Defense Wins the Game

One thing that really clicks with experience is how keeping drawdowns small becomes the game-changer.

Early on, everyone’s focused on finding the next big winner — but over time, you realize it’s not about how much you can make when things are good... it’s about how little you lose when things aren’t.

You start to trust that when the market comes back in your favor, you don’t need to force it. A couple of solid days — 1, 2, maybe 3 — and you’re not just back to even, you’re pushing new highs.

That’s when you truly get the value of good defense. Not being stubborn. Not trying to prove anything when conditions aren’t right. Just staying light, protecting capital, and keeping your mental game intact.

Because once you master that, you stop digging holes — and making progress becomes a lot easier.

Stay patient. Stay sharp. The offense is easy when you’re not spending all your energy climbing out of a deep drawdown.

PrimeTrading is an equity SWING trading community to learn & trade alongside experienced traders. It's like sneaking into a trader's POD, where you can see us execute & discuss...but in ours, you can also interact and ask questions.

I would have killed for such an opportunity when I started trading! 🔥

Education & mentoring from Alex & experienced traders. (10 Experienced Traders team)

See how I execute intraday while I share all my trades with explanations live.

Alex's daily market commentary, Portfolio updates, trade explanations, and daily FocusList.

Share & Discuss potential trade ideas with an amazing, like-minded community.

Talk Sectors, Macro Economy, Cryptocurrencies & much more!

Talk about mental game & psychology to evolve as a trader!

Live trading and Q&A live sessions 2x week.

Trade & learn with us, from Novice to Expert!

Cheers, Alex 🛡️✌️

Try it 1-month FREE with the code “TRIAL25”.

MARKET ANALYSIS

Don’t feel bad about the last few days and now today’s action guys. Remember WHERE AND HOW the market gets into an easy $$ market... always the same thing, it comes from a pullback or a correction....each and every time.

So don’t fear what we’re in, and what could come next...EMBRACE IT! that’s the kind of setup that we know we’ll be able to have real traction and make big returns over multiple weeks and months.

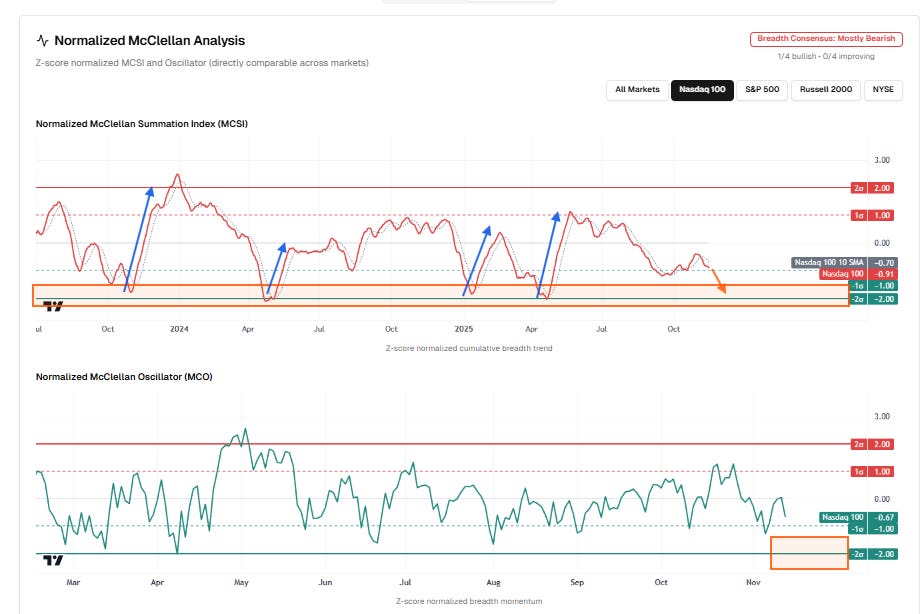

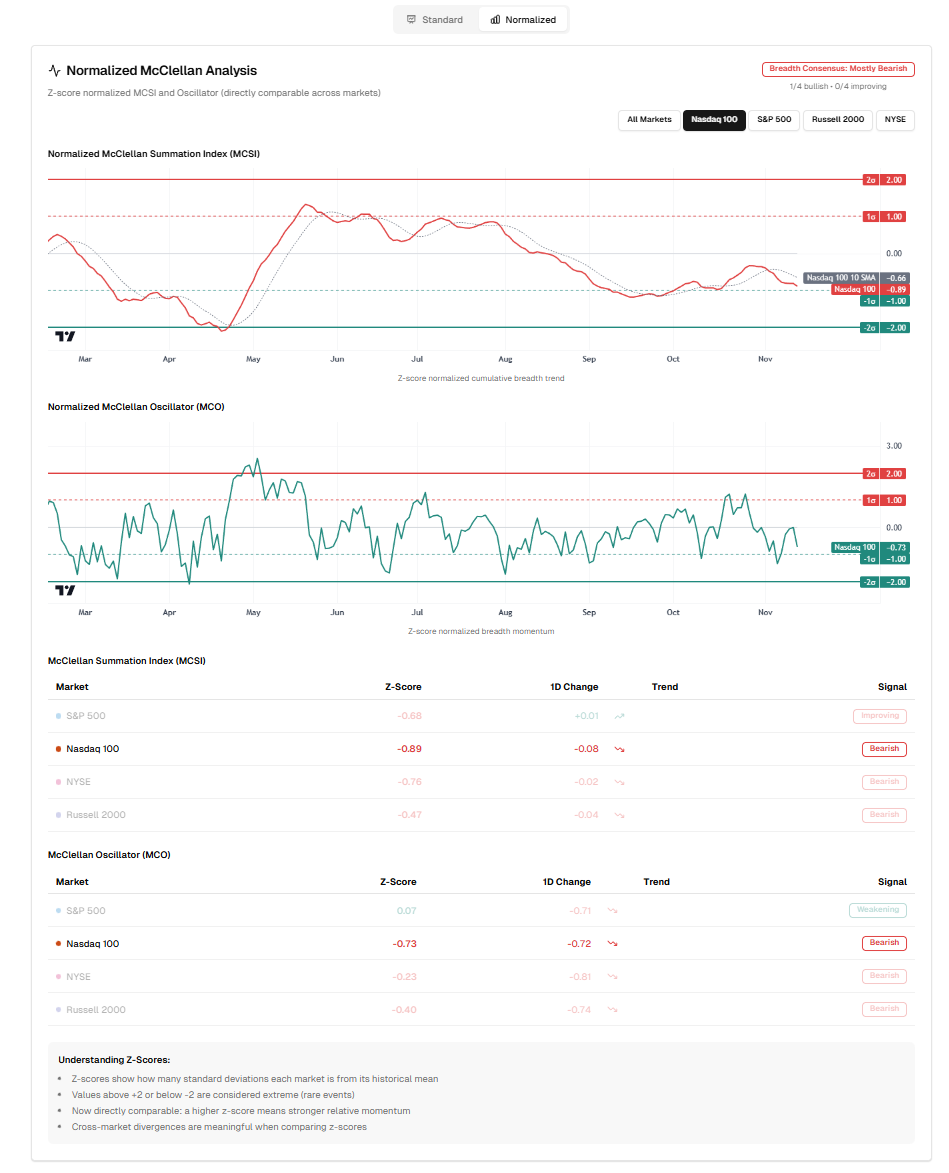

Look at that MCSI, everytime it comes from -2σ OS area....everytime it needs a MCO flush.

Now the goal is to NOT dig ourselves deeper in drawdown, and wait the best we can for that moment to present itself...then we STRIKE.

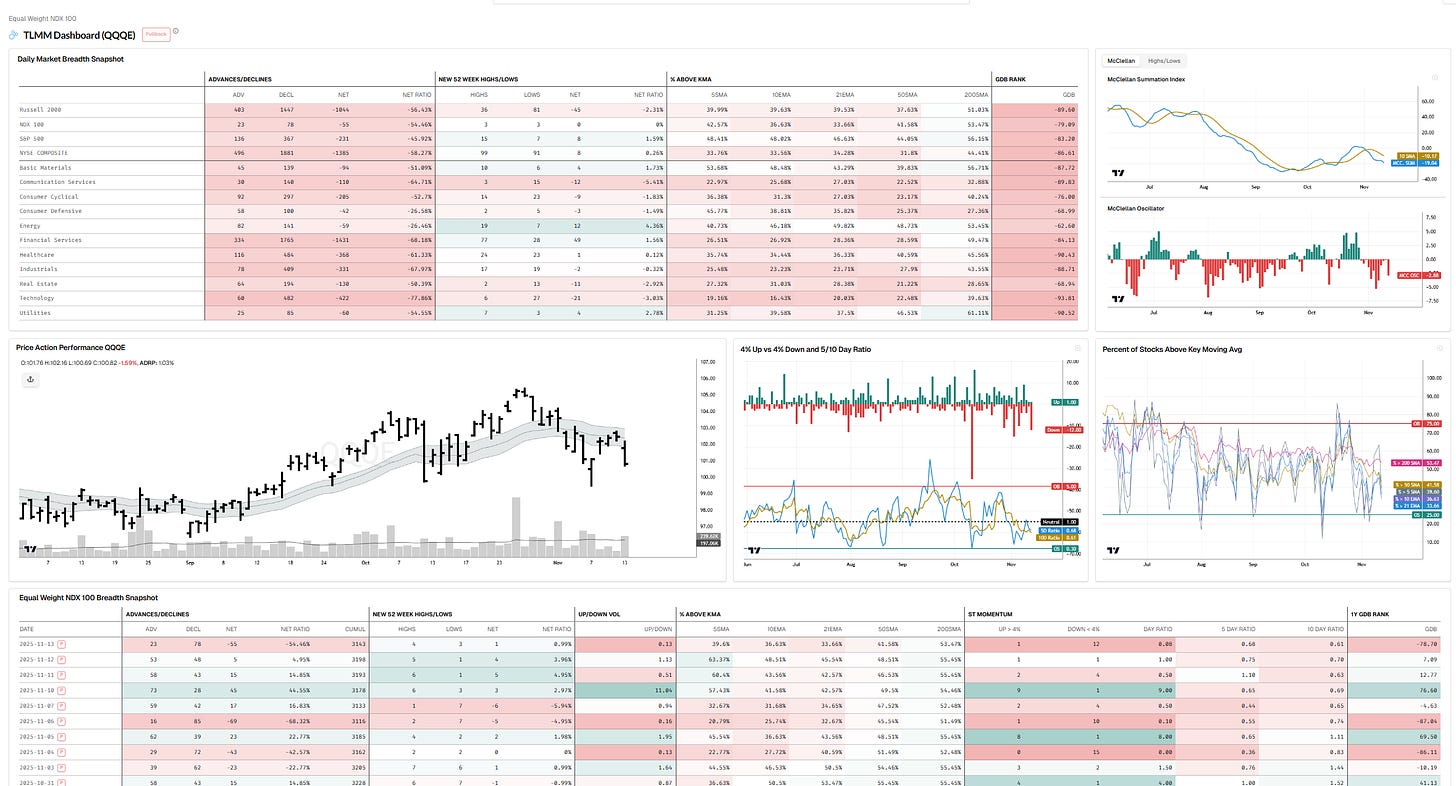

PRICE (QQQE)

That bear flag came into play, and instead of a reclaim of the 21dma-structure, we had a hard rejection today.

We didn’t make a new low yet, but it was a new closing low.

Price does not look good, and I’m back in cash on the sidelines until we can reclaim that declining daily structure.

BREADTH (MCSI/MCO)

Hook-up attempt failed…hooked back down below a now declining 10dma.

MCO hooked-down

MCSI hooked-down

360° VIEW (TLMM DASHBOARD)

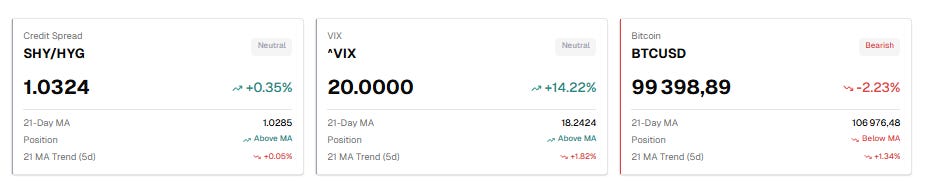

MARKET INTERNALS

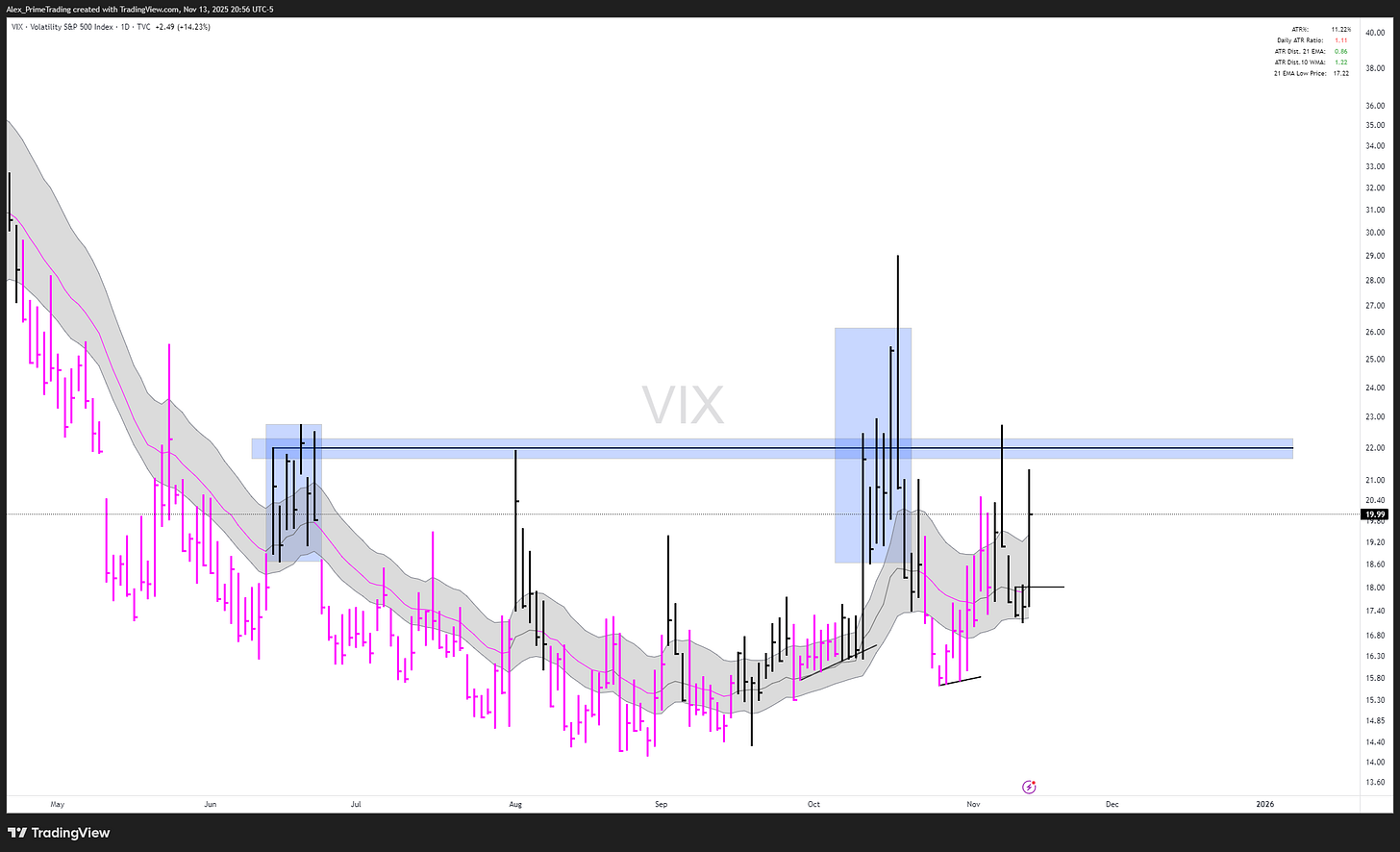

Spike above 21dma-structure - CAUTION

Spike above 21dma-structure - CAUTION

/BTC (Bitcoin)

REJECTION of declining 21dma-structure and base structure. New low…

SECTORS & THEMES

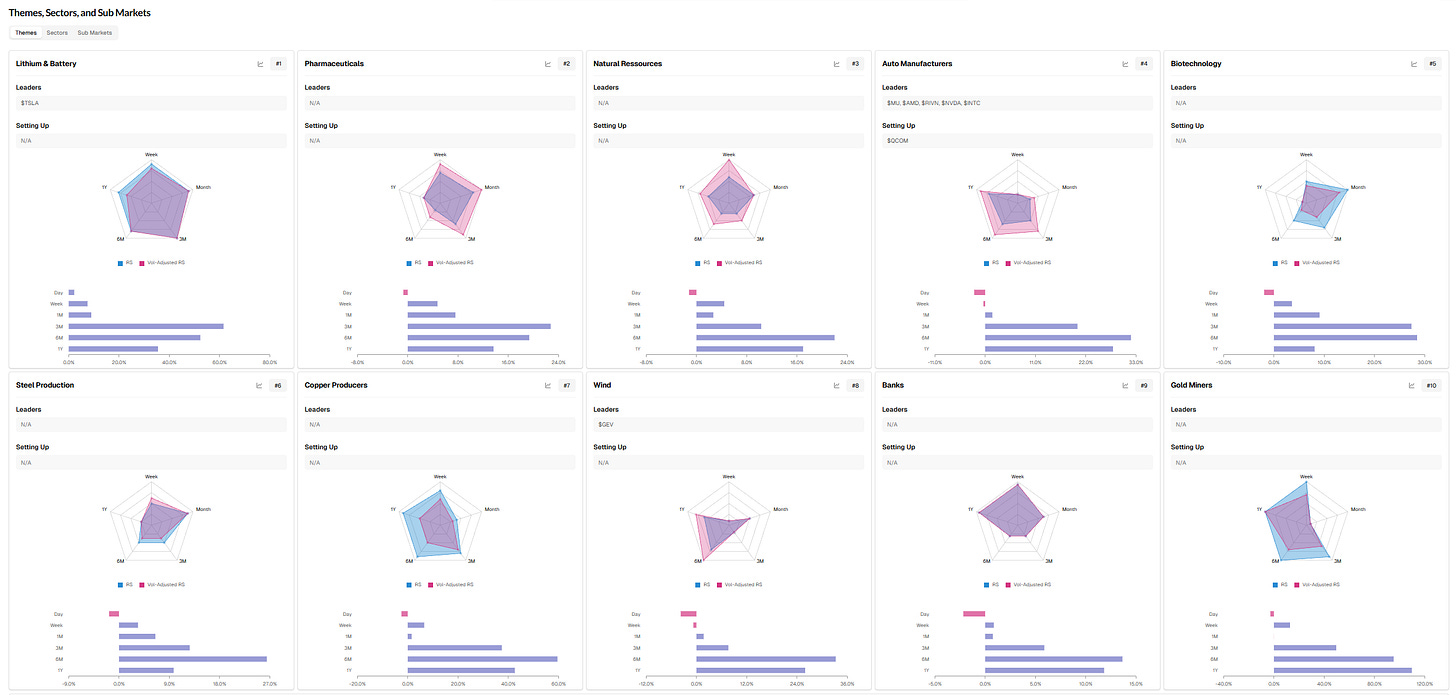

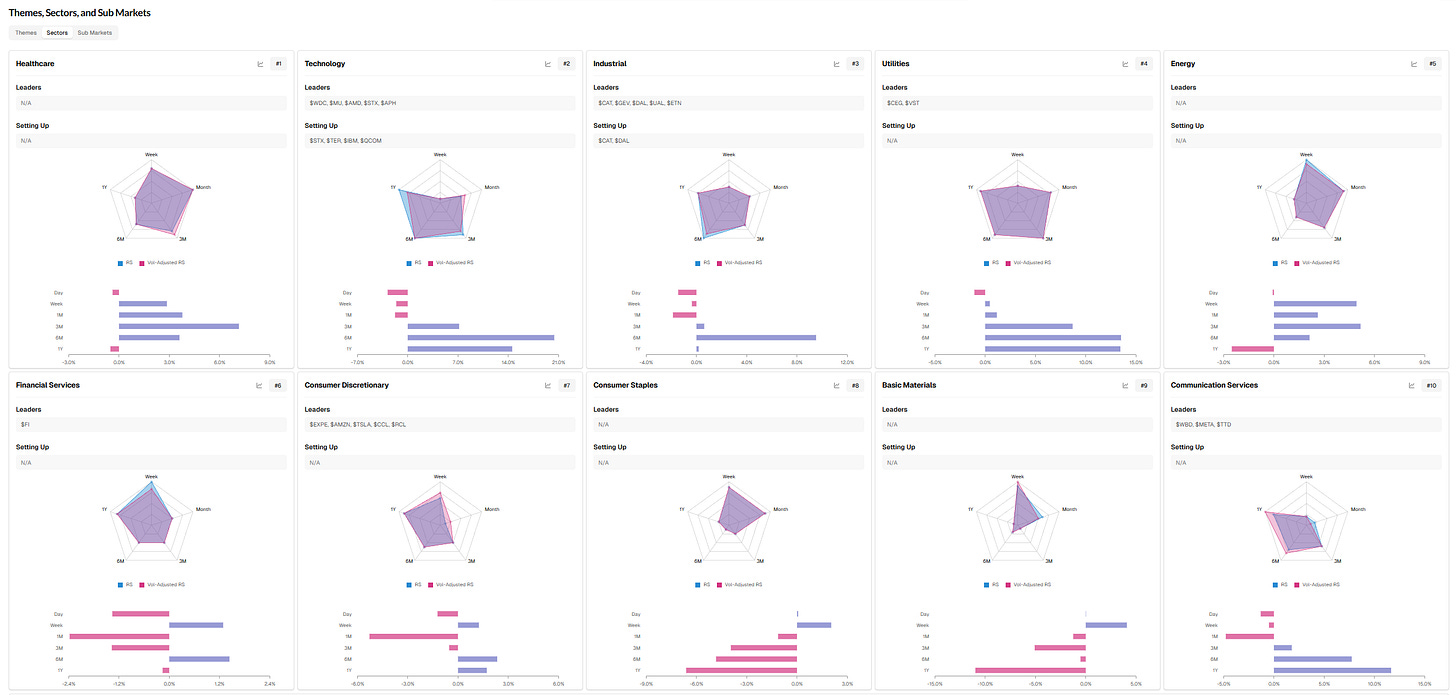

Top 10 Leading THEMES - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

Top 10 Leading SECTORS - Relative Strength RANK sorted (W/ Leading & Setting up Stocks)

LEADERS STALKLIST

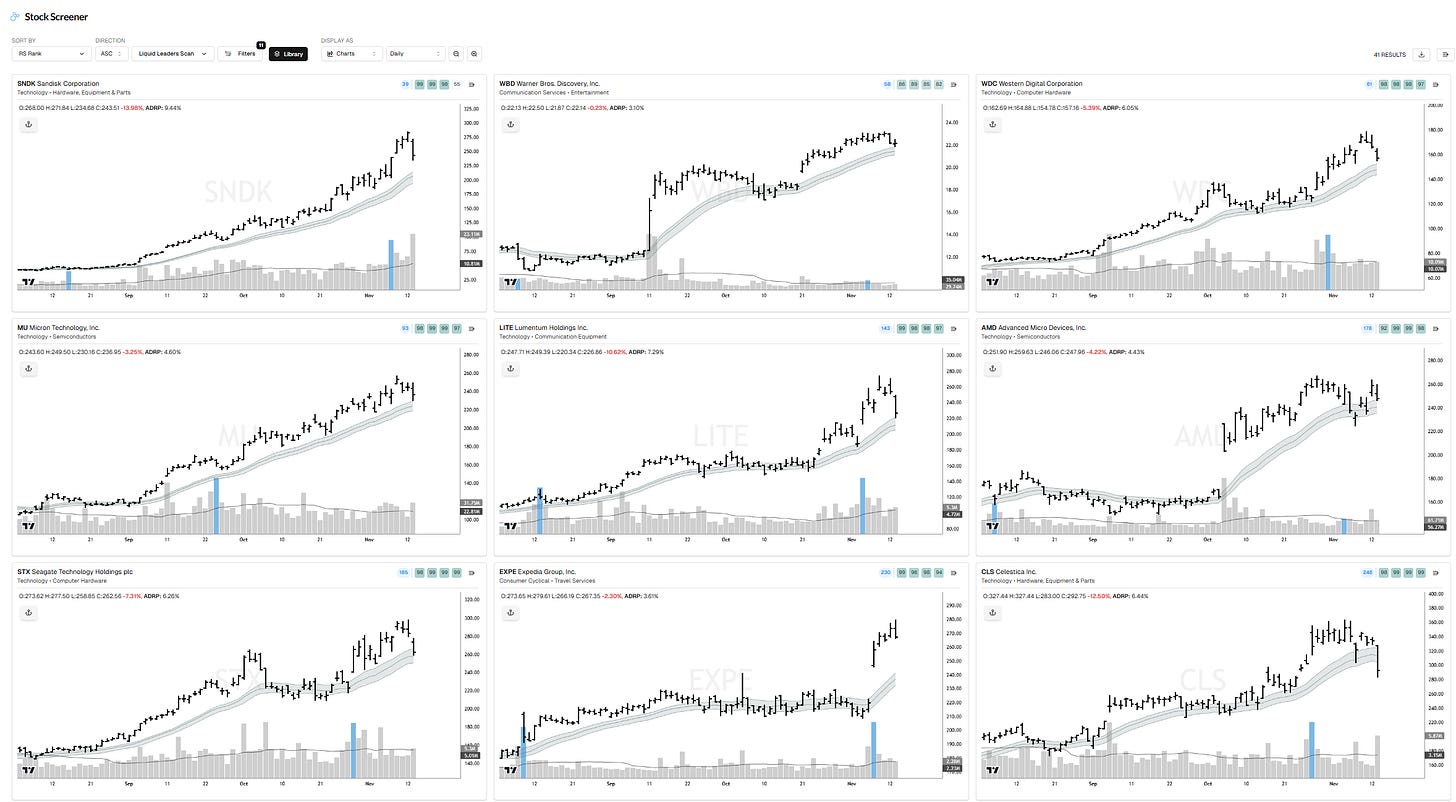

Liquid Leaders Universe (top RS)

SNDK, WBD, WDC, MU, LITE, AMD, STX, EXPE, CLS, APH, DDOG, LRCX, TER, MDB, CAT, COHR, SNOW, CRWD, KLAC, NU, RIVN, AVGO, IBM, PLTR, GLW, NVDA, AMAT, VRT, AMZN, NET, INTC, HPE, GEV, JOBY, DAL, APP, UAL, CVNA, ETN, CEG, QCOM

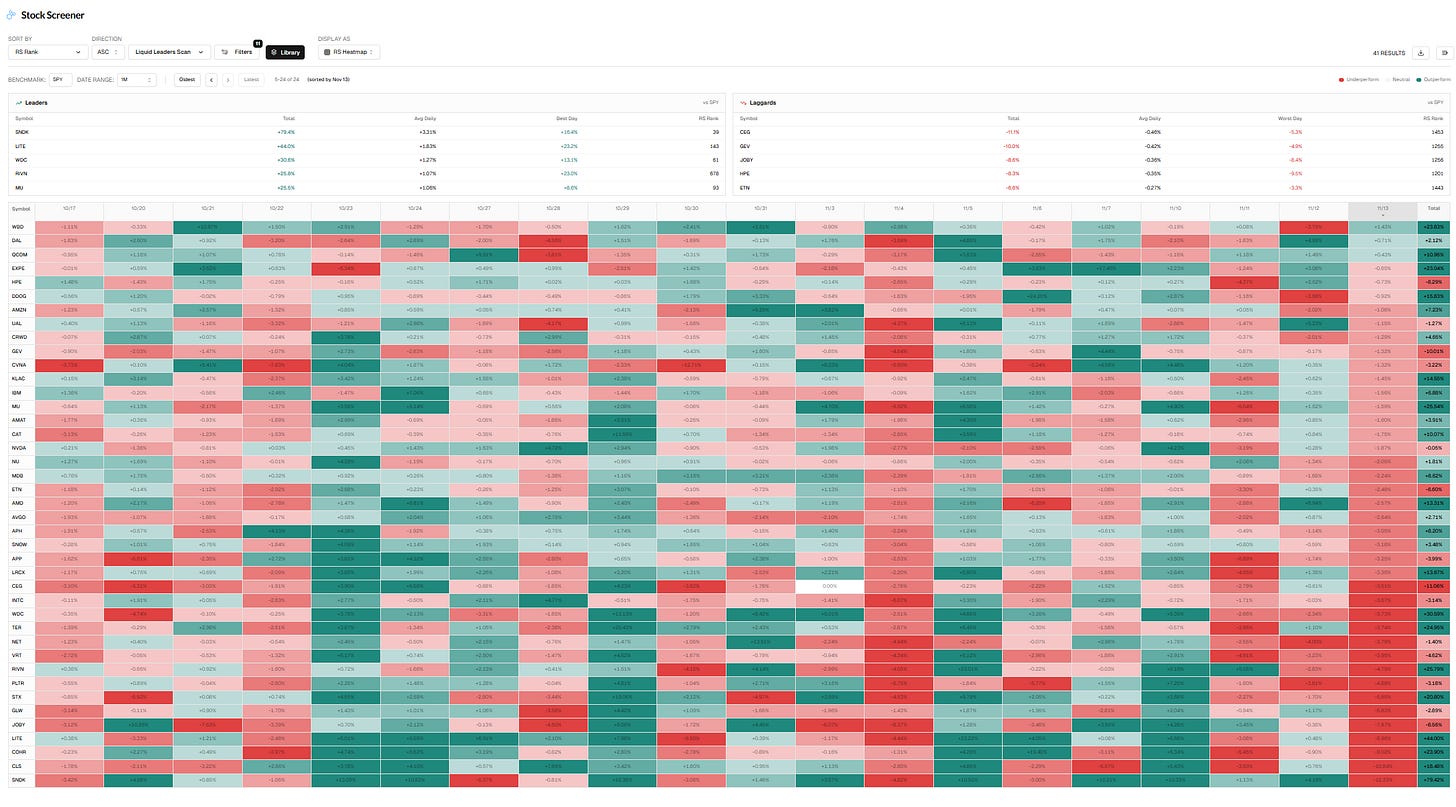

Liquid Leaders RS Heat Map

A quick visual of daily Relative Strength vs SPY, helping you spot which stocks are leading or lagging on any given day.

That WL is shared as a community WL that you can access in Tlab.

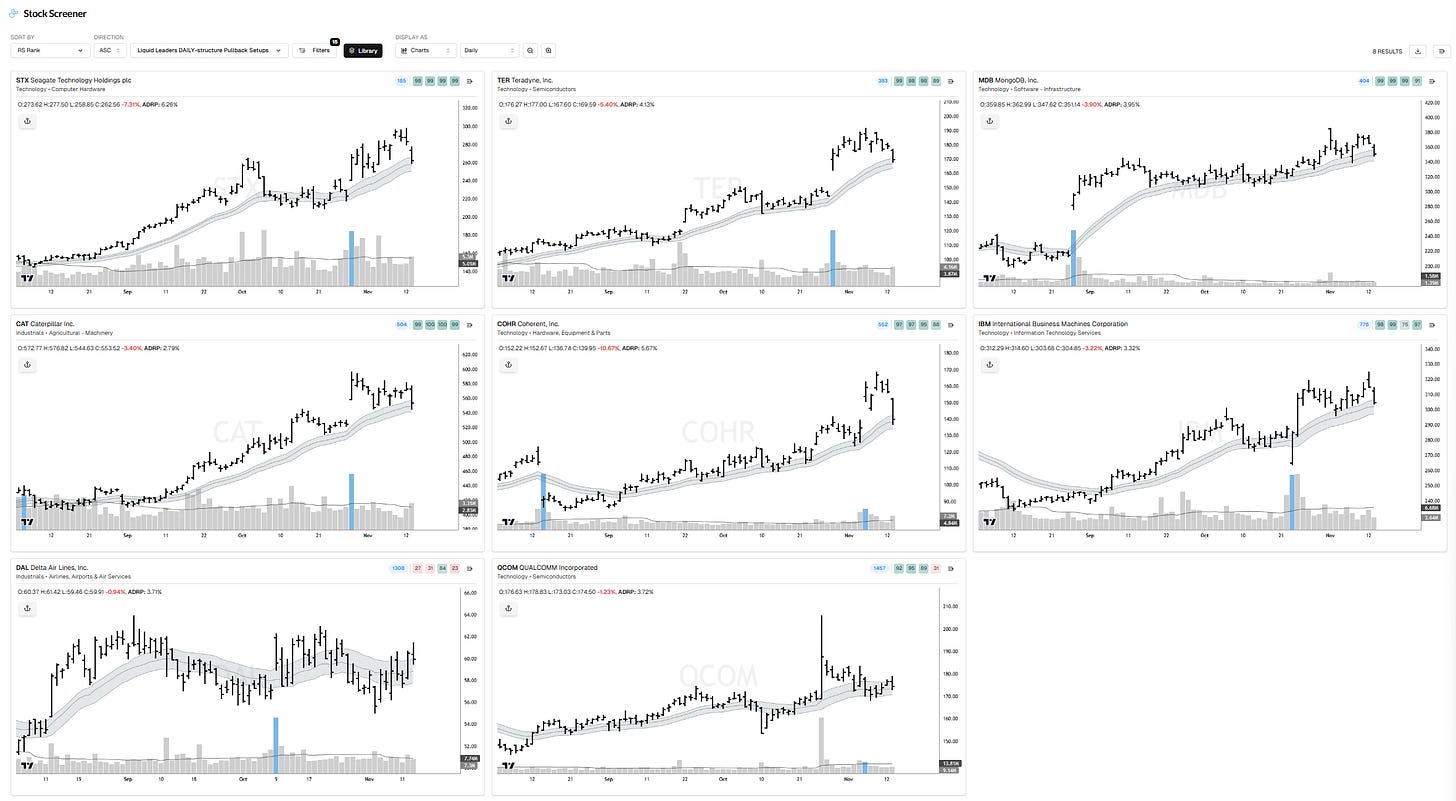

Liquid Leaders DAILY-structure Pullback scan

STX, TER, MDB, CAT, COHR, IBM, DAL, QCOM

Episodic Pivot scan (Potential new Leaders)

None

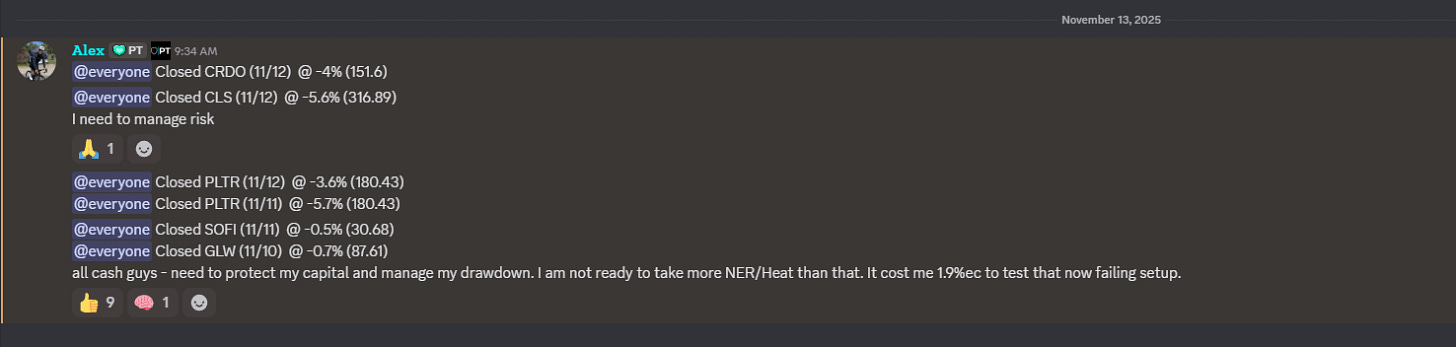

PORTFOLIO UPDATE

Hey guys!

Well, the market setup failed, and I’m back to cash!! Glad I was quick enough to dodge the bullet at open and went to cash in the first 5 minutes of the session after realizing this market didn’t confirm what I wanted to see out of this support area. Sometimes you get lucky, and today was one of those.

Now that QQQ is below a declining 21dma-structure, that MCSI is back in a downtrend below the declining 10dma, VIX/CS spiking above now rising 21dma-structure, and breadth ext. are far from being oversold...it’s time for being disciplined and patient. Let’s wait for this market to setup again. We have the playbook and the tools for that, so we need to show our Panda who’s the boss and wait for that moment.

Cheers, HAGN.

NEW:

ADDED:

TRIMMED:

INTRADAY ATTEMPTS:

OUT: ALL CASH

POSITIONS/TRADES LIVE EXPLANATIONS REVIEW (Shared live in Discord):

Try TradersLab.io — your faster research workflow.

Build your plan in minutes with top-down market dashboards, sector/money-flow views, and screeners that drill down to leading stocks—all in one platform.

It’s the same set of TradersLab scans I use to build my Focuslist, now in an app built for every swing or position trader’s daily routine.

Open the app → TradersLab.io

Try it 1-month FREE with the code “TRIAL”.

Want to keep reading The Prime Report? Subscribe below to see my game plan and top ideas for tomorrow.

See you there!

SITUATIONAL AWARENESS, GAMEPLAN, and TOP IDEAS 11/13

Keep reading with a 7-day free trial

Subscribe to PrimeTrading to keep reading this post and get 7 days of free access to the full post archives.