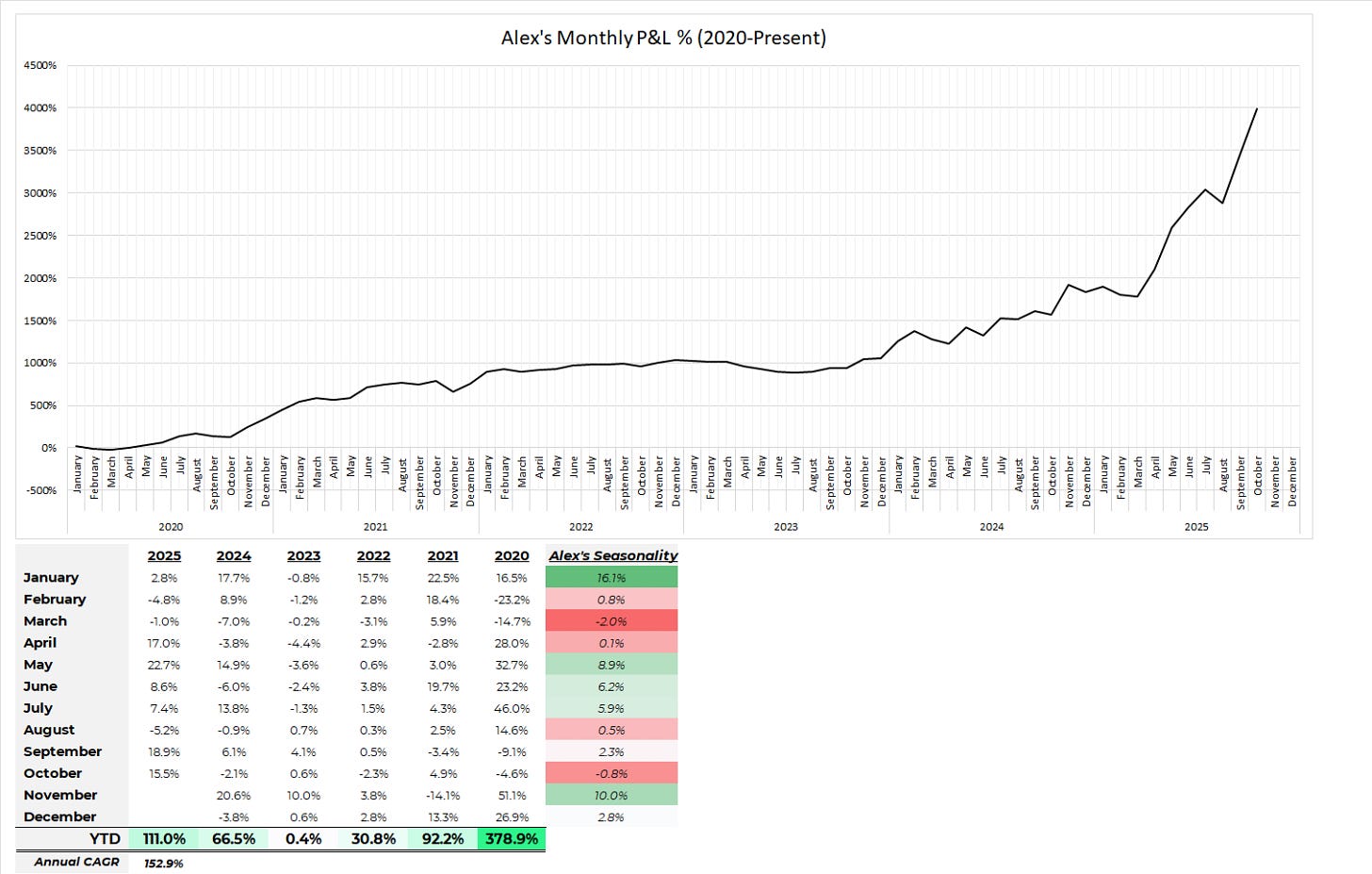

Alex’s PF performance. - October 2025 📑🛡️

MTD ( +15.49% )

YTD ( +110.98% )

YTD benchmark QQQ (+23.52%)

Hey guys!

Another month in the books, and that was not an easy one... we really had to be in the right groups & leaders, otherwise it was a pure chopfest. Keeping good core exposure from Sept., and engaging only in support and not in an extended market, saved me in Oct. I was able to maintain a good win rate %, good total R, and not overtrade in a month that would have been easy to. It’s an average month based on statistics, but the patience and the Panda spirit paid off significantly in this type of chop-and-grind-up market.

Triple-digit year is achieved (yeahhh!)...for now. Now I need to protect that EC level and not be as aggressive as I’ve been since April. My goal is to NOT use margin for the rest of the year, and manage to keep my NER closer to 1/1.5% on positioning attempt. 2 months left to this year, so let’s go for it, but with a more restrained approach 😉

I hope you had the Oct. performance you wished for, and if not, don’t hesitate to ask questions around and be active in the Discord. That’s how you can accelerate and enhance your learning process.

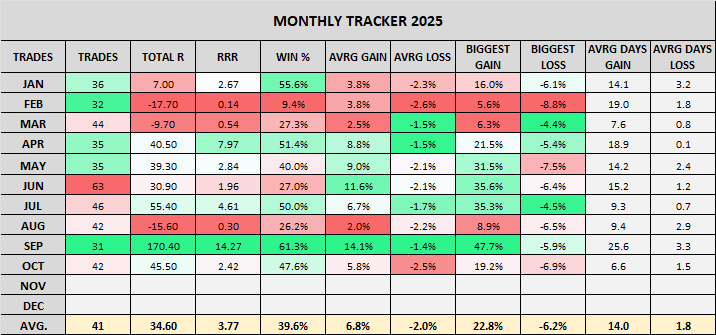

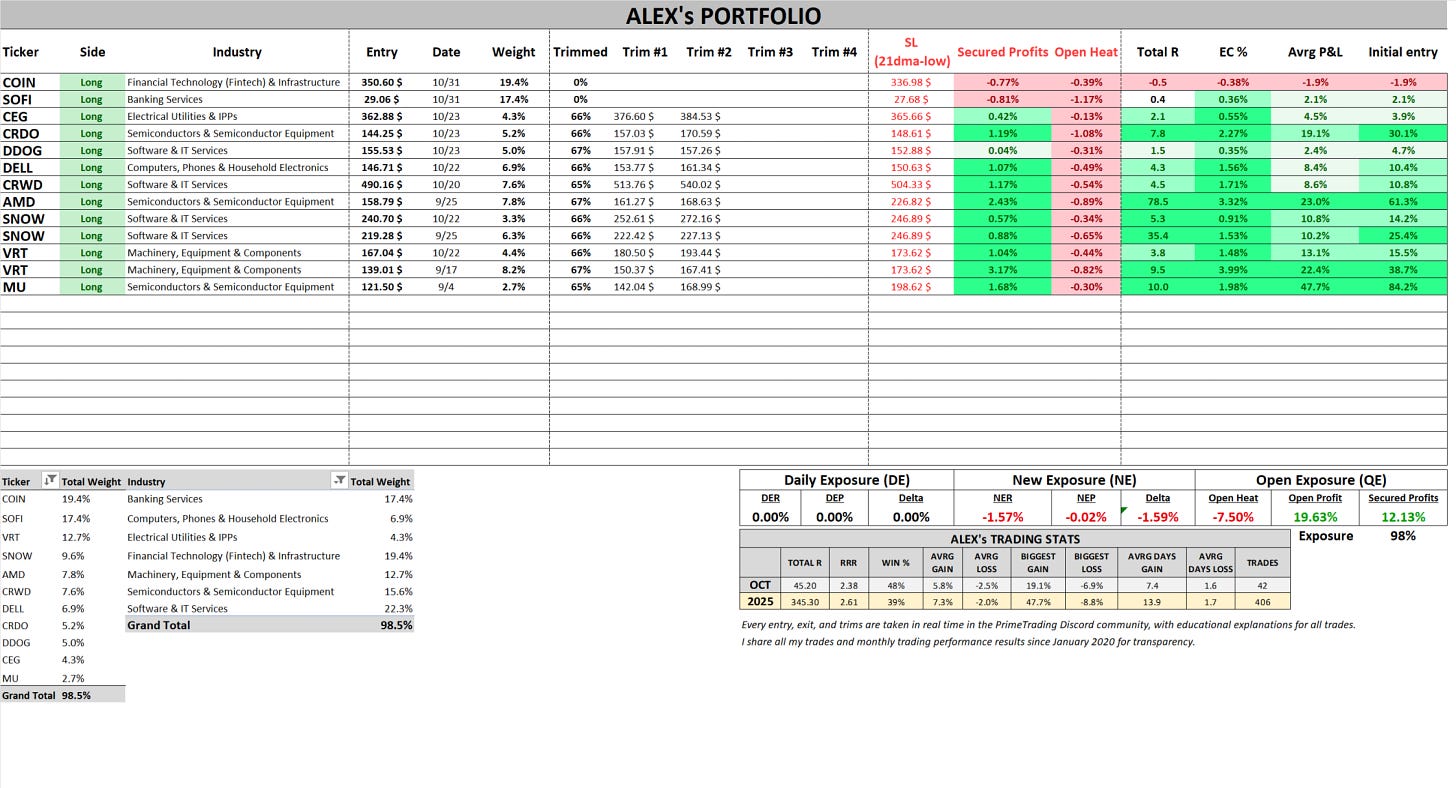

MTD stats:

42 trades, within my average (no over trading despite the choppy market)

45 total R, above my average.

2.47 RRR... low as I was not able to get big traction on my winners. That was a choppy month and most of the returns came from Sept. winners/cores.

Win rate at 48% is good and above average....consider chop it’s good.

win/loss avrg is boff, but probably market related.

Overall, average stats this month, but holding a good size in my Sept and early Oct winners, which proved to push EC this month.

PTA:

I don’t want to change much, but I’d like to reflect a bit on my trim into strength process next week, and see how I can improve it a bit. I like my buying process, I’m very comfortable with it, but I feel I can improve a bit my sell into strength side. I’ll share what/if I change anything apart going back to 5R 2nd target as I shared earlier this week. Overall good trading, just need to stay disciplined, patient, and trust the trend.

Cheers HAGN!

Alex ✌️

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

Try it 1-month FREE with the code “TRIAL25”.

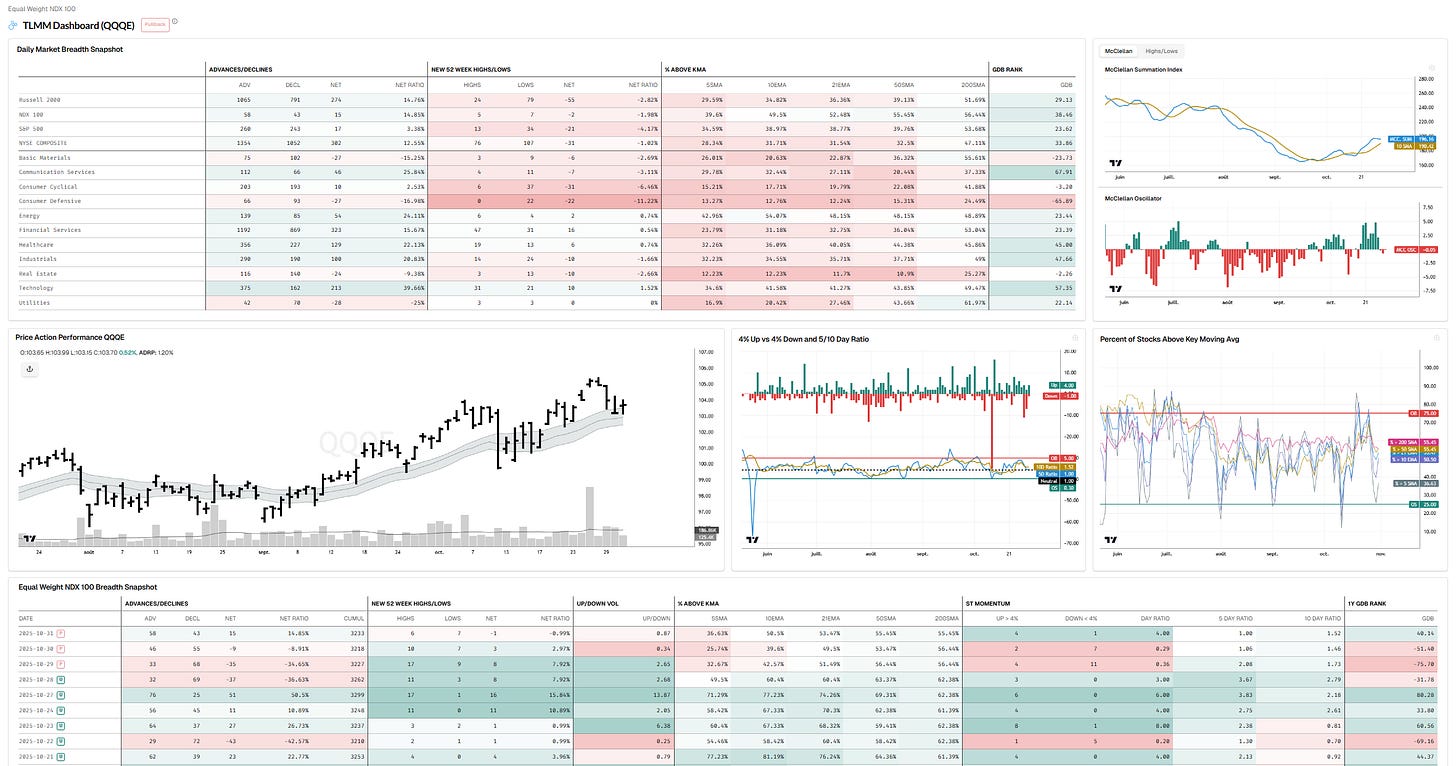

MARKET ANALYSIS

Good evening,

Price potential higher low right at the 21dma-structure, with a base structure reclaim. No daily reversal confirmed, on watch tomorrow for potential re-confirmation of the trend.

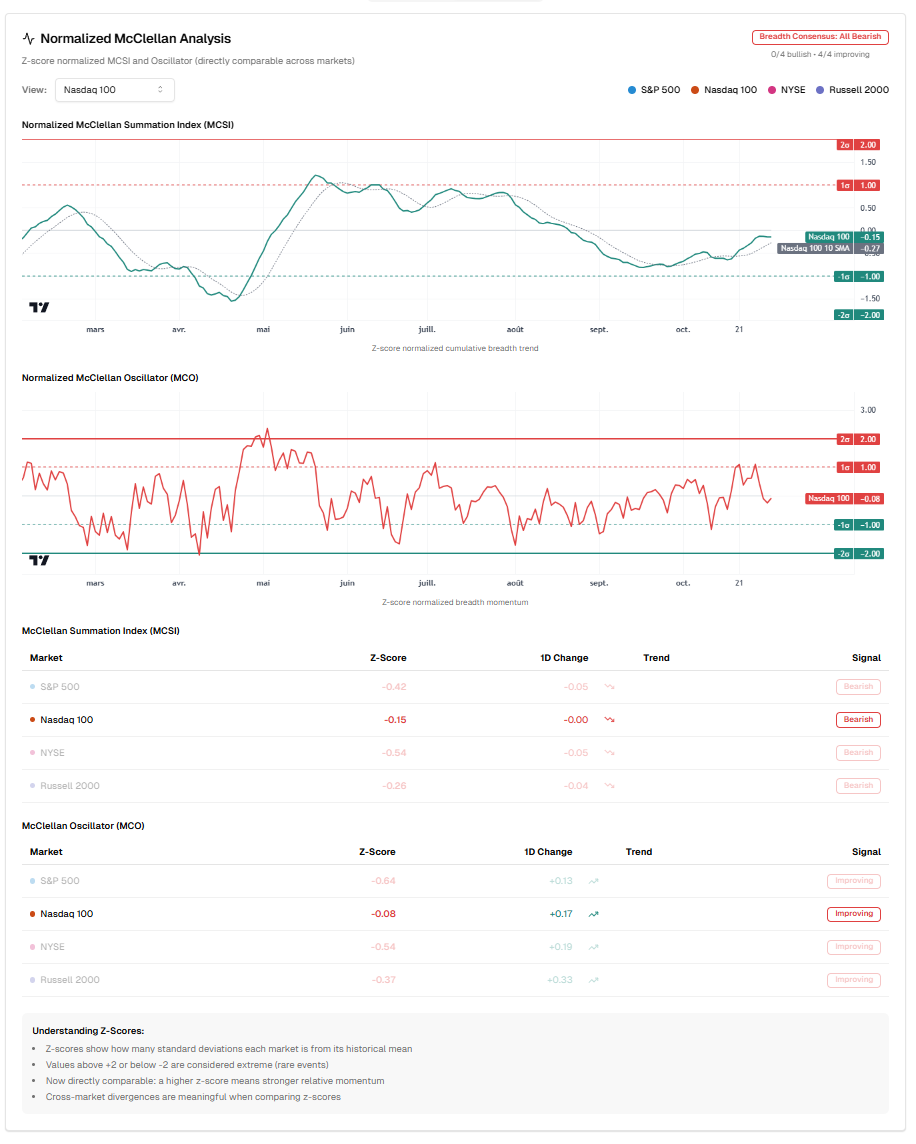

MCSI UP above rising 10dma.

MCO neutral

TLMM Model = Pullback (day #2)

The market showed some constructive action on Friday, as price found support in the 21dma-structure, and breadth was decent enough to hook back MCSI up.

With breadth extending from a short-term oversold reading, that’s pretty much the market pullback setup I like to engage in, and that’s why I used it to put back some risk, as the odds favor a potential re-confirmation of the trend.

I have no idea what will happen, but this is definitely a pivotal moment. We will need to confirm that constructive action with a reclaim of Friday’s high on QQQE, and breadth to confirm that hook-up.

One day at a time, let’s see if this trend has more fuel in it.

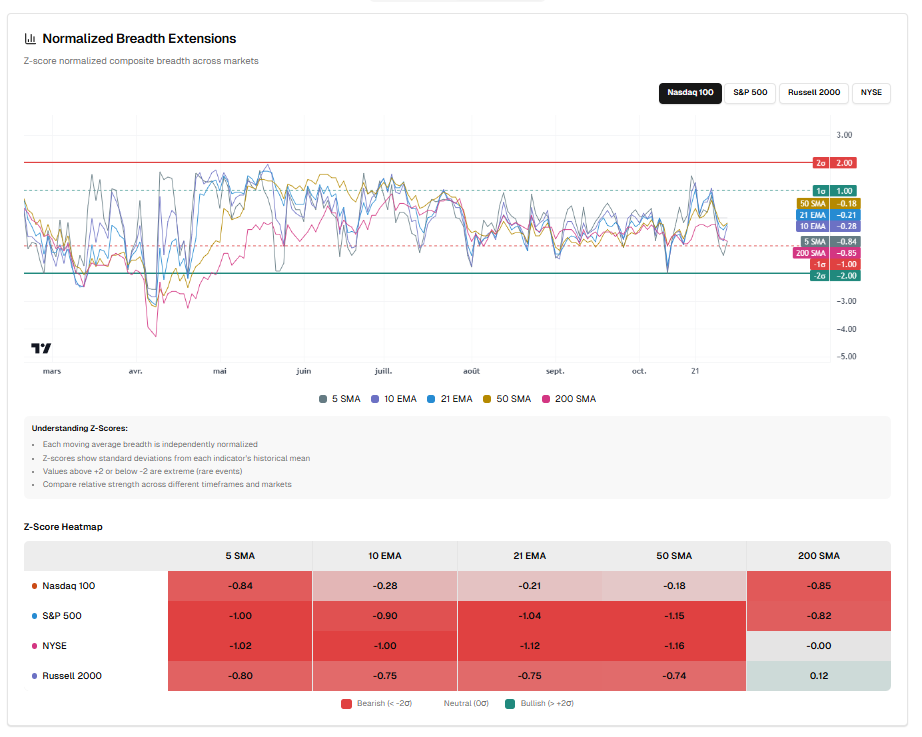

TLMM DASHBOARD NASDAQ

MARKET INTERNALS

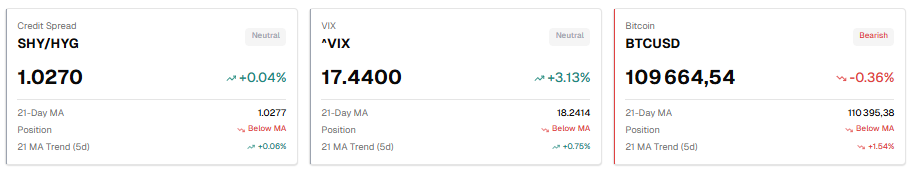

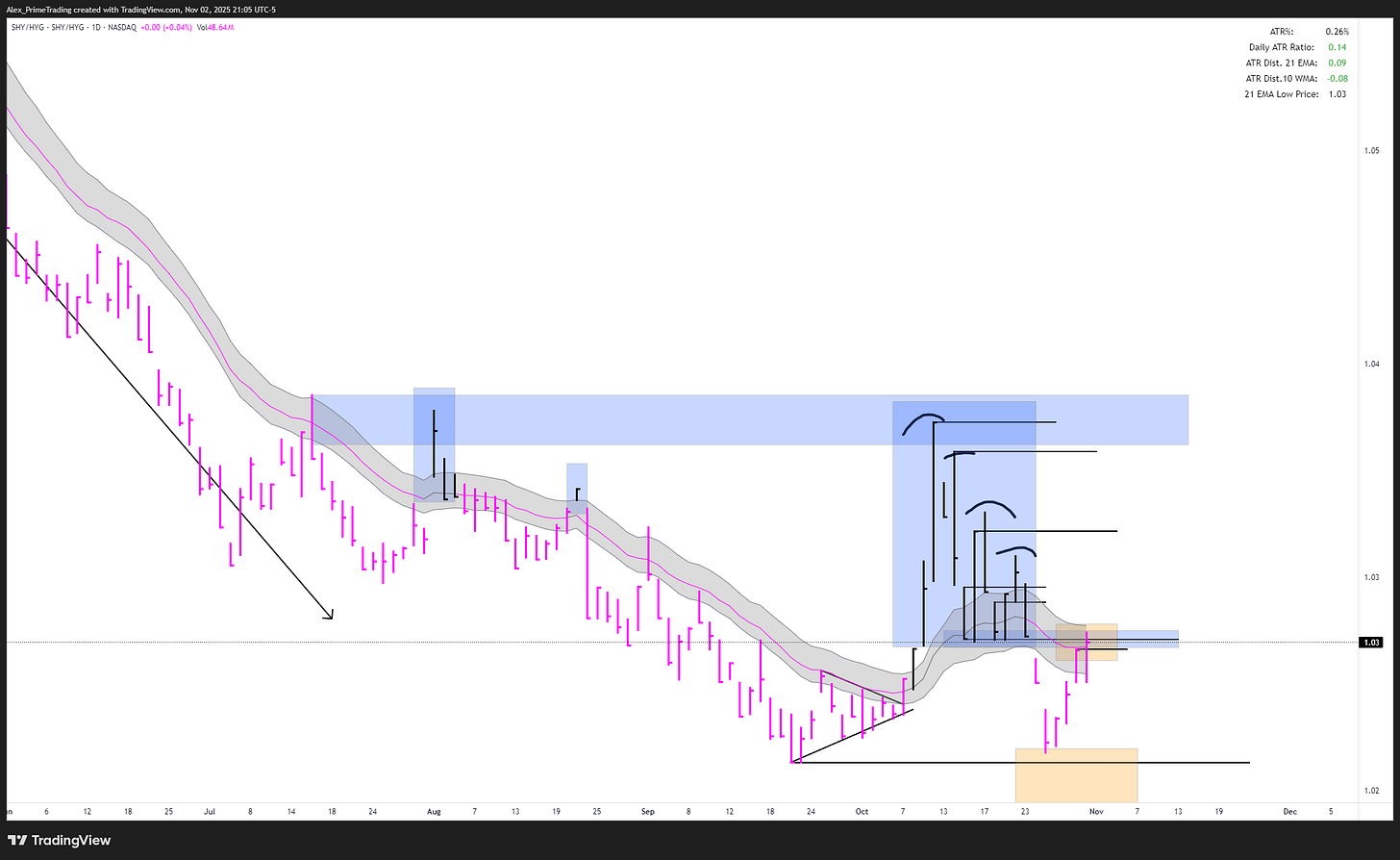

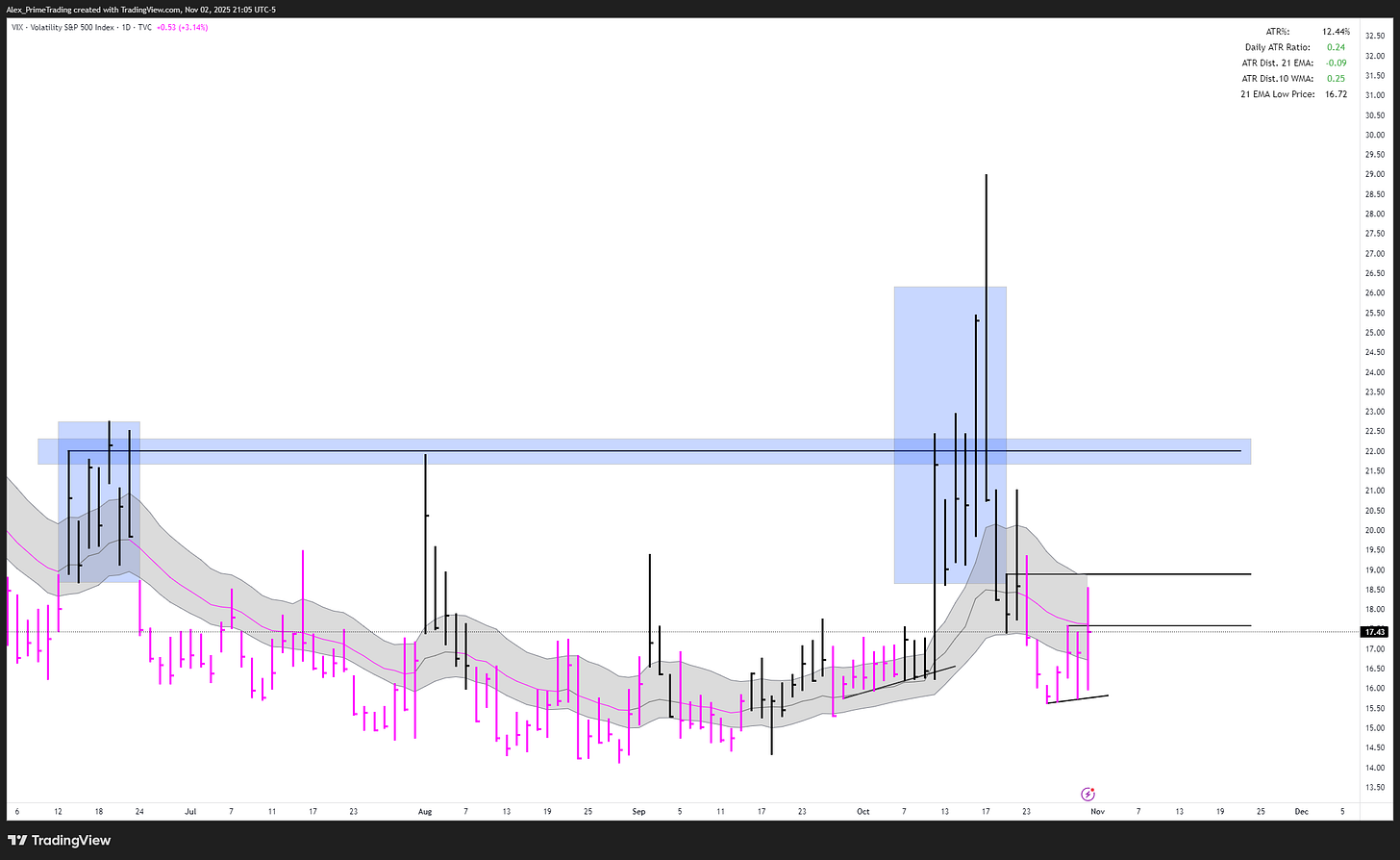

Downtrend below declining 21dma-structure. Retest of declining structure…love that spot for reversal and re-confirming the uptrend. If we reclaim, then it’s a red flag.

Downtrend below declining 21dma-structure. Retest of declining structure…love that spot for reversal and re-confirming the uptrend. If we reclaim, then it’s a red flag.

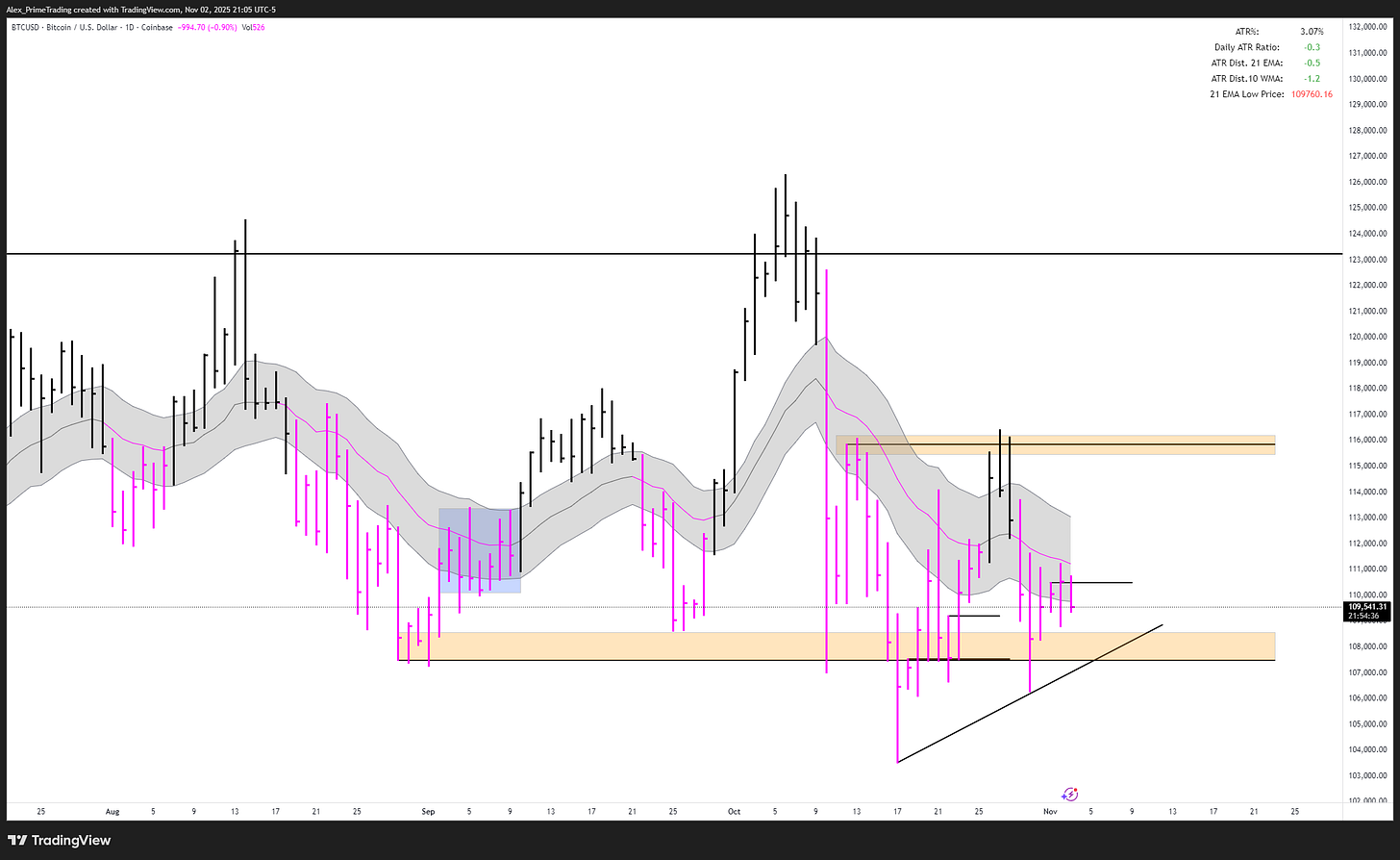

/BTC (Bitcoin)

Downtrend below declining 21dma-structure.

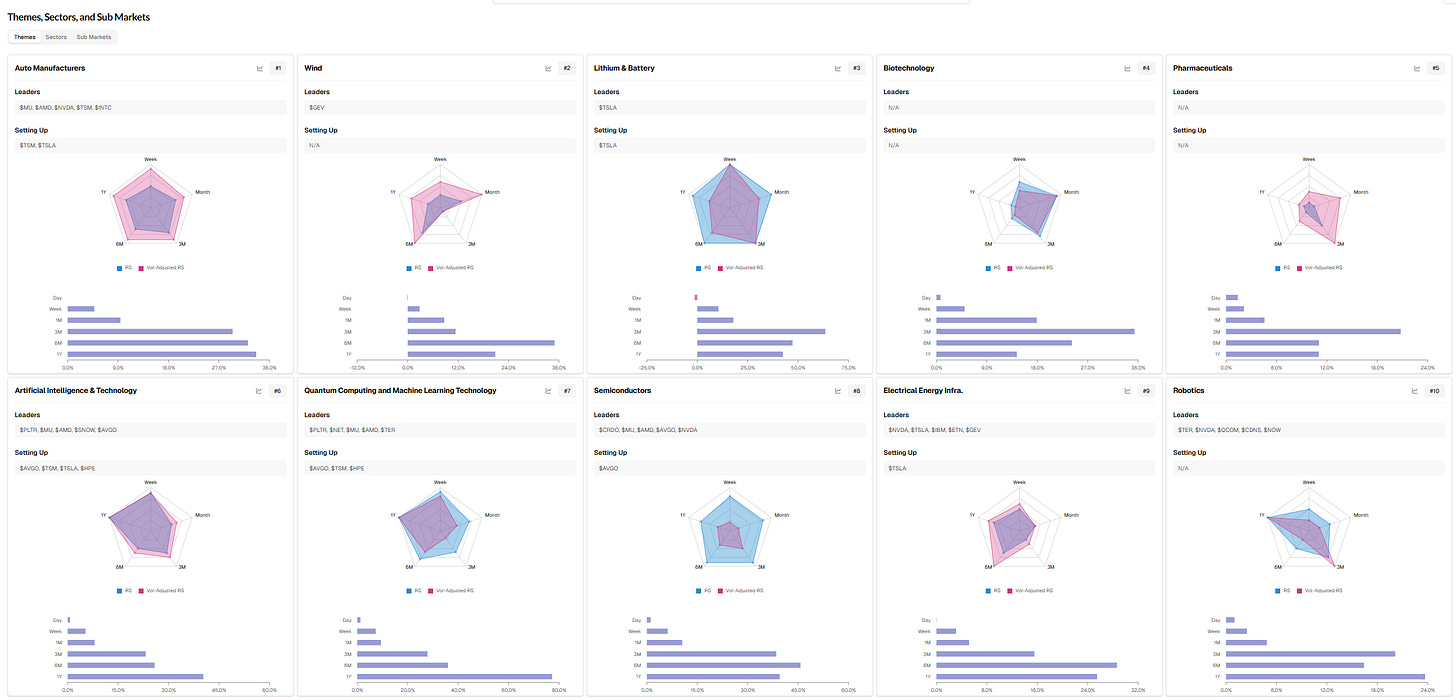

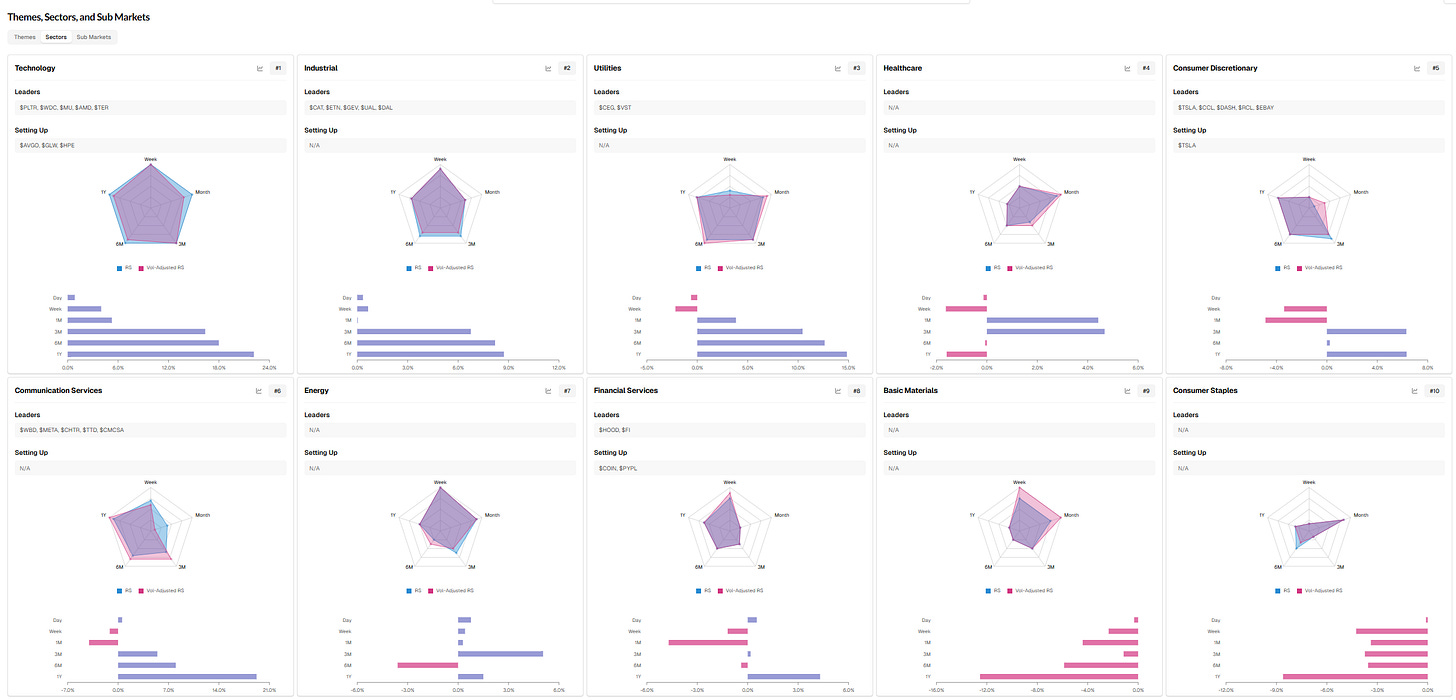

SECTORS & THEMES

Top 10 Leading THEMES - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

Top 10 Leading SECTORS - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

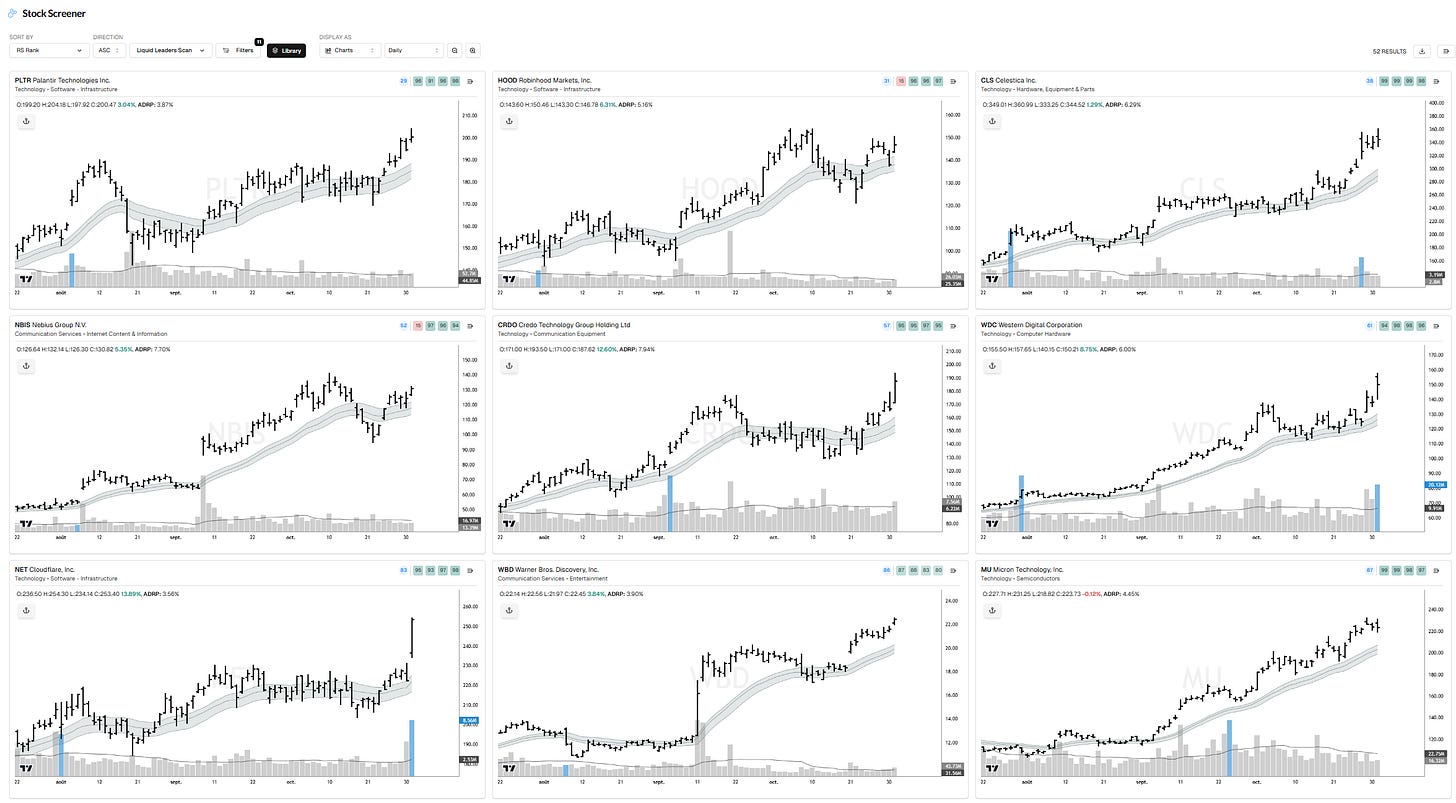

LEADERS STALKLIST

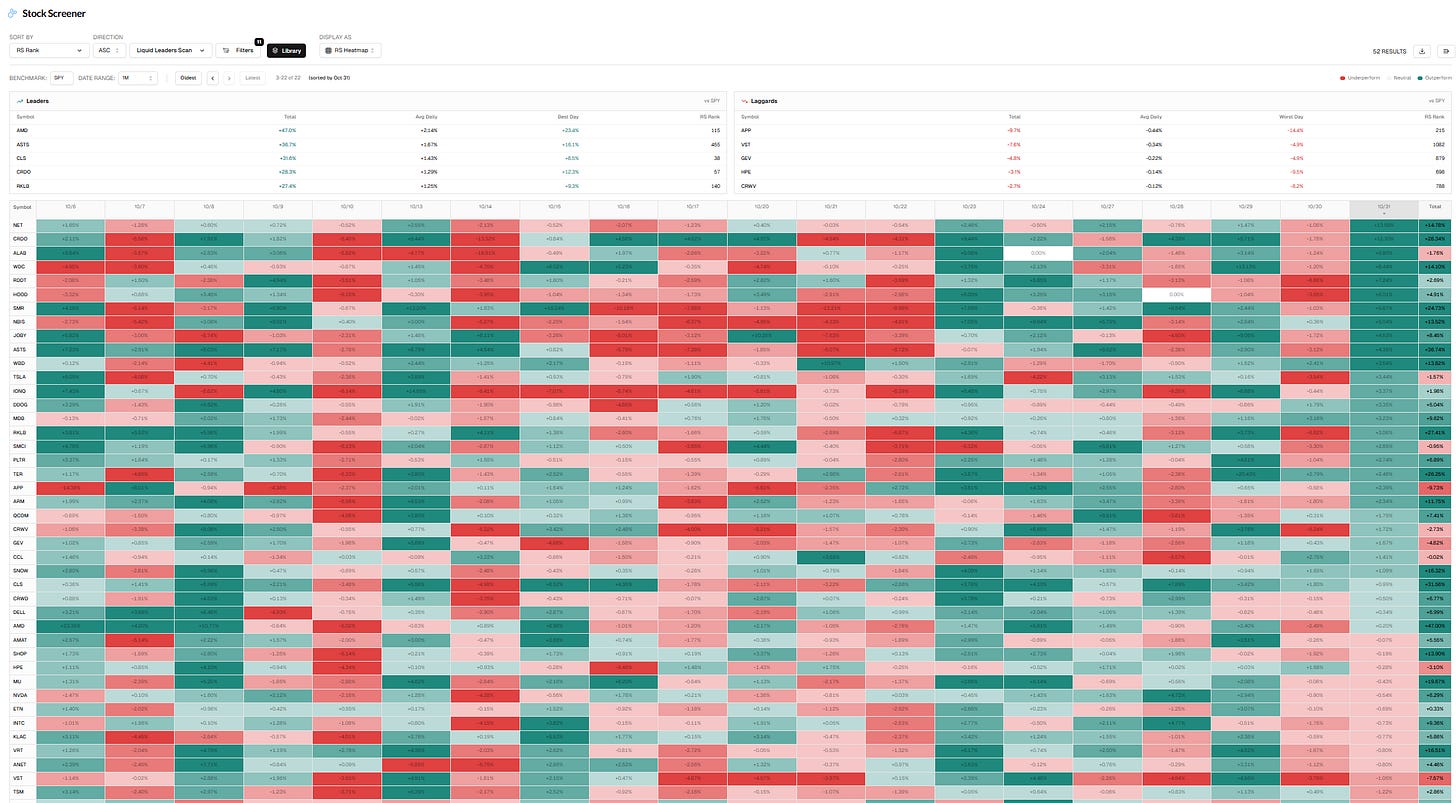

Liquid Leaders Universe (top RS)

PLTR, HOOD, CLS, NBIS, CRDO, WDC, NET, WBD, MU, AMD, TER, SNOW, VRT, RKLB, CAT, MDB, AVGO, APP, LRCX, NVDA, STX, DELL, GLW, ANET, OKLO, SHOP, CRWD, TSM, KLAC, DDOG, ASTS, INTC, AMAT, TSLA, ARM, CEG, SMR, JOBY, IBM, ETN, HPE, IONQ, CRWV, GEV, ALAB, SMCI, CCL, VST, QCOM, RDDT

Liquid Leaders RS Heat Map

A quick visual of daily Relative Strength vs SPY, helping you spot which stocks are leading or lagging on any given day.

That WL is shared as a community WL that you can access in Tlab.

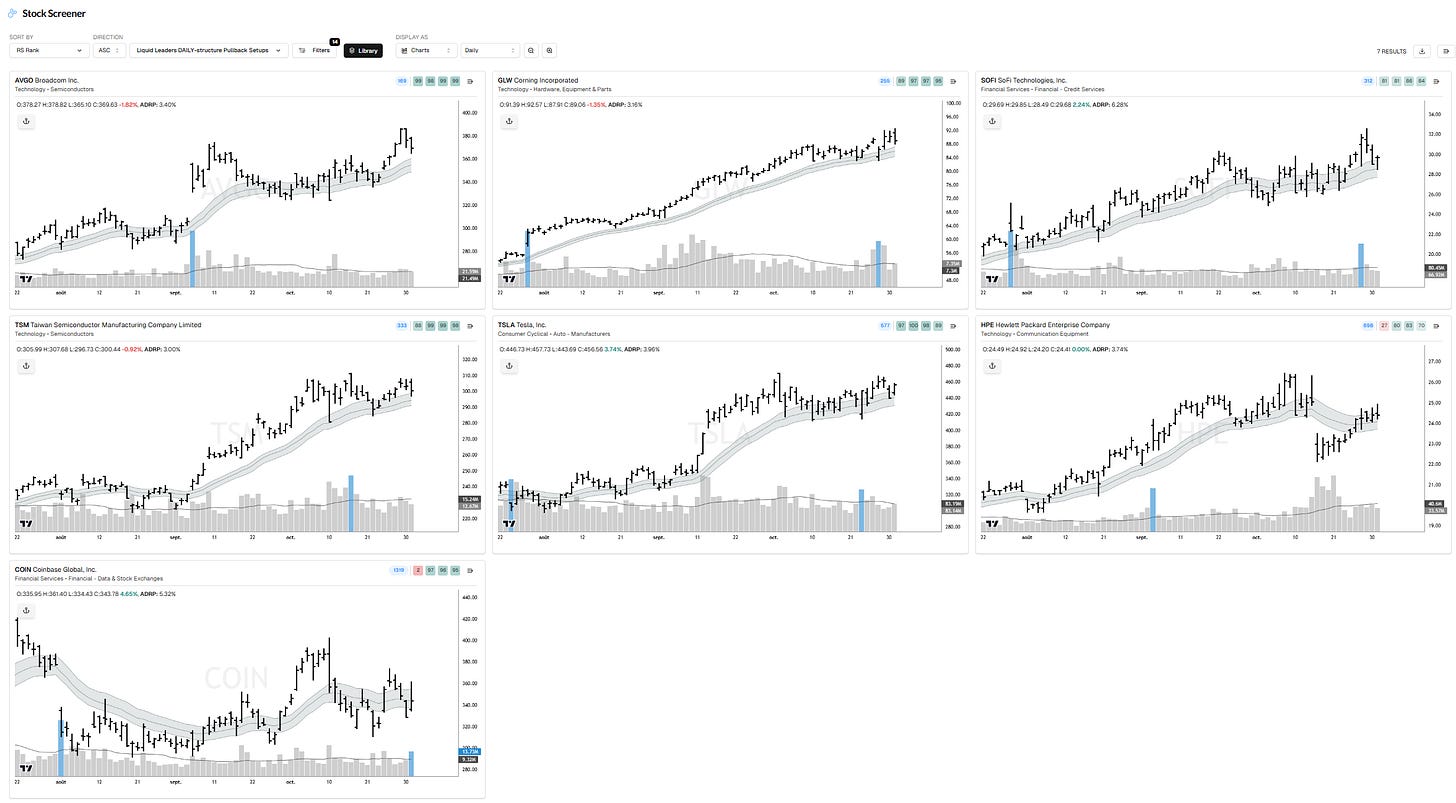

Liquid Leaders DAILY-structure Pullback scan

AVGO, GLW, SOFI, TSM, TSLA, HPE, COIN

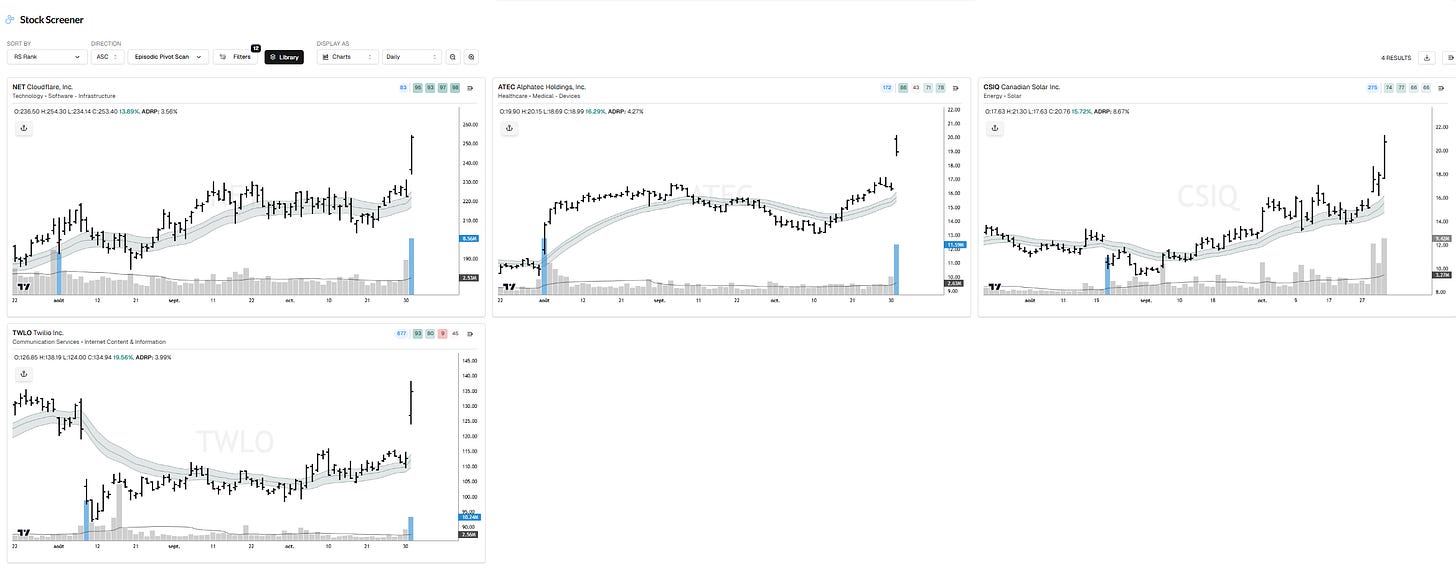

Episodic Pivot scan (Potential new Leaders)

NET, ATEC, CSIQ, TWLO

PORTFOLIO UPDATE

Hey guys!

Friday was a constructive day overall, as QQQE found support right into the base & 21dma-structure, breadth was decent...enough to turn MCSI back up and reconfirm the uptrend above a rising 10dma. VIX/CS retesting declining daily-structures as well. Many constructive structure backtest and overall digestion in PF holdings, while some making new highs. PF feedback was good.

Without doing predictions, you know me by now...that’s where I want to push myself to engage and increase exposure even if the market outlook look bad to some. Let’s see if the odds play out and we get an uptrend resumption.

NER up at 1.57%, with an Open Heat of -7.5%.

Cheers, HAGN.

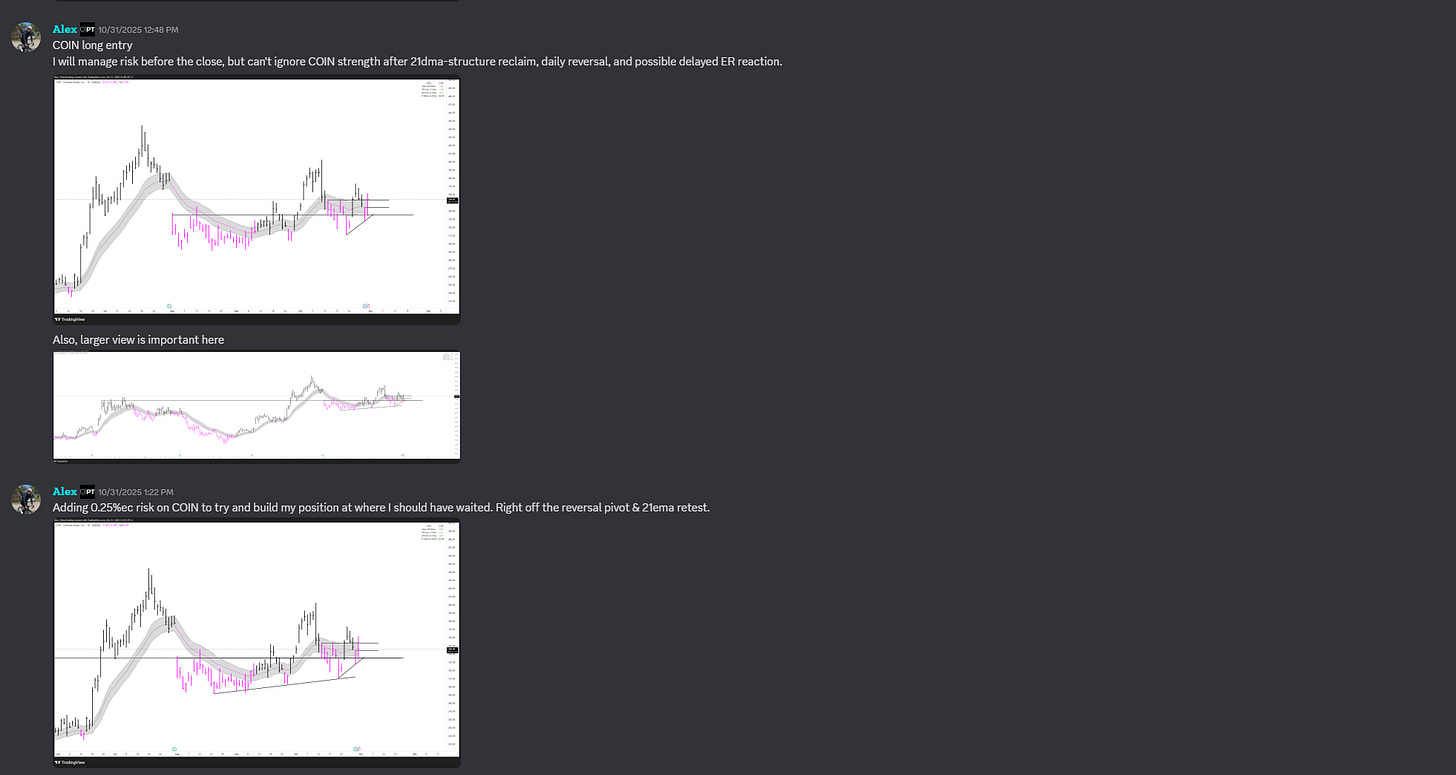

NEW: SOFI, COIN

ADDED:

TRIMMED:

INTRADAY ATTEMPTS: HPE, ASTS

OUT:

POSITIONS/TRADES LIVE EXPLANATIONS REVIEW (Shared live in Discord):

Try TradersLab.io — your faster research workflow.

Build your plan in minutes with top-down market dashboards, sector/money-flow views, and screeners that drill down to leading stocks—all in one platform.

It’s the same set of TradersLab scans I use to build my Focuslist, now in an app built for every swing or position trader’s daily routine.

Open the app → TradersLab.io

Try it 1-month FREE with the code “TRIAL”.

Want to keep reading The Prime Report? Subscribe below to see my game plan and top ideas for tomorrow.

See you there!

FOCUSLIST 11/02

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.