Defense Wins the Game

One thing that really clicks with experience is how keeping drawdowns small becomes the game-changer.

Early on, everyone’s focused on finding the next big winner — but over time, you realize it’s not about how much you can make when things are good... it’s about how little you lose when things aren’t.

You start to trust that when the market comes back in your favor, you don’t need to force it. A couple of solid days — 1, 2, maybe 3 — and you’re not just back to even, you’re pushing new highs.

That’s when you truly get the value of good defense. Not being stubborn. Not trying to prove anything when conditions aren’t right. Just staying light, protecting capital, and keeping your mental game intact.

Because once you master that, you stop digging holes — and making progress becomes a lot easier.

Stay patient. Stay sharp. The offense is easy when you’re not spending all your energy climbing out of a deep drawdown.

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

Try it 1-month FREE with the code “TRIAL25”.

MARKET ANALYSIS

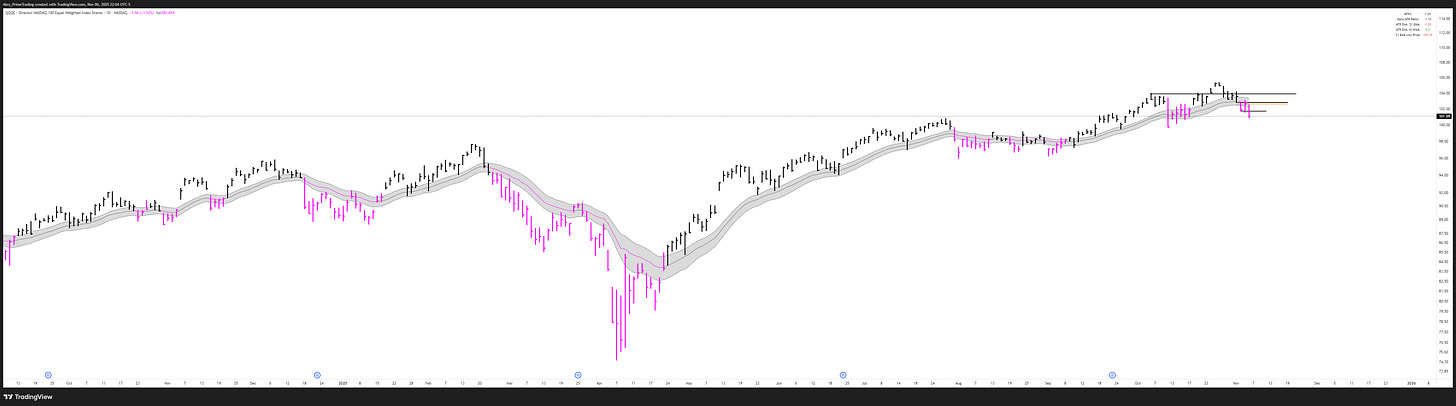

The picture changed today, with what looks like a failure of the short-term pullback.

QQQE price < declining 21dma-structure

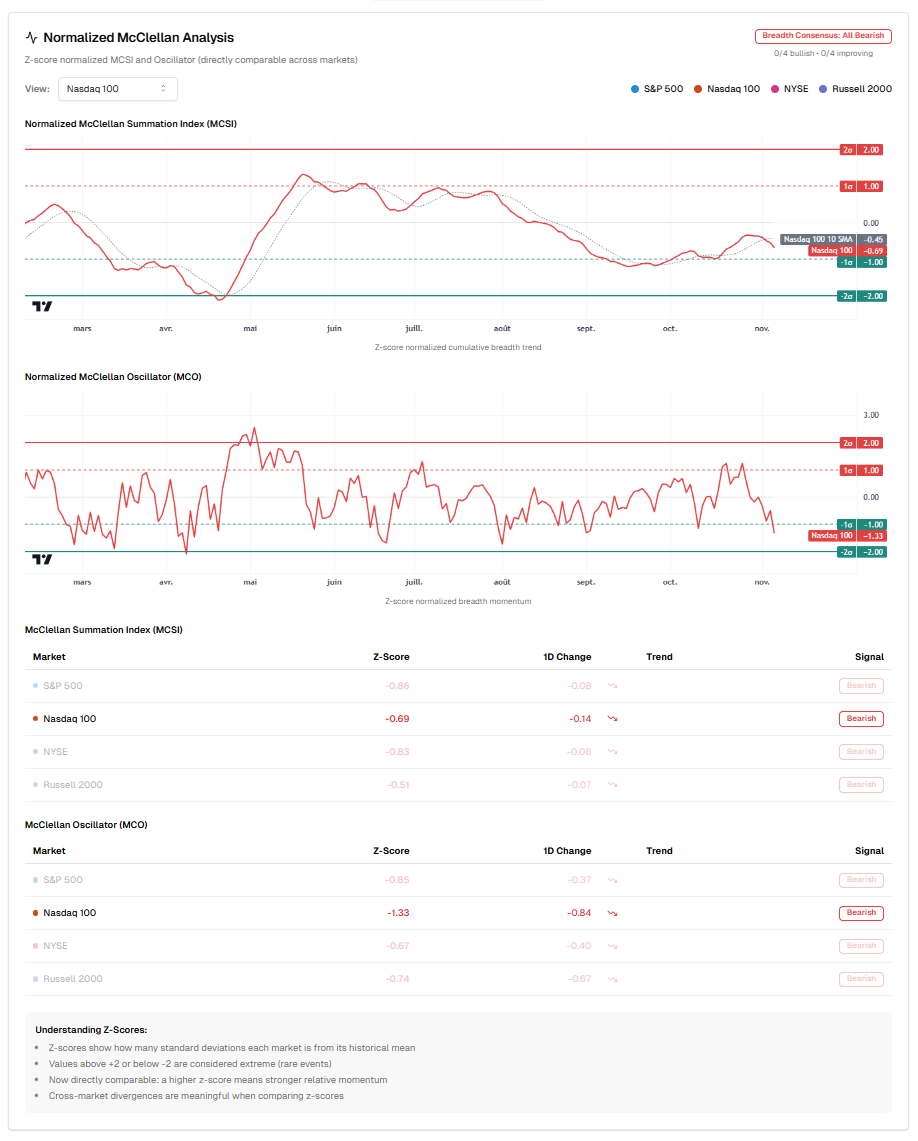

MCSI downtrend < 10dma, not oversold yet, and picking up downside momentum.

For these two reasons, I will not trade until I see constructive action around the 21-day moving average structure on QQQE.

PRICE (QQQE)

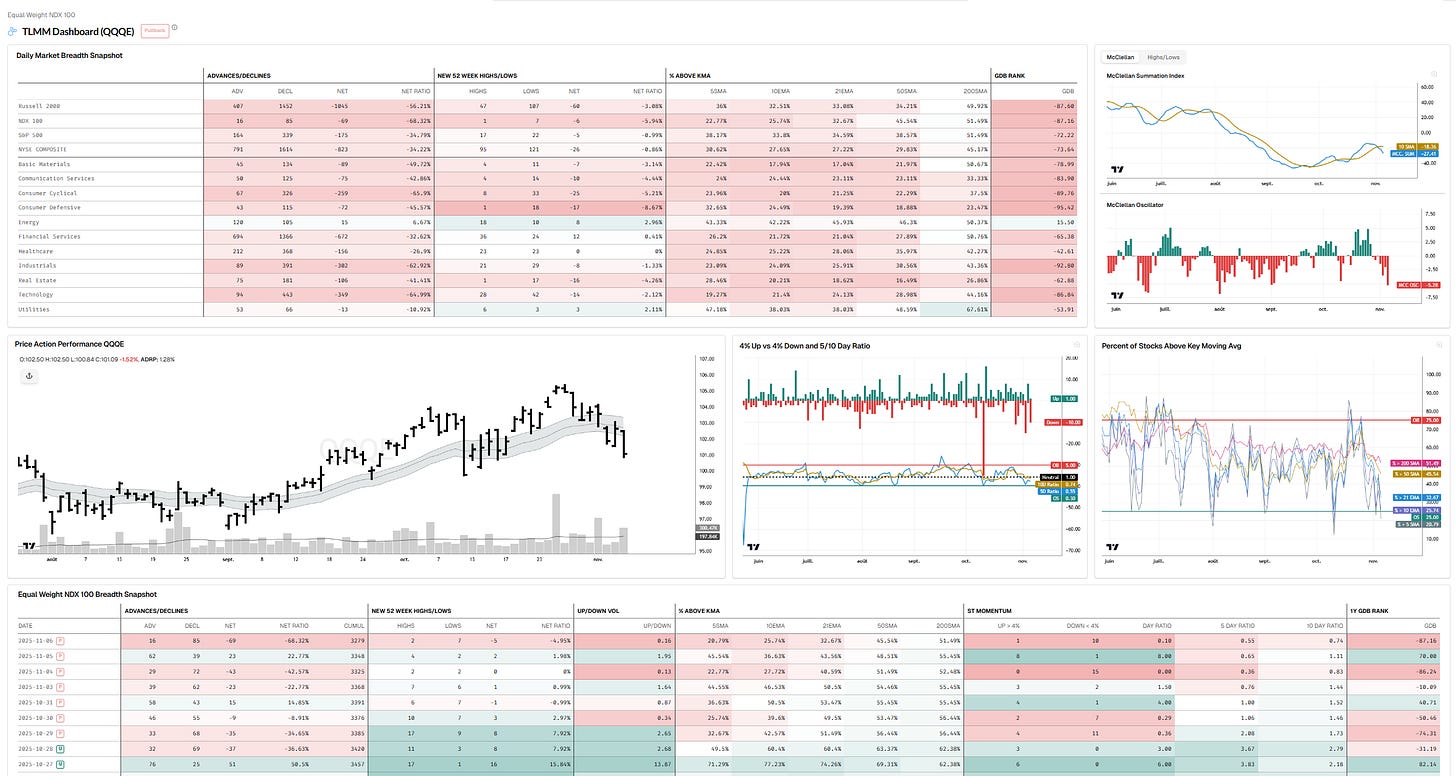

TLMM DASHBOARD NASDAQ

MARKET INTERNALS

Potential 21dma-structure reclaim & backtest setup. Not good if follow through higher tomorrow.

Potential 21dma-structure reclaim & backtest setup. Not good if follow through higher tomorrow.

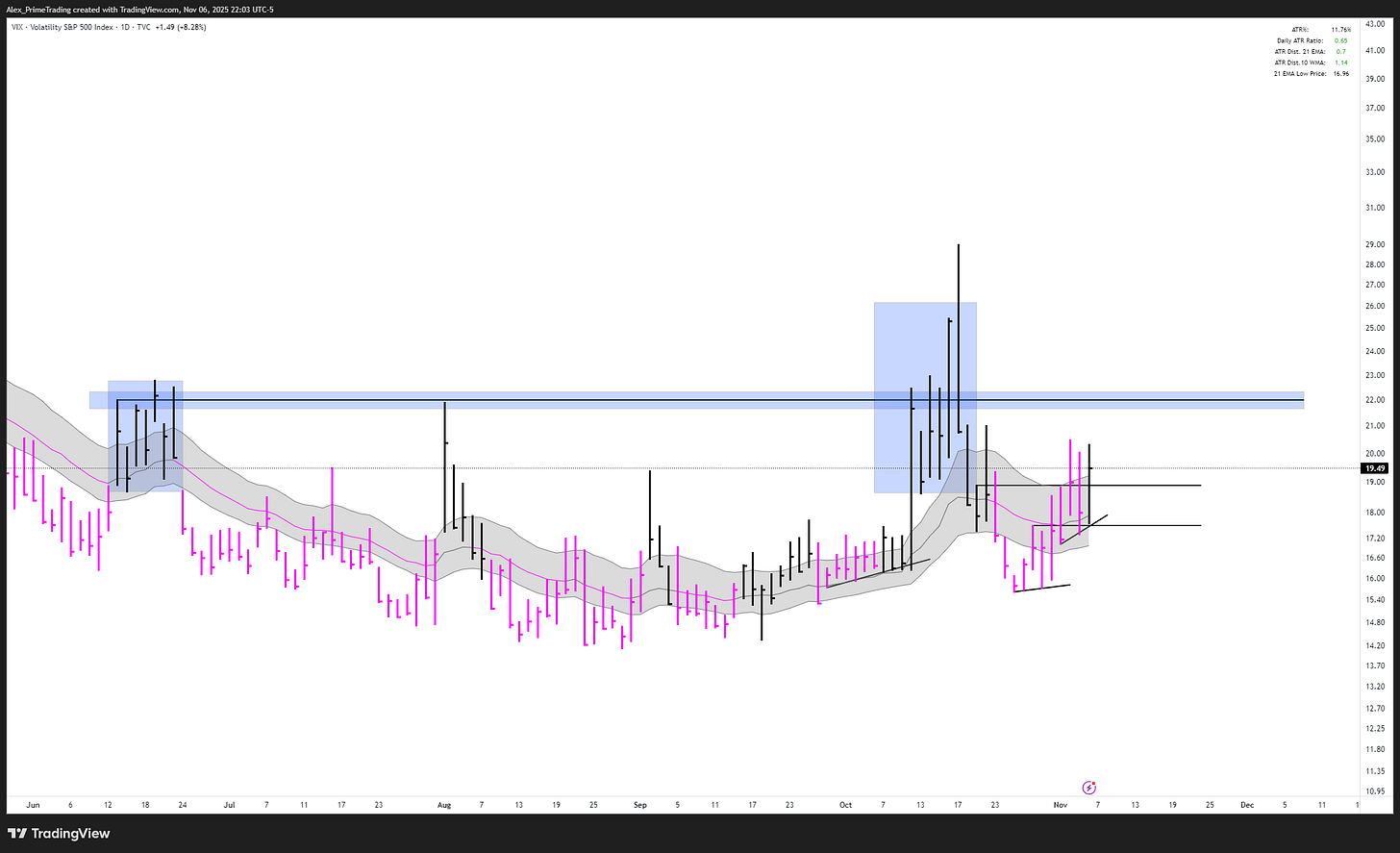

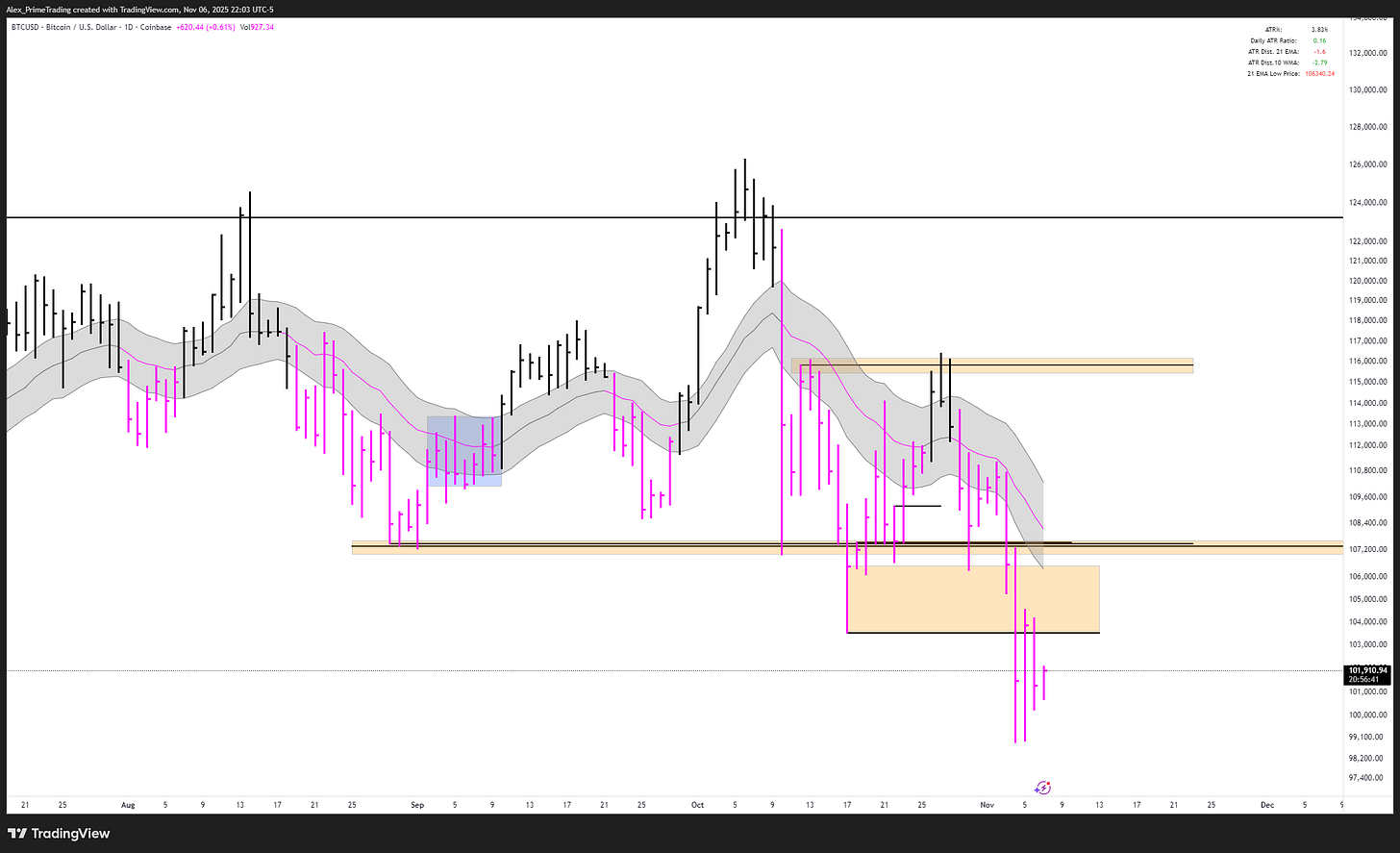

/BTC (Bitcoin)

Downtrend below declining 21dma-structure. Rejected at recent swing low pivot retest today.

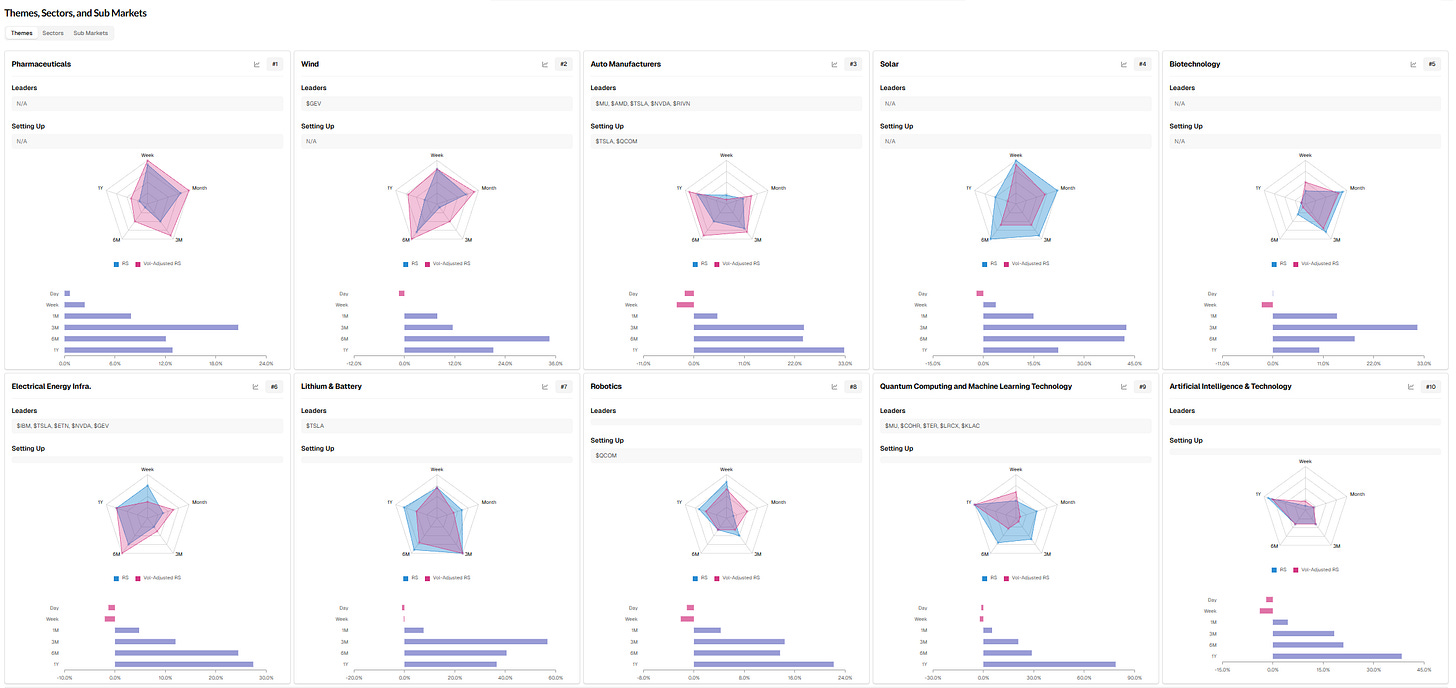

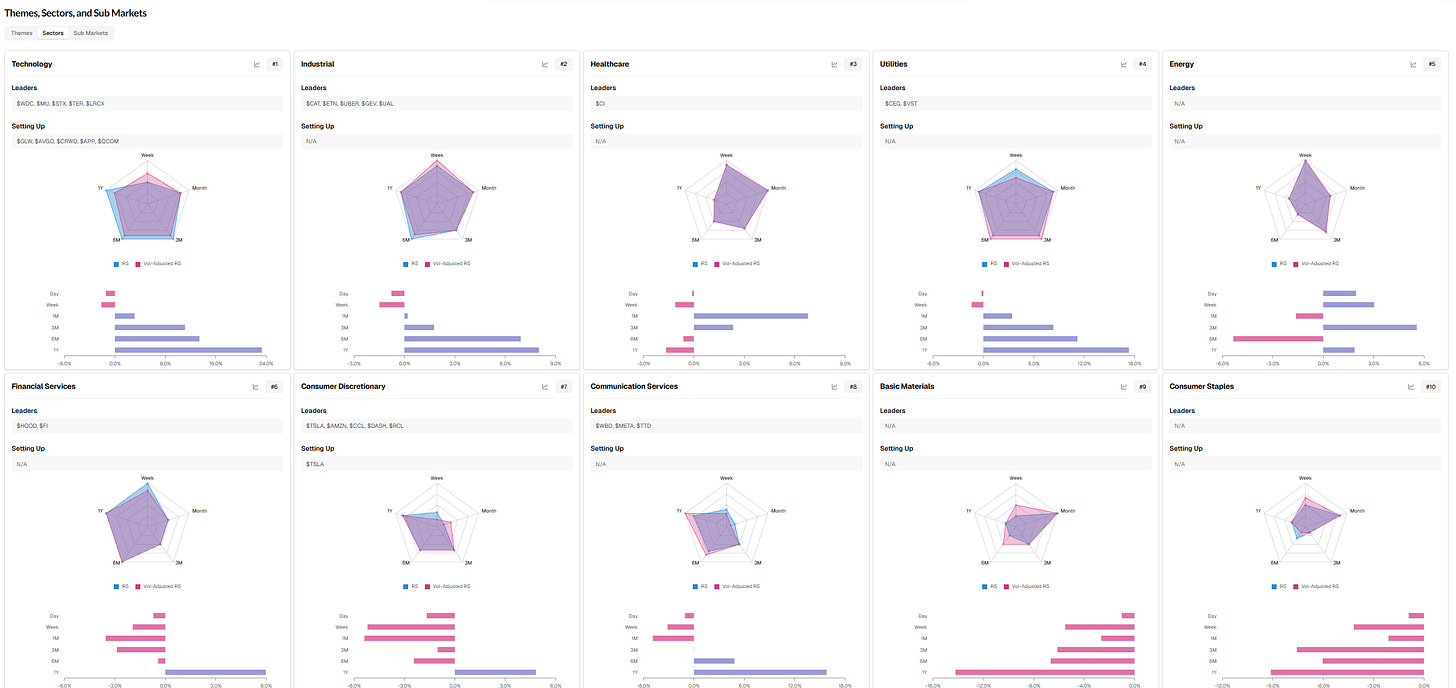

SECTORS & THEMES

Top 10 Leading THEMES - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

Top 10 Leading SECTORS - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

LEADERS STALKLIST

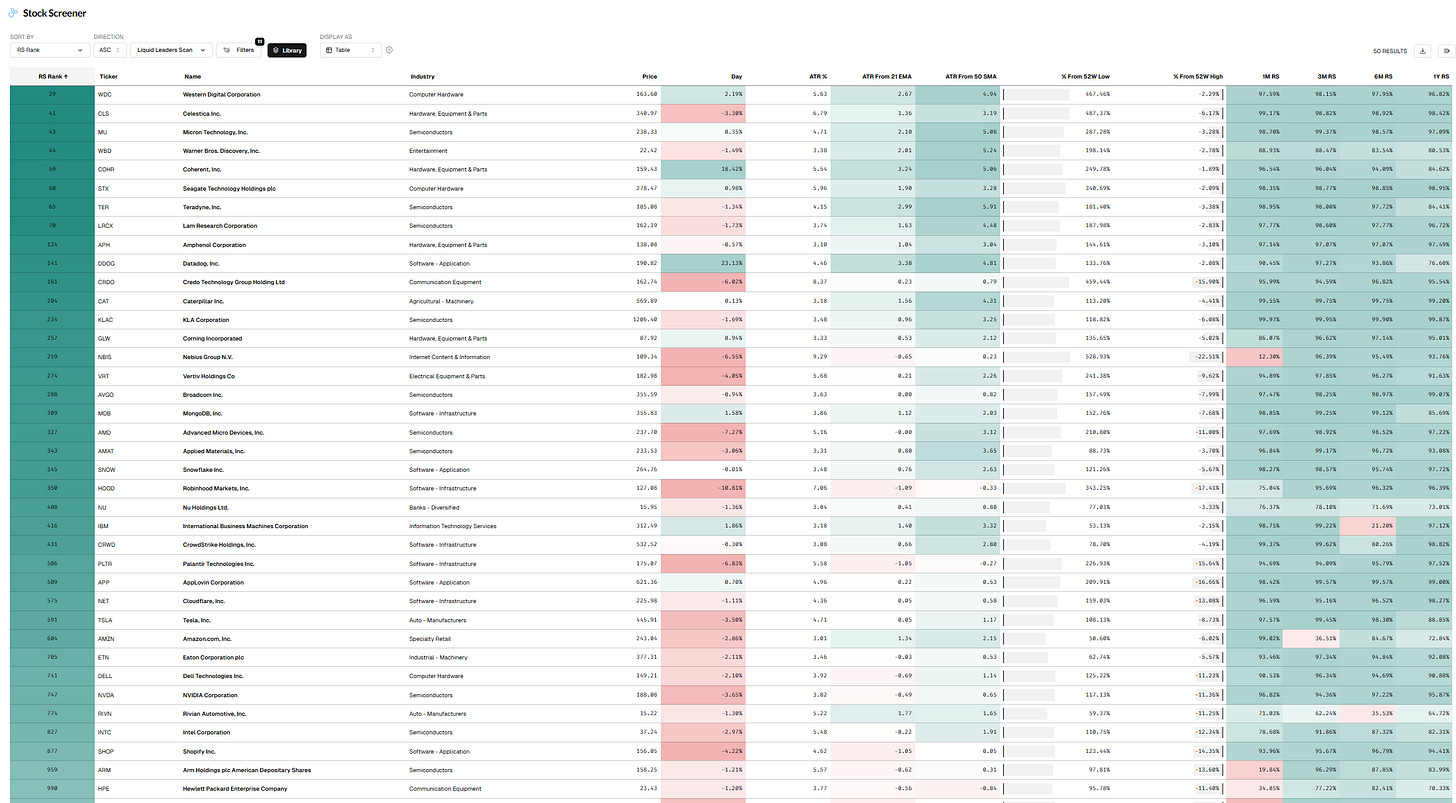

Liquid Leaders Universe (top RS)

WDC, CLS, WBD, HOOD, PLTR, MU, APH, CRDO, TER, AMD, LRCX, STX, NBIS, VRT, SNOW, NVDA, MDB, KLAC, AMZN, NET, ANET, APP, AVGO, TSM, RKLB, CRWD, C, AMAT, CAT, GLW, DELL, TSLA, DDOG, ETN, SHOP, IBM, CEG, INTC, ARM, ASTS, UBER, HPE, ALAB, SMR, VST, JOBY, IONQ, GEV, CDNS, CVNA

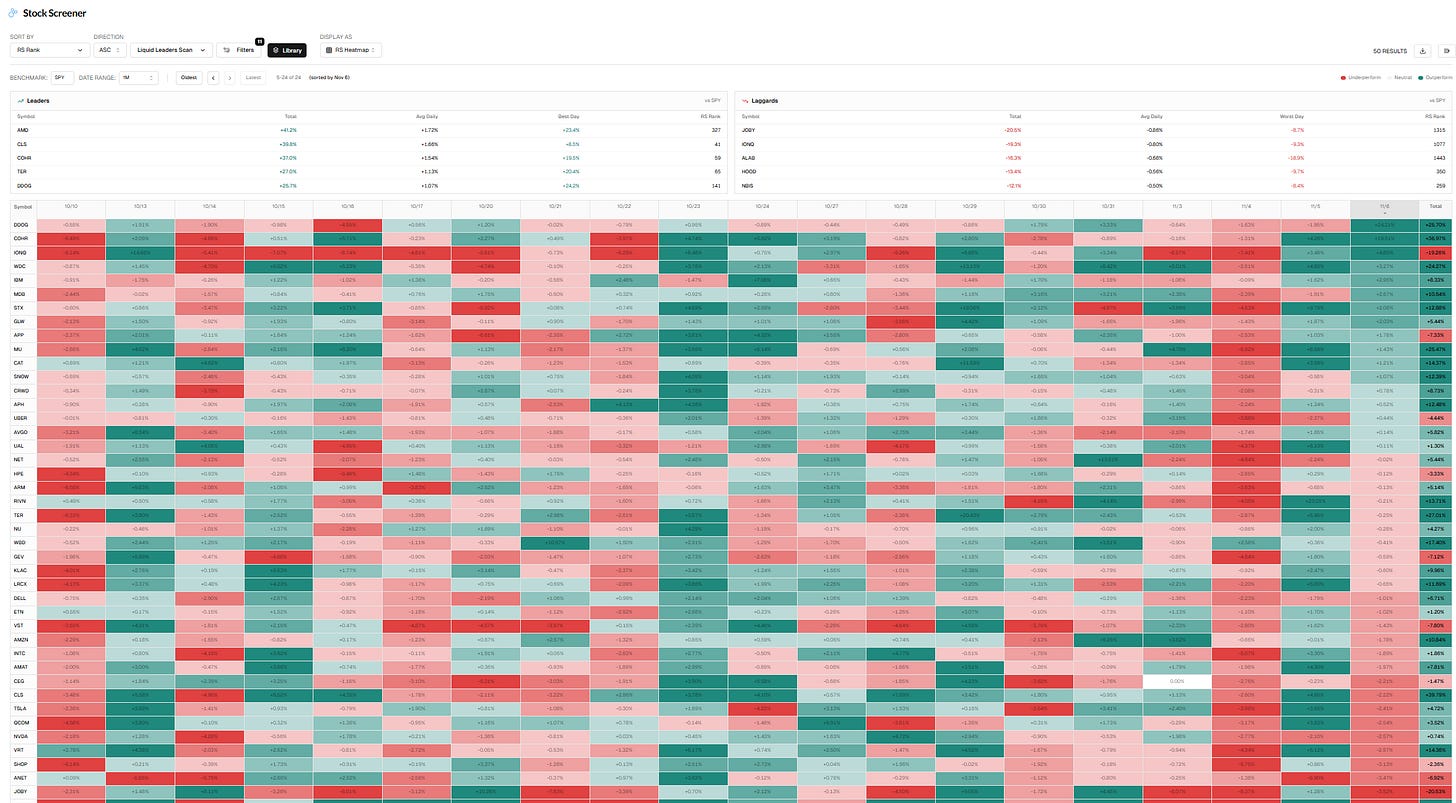

Liquid Leaders RS Heat Map

A quick visual of daily Relative Strength vs SPY, helping you spot which stocks are leading or lagging on any given day.

That WL is shared as a community WL that you can access in Tlab.

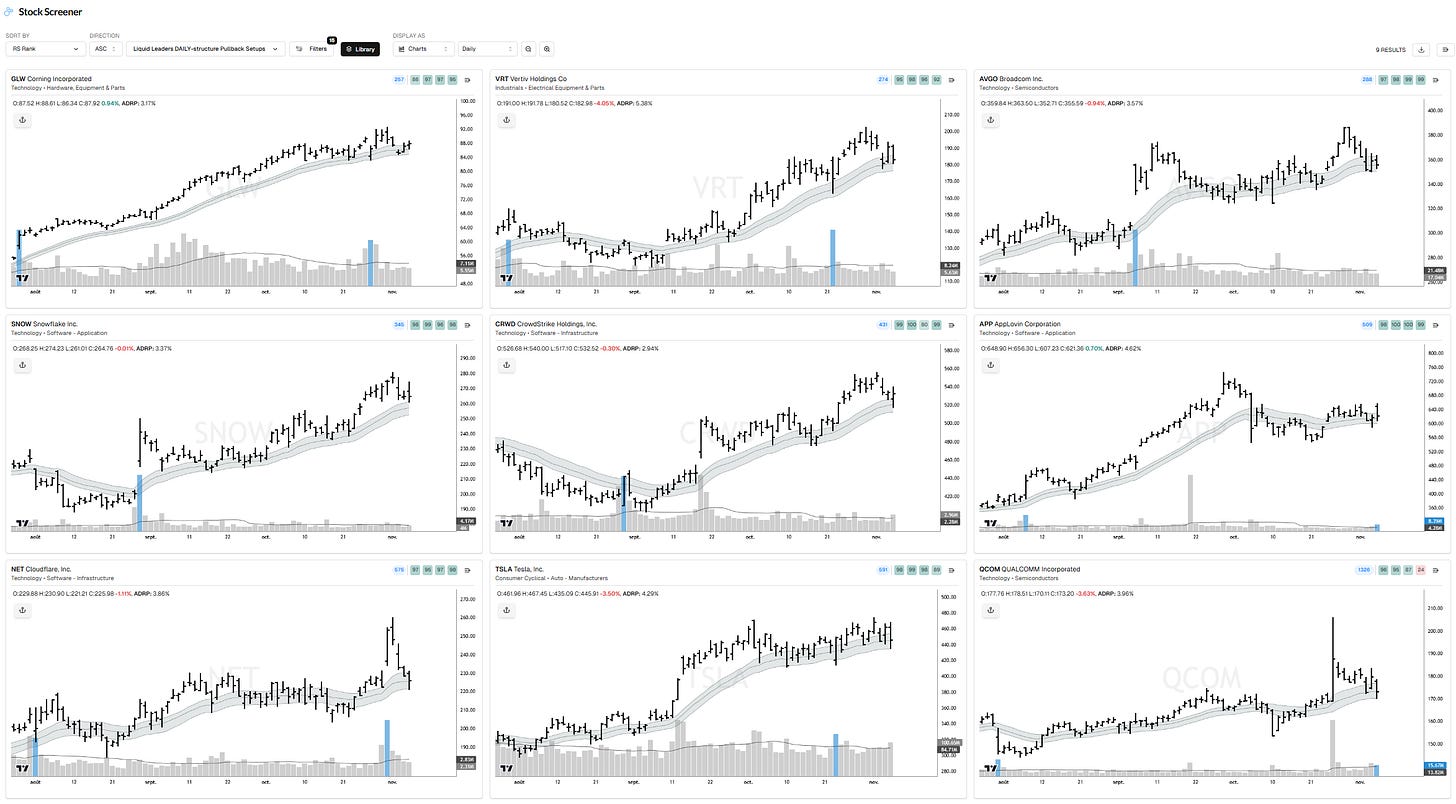

Liquid Leaders DAILY-structure Pullback scan

GLW, VRT, AVGO, SNOW, CRWD, APP, NET, TSLA, QCOM

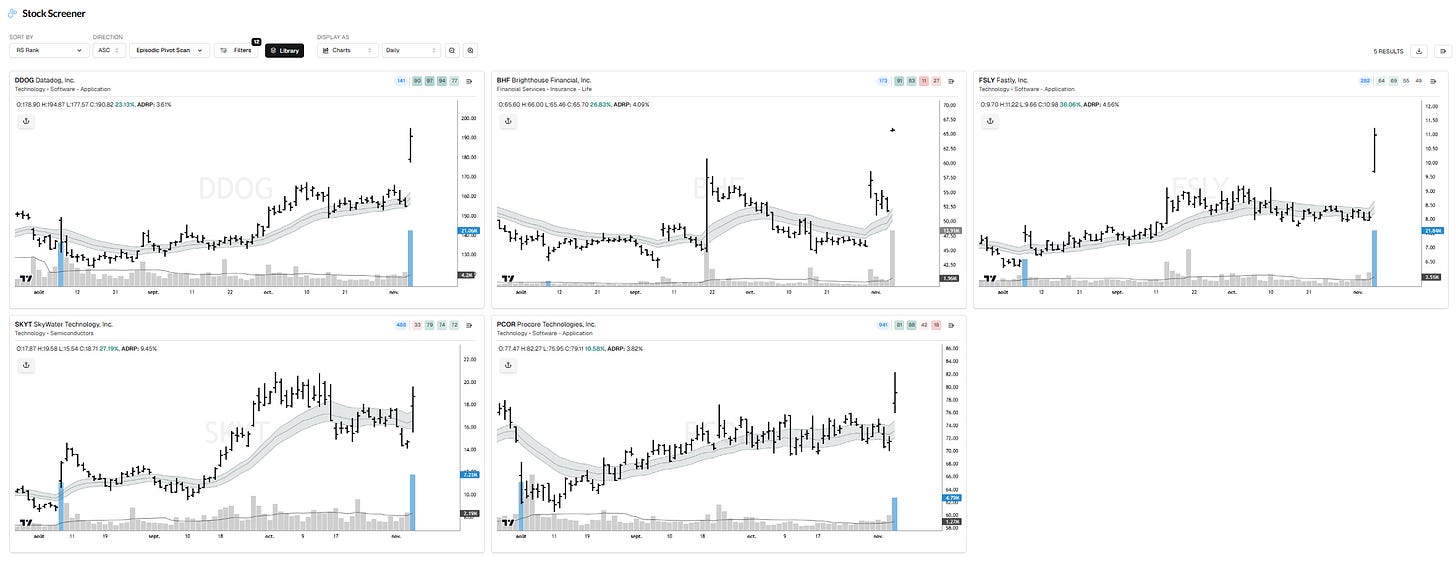

Episodic Pivot scan (Potential new Leaders)

DDOG, BHF, FSLY, SKYT, PCOR

PORTFOLIO UPDATE

Hey guys, With today’s action, I decided to get into a defensive stance and go all cash. No idea if this market goes higher and bounces from here, or simply rolls over, but enough red flags piled up to push me into a cash position and protect my capital. Let me try to be as concise as possible with what pushed me to do so:

This week has not been easy, and I’ve been too aggressive earlier this week and yesterday, and today, which pushed me in a 7% drawdown. For me the recent trades, especially new trades feedback is key to listen...especially coming from key leading stocks off their 21dma-structure which usually act as good support.,

The market has been straight up for the past 8 months, since April’s low. That’s a huge run...and I traded very well, doubling my account. Easy money can’t be forever; they’ll need to punish and digest.,

QQQE having that 21dma-structure breakdown earlier this week, and today was the rejection of that declining structure after a retest yesterday on the bounce.,

MCSI is showing an acceleration below the 10dma. Wind is in our face, and it’s picking up speed.,

Despite a short-term breadth oversold, there is no buyers in sight, and that’s a big weakness sign.,

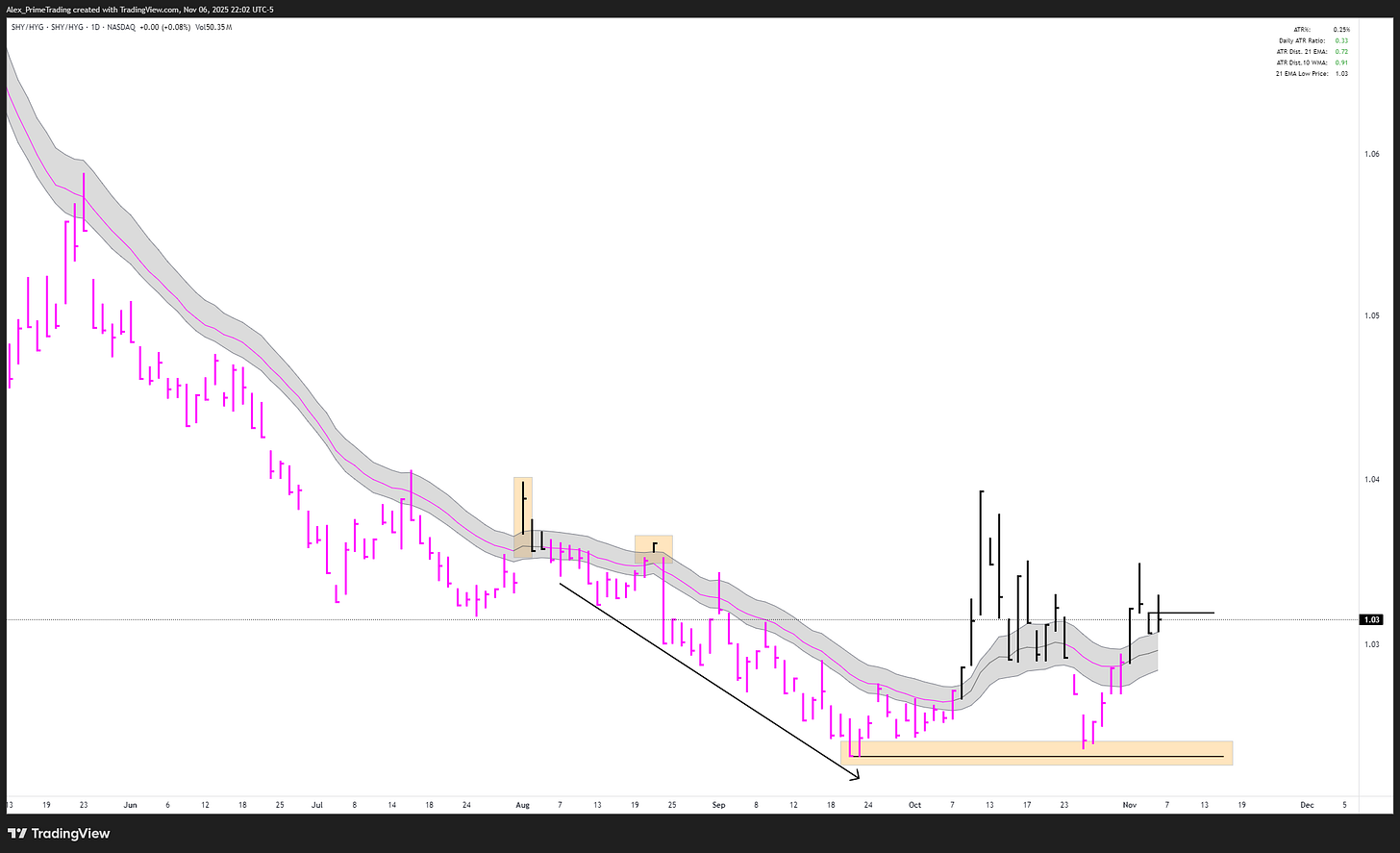

Both the VIX and Credit Spreads have that 21dma-structure reclaim & backtest setup here.,

Bitcoin continues to trend below a declining 21dma-structure and just retested and rejected the prior swing low pivot.,

After losing the Nuclear/Quantum comp. speculative names in Oct, they retested and rejected their now declining 21dma-structure. One of the few group still leading was AI, and we are starting to see cracks in those leaders, along the other liquid leaders such as HOOD and PLTR breaking down heavily from their 21dma-structure today.,

NAAIM exposure index showed fully exposure...that’s not good sentiment late in trend.,

Those are hints, clues that we might be shifting from that SHORT-TERM PULLBACK scenario we discussed in yesterday morning PMS session, into a longer pullback. We’re not into bigger scenarios yet, and again, we go scenario by scenario as each of them presents itself and works or fails. I could have held to my core, for around 40/45% exposure, but trading was intense for the past 8 months, and I feel that a couple days or weeks, depending on the market next actions, will reset myself into a good mindset and mental state to punch it big when the market is really ready to fire higher. No prediction, just need to listen to myself and put myself in a good spot. Cheers, HAGN.

NEW:

ADDED:

TRIMMED:

INTRADAY ATTEMPTS:

OUT: All cash

POSITIONS/TRADES LIVE EXPLANATIONS REVIEW (Shared live in Discord):

Try TradersLab.io — your faster research workflow.

Build your plan in minutes with top-down market dashboards, sector/money-flow views, and screeners that drill down to leading stocks—all in one platform.

It’s the same set of TradersLab scans I use to build my Focuslist, now in an app built for every swing or position trader’s daily routine.

Open the app → TradersLab.io

Try it 1-month FREE with the code “TRIAL”.

Want to keep reading The Prime Report? Subscribe below to see my game plan and top ideas for tomorrow.

See you there!

FOCUSLIST 11/06

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.