheers, HAGN.

NEW:

ADDED:

TRIMMED: DDOG (2/3), CRDO, CEG, VRT, DELL, CRWD, DDOG (1/3)

INTRADAY ATTEMPTS: RKLB (add)

OUT: TSLA

POSITIONS/TRADES LIVE EXPLANATIONS REVIEW (Shared live in Discord):

Try TradersLab.io — your faster research workflow.

Build your plan in minutes with top-down market dashboards, sector/money-flow views, and screeners that drill down to leading stocks—all in one platform.

It’s the same set of TradersLab scans I use to build my Focuslist, now in an app built for every swing or position trader’s daily routine.

Open the app → TradersLab.io

Try it 1-month FREE with the code “TRIAL”.

Want to keep reading The Prime Report? Subscribe below to see my game plan and top ideas for tomorrow.

See you there!

FOCUSLIST 10/30

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.